Q3 2017 SUPPLEMENTAL INFORMATION

OCTOBER 31, 2017

©2017 Ameresco, Inc. All rights reserved. 2

USE OF NON-GAAP FINANCIAL MEASURES

Use of Non-GAAP Financial Measures

This presentation includes references to adjusted EBITDA, adjusted cash from operations, non-GAAP net income

and non-GAAP earnings per share, which are non-GAAP financial measures. For a description of these non-GAAP

financial measures, including the reasons management uses these measures, please see the section in the

Appendix in this presentation titled “Non-GAAP Financial Measures”. For a reconciliation of these non-GAAP

financial measures to the most directly comparable financial measures prepared in accordance with GAAP, please

see the tables in the Appendix to this presentation titled “GAAP to Non-GAAP Reconciliation.”

©2017 Ameresco, Inc. All rights reserved. 3

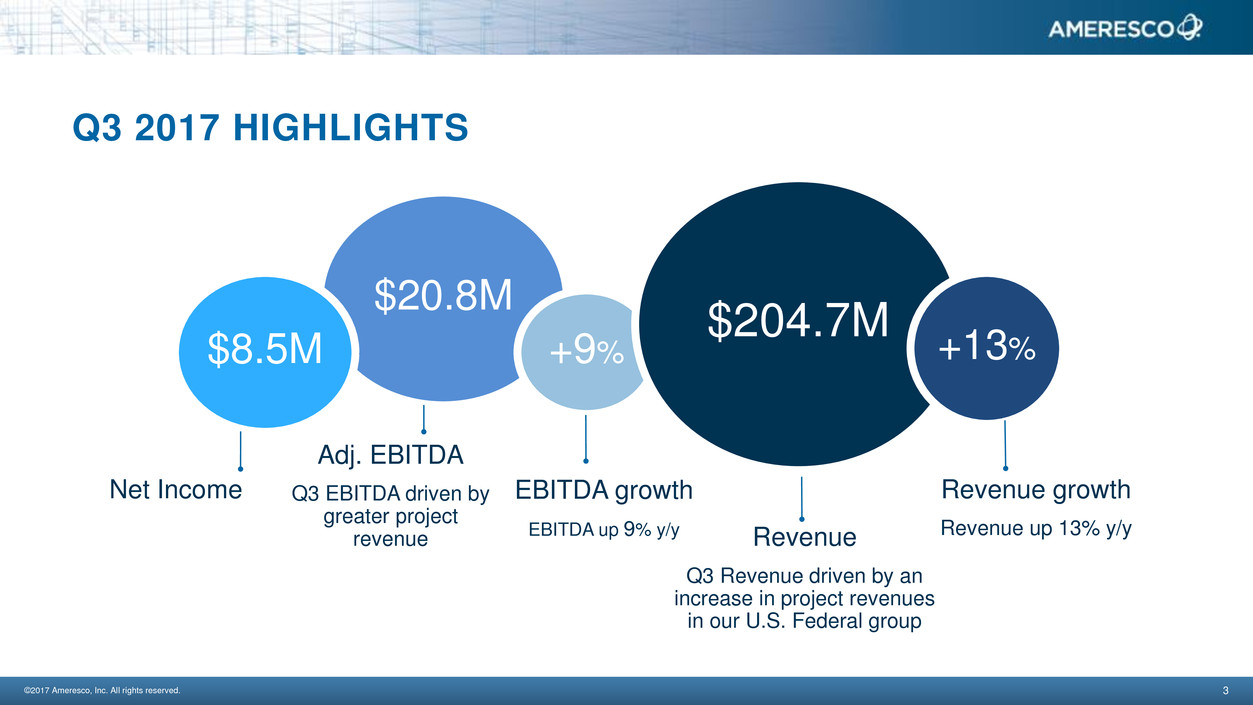

Q3 2017 HIGHLIGHTS

$20.8M

$8.5M +9%

$204.7M

+13%

Adj. EBITDA

Q3 EBITDA driven by

greater project

revenue

EBITDA growth

EBITDA up 9% y/y

Revenue growth

Revenue up 13% y/y Revenue

Q3 Revenue driven by an

increase in project revenues

in our U.S. Federal group

Net Income

©2017 Ameresco, Inc. All rights reserved. 4

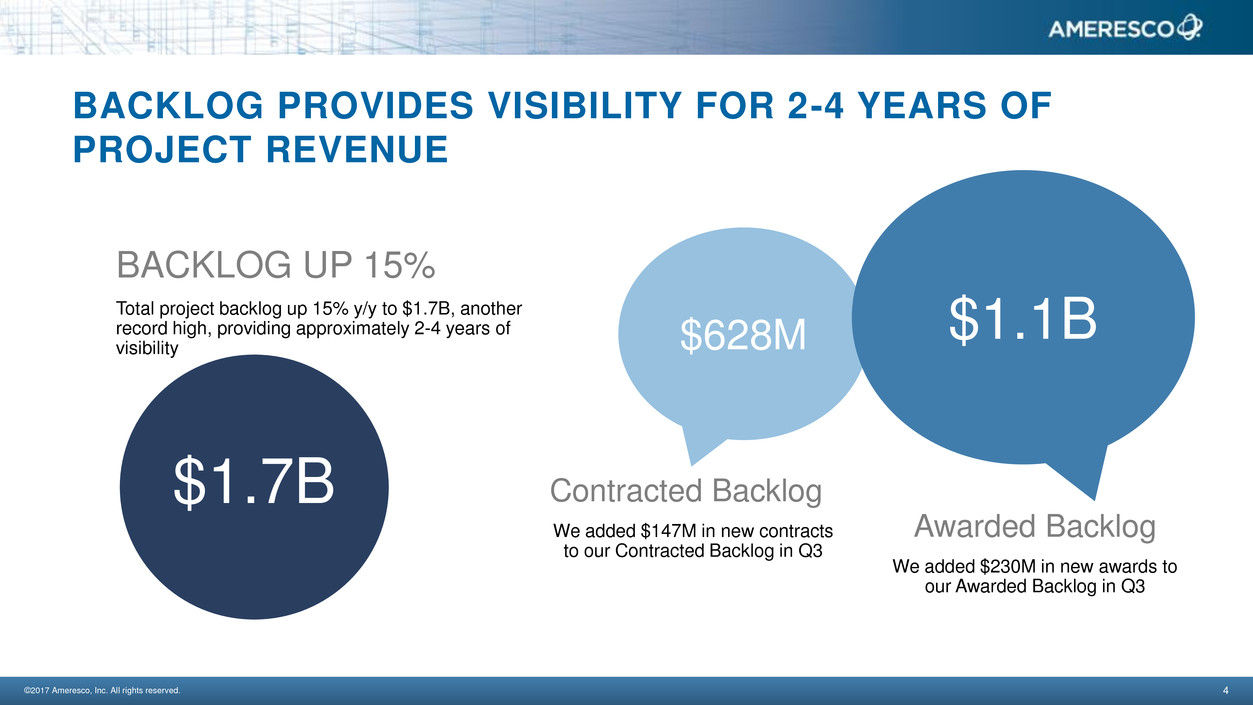

BACKLOG PROVIDES VISIBILITY FOR 2-4 YEARS OF

PROJECT REVENUE

BACKLOG UP 15%

Total project backlog up 15% y/y to $1.7B, another

record high, providing approximately 2-4 years of

visibility

Contracted Backlog

We added $147M in new contracts

to our Contracted Backlog in Q3

$628M $1.1B

Awarded Backlog

We added $230M in new awards to

our Awarded Backlog in Q3

$1.7B

©2017 Ameresco, Inc. All rights reserved. 5

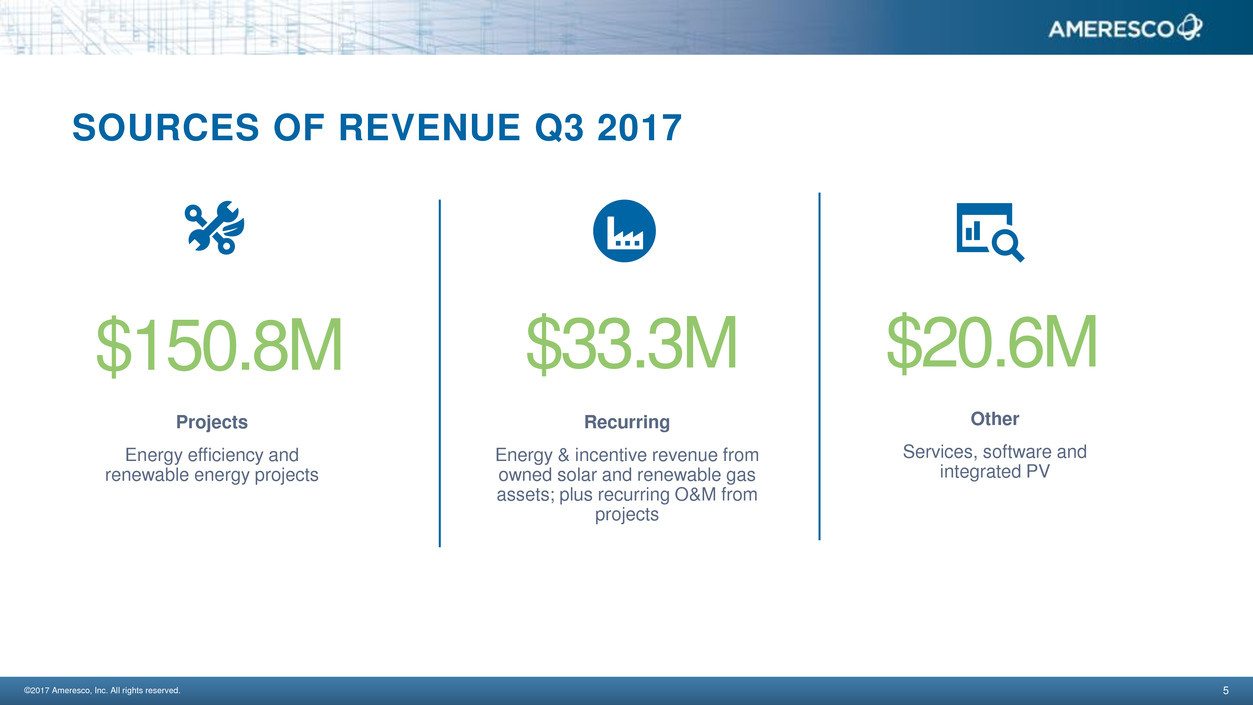

SOURCES OF REVENUE Q3 2017

$20.6M $33.3M $150.8M

Projects

Energy efficiency and

renewable energy projects

Recurring

Energy & incentive revenue from

owned solar and renewable gas

assets; plus recurring O&M from

projects

Other

Services, software and

integrated PV

©2017 Ameresco, Inc. All rights reserved.

6

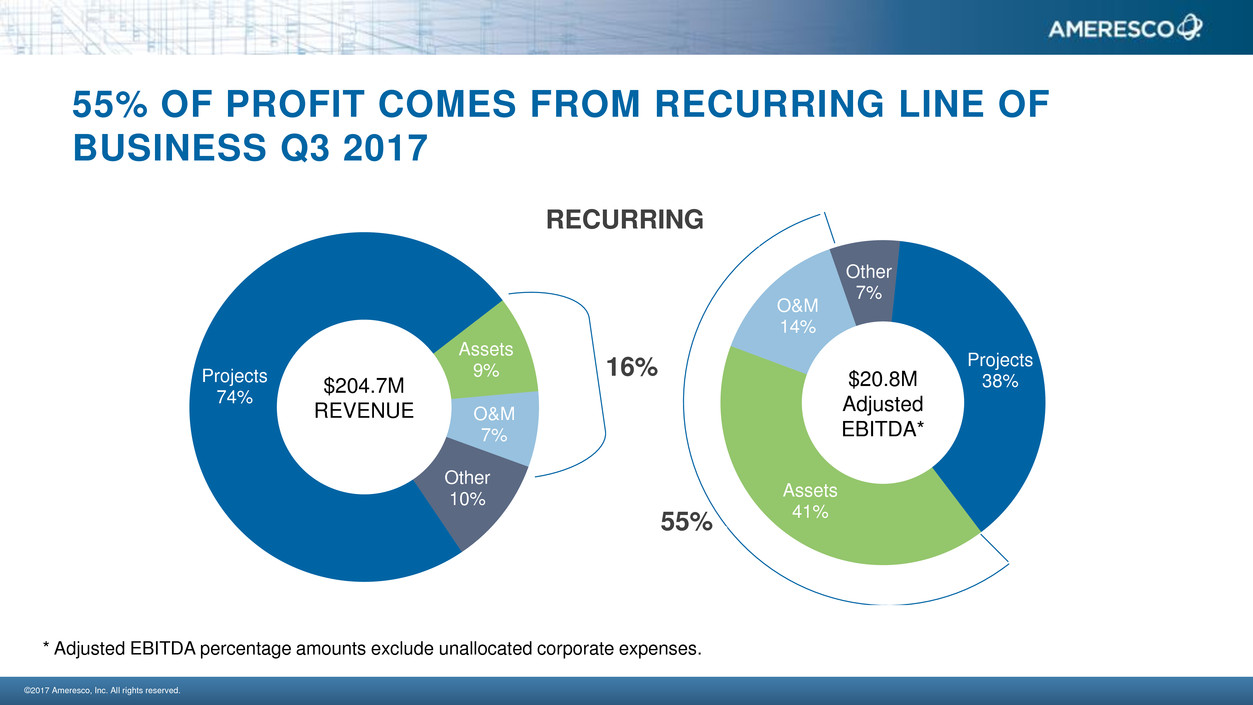

55% OF PROFIT COMES FROM RECURRING LINE OF

BUSINESS Q3 2017

16% Projects

74%

Assets

9%

O&M

7%

Other

10%

$204.7M

REVENUE

Projects

38%

Assets

41%

O&M

14%

Other

7%

$20.8M

Adjusted

EBITDA*

55%

* Adjusted EBITDA percentage amounts exclude unallocated corporate expenses.

RECURRING

©2017 Ameresco, Inc. All rights reserved. 7

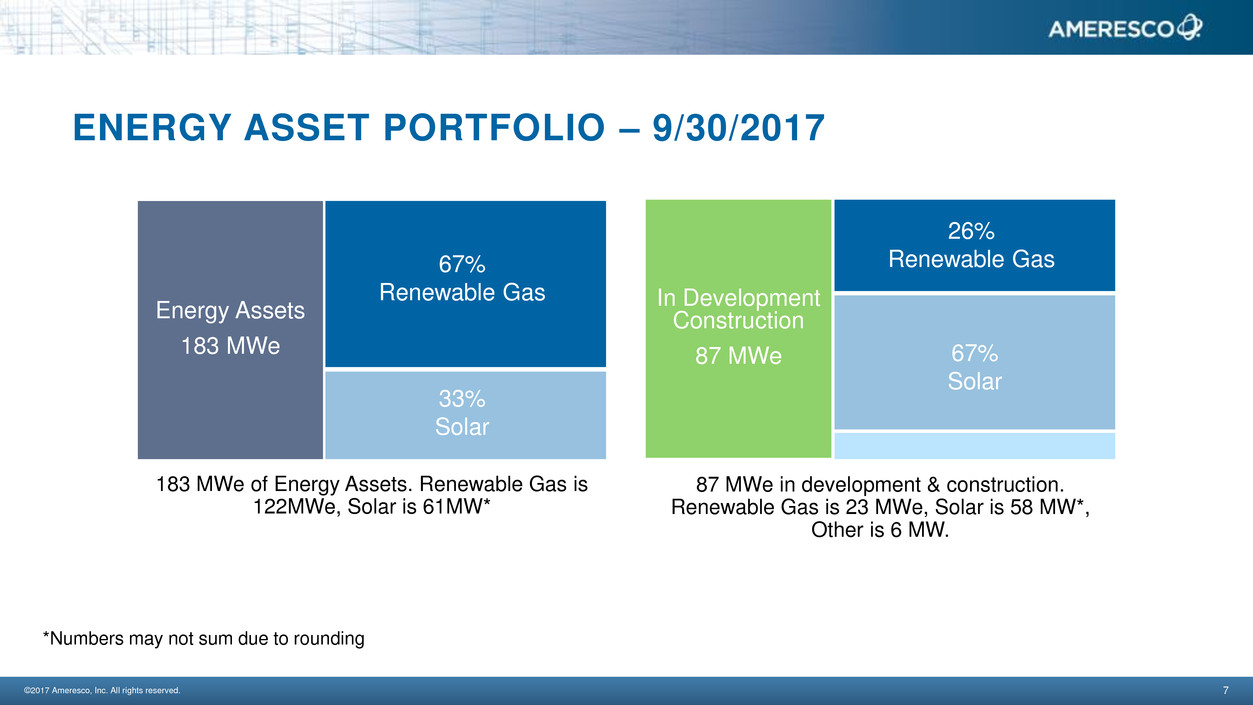

ENERGY ASSET PORTFOLIO – 9/30/2017

183 MWe of Energy Assets. Renewable Gas is

122MWe, Solar is 61MW*

Energy Assets

183 MWe

67%

Renewable Gas

33%

Solar

In Development

Construction

87 MWe

67%

Solar

26%

Renewable Gas

87 MWe in development & construction.

Renewable Gas is 23 MWe, Solar is 58 MW*,

Other is 6 MW.

*Numbers may not sum due to rounding

©2017 Ameresco, Inc. All rights reserved. 8

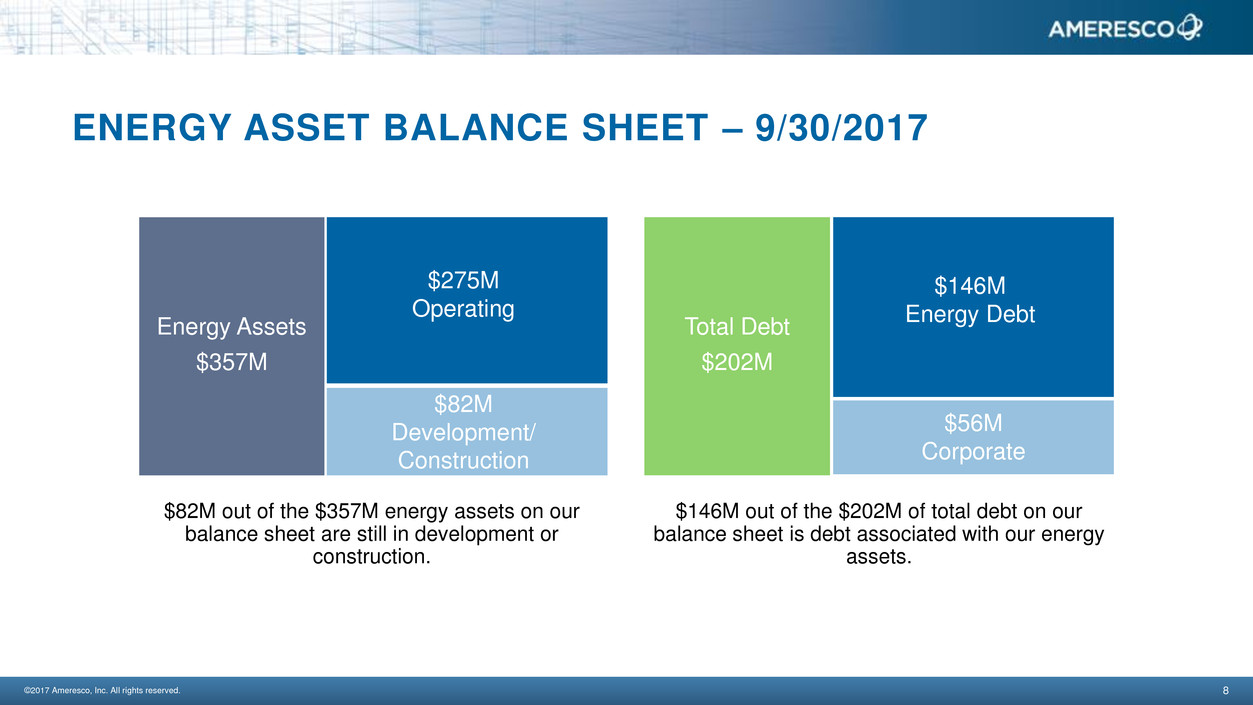

ENERGY ASSET BALANCE SHEET – 9/30/2017

$82M out of the $357M energy assets on our

balance sheet are still in development or

construction.

$146M out of the $202M of total debt on our

balance sheet is debt associated with our energy

assets.

Energy Assets

$357M

$275M

Operating

$82M

Development/

Construction

Total Debt

$202M

$56M

Corporate

$146M

Energy Debt

APPENDIX

©2017 Ameresco, Inc. All rights reserved. 10

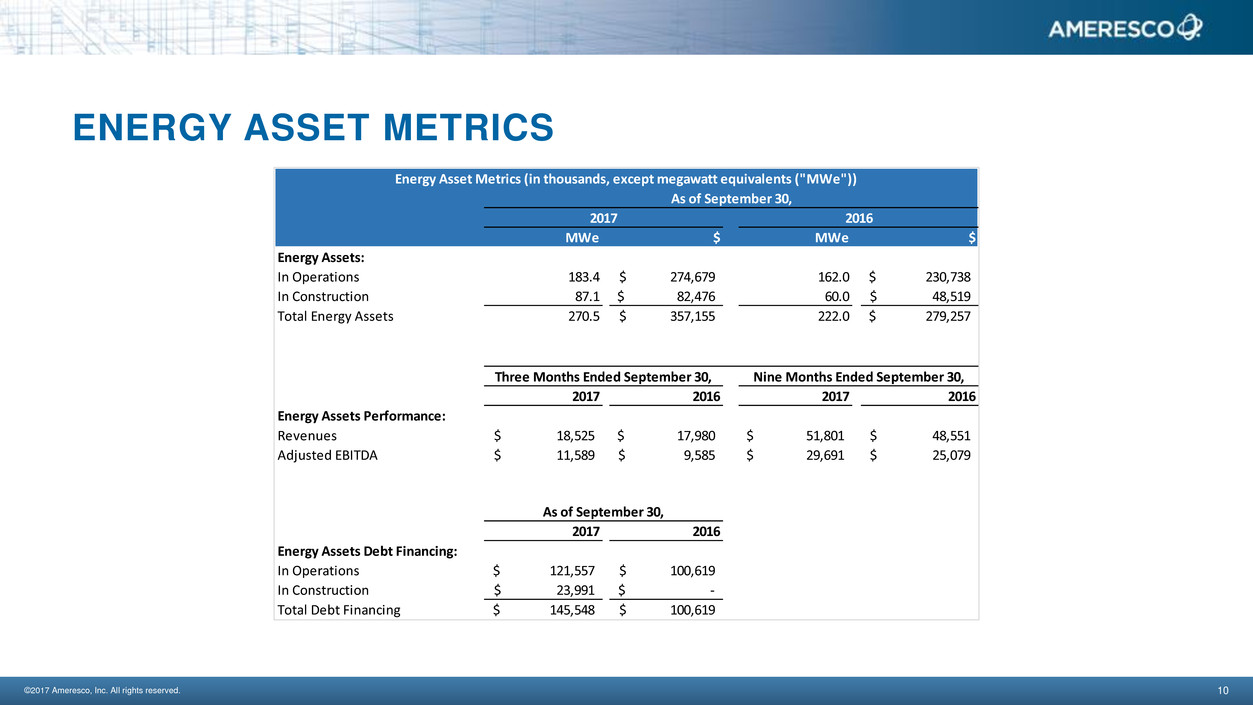

ENERGY ASSET METRICS

MWe $ MWe $

Energy Assets:

In Operations 183.4 274,679$ 162.0 230,738$

In Construction 87.1 82,476$ 60.0 48,519$

Total Energy Assets 270.5 357,155$ 222.0 279,257$

2017 2016 2017 2016

Energy Assets Performance:

Revenues 18,525$ 17,980$ 51,801$ 48,551$

Adjusted EBITDA 11,589$ 9,585$ 29,691$ 25,079$

2017 2016

Energy Assets Debt Financing:

In Operations 121,557$ 100,619$

In Construction 23,991$ -$

Total Debt Financing 145,548$ 100,619$

Energy Asset Metrics (in thousands, except megawatt equivalents ("MWe"))

As of September 30,

Three Months Ended September 30, Nine Months Ended September 30,

As of September 30,

2017 2016

©2017 Ameresco, Inc. All rights reserved. 11

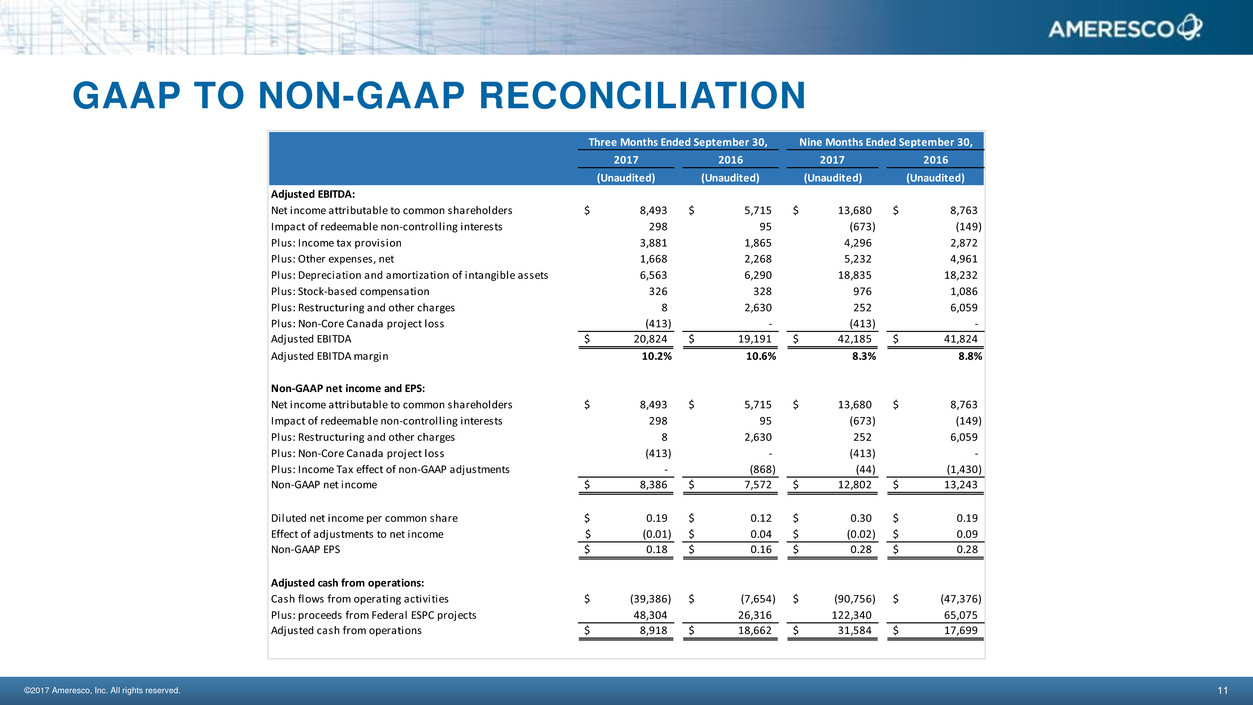

GAAP TO NON-GAAP RECONCILIATION

2017 2016 2017 2016

(Unaudited) (Unaudited) (Unaudited) (Unaudited)

Adjusted EBITDA:

Net income attributable to common shareholders 8,493$ 5,715$ 13,680$ 8,763$

Impact of redeemable non-controlling interests 298 95 (673) (149)

Plus: Income tax provision 3,881 1,865 4,296 2,872

Plus: Other expenses, net 1,668 2,268 5,232 4,961

Plus: Depreciation and amortization of intangible assets 6,563 6,290 18,835 18,232

Plus: Stock-based compensation 326 328 976 1,086

Plus: Restructuring and other charges 8 2,630 252 6,059

Plus: Non-Core Canada project loss (413) - (413) -

Adjusted EBITDA 20,824$ 19,191$ 42,185$ 41,824$

Adjusted EBITDA margin 10.2% 10.6% 8.3% 8.8%

Non-GAAP net income and EPS:

Net income attributable to common shareholders 8,493$ 5,715$ 13,680$ 8,763$

Impact of redeemable non-controlling interests 298 95 (673) (149)

Plus: Restructuring and other charges 8 2,630 252 6,059

Plus: Non-Core Canada project loss (413) - (413) -

Plus: Income Tax effect of non-GAAP adjustments - (868) (44) (1,430)

Non-GAAP net income 8,386$ 7,572$ 12,802$ 13,243$

Diluted net income per common share 0.19$ 0.12$ 0.30$ 0.19$

Effect of adjustments to net income (0.01)$ 0.04$ (0.02)$ 0.09$

Non-GAAP EPS 0.18$ 0.16$ 0.28$ 0.28$

Adjusted cash from operations:

Cash flows from operating activities (39,386)$ (7,654)$ (90,756)$ (47,376)$

Plus: proceeds from Federal ESPC projects 48,304 26,316 122,340 65,075

Adjusted cash from operations 8,918$ 18,662$ 31,584$ 17,699$

Three Months Ended September 30, Nine Months Ended September 30,

©2017 Ameresco, Inc. All rights reserved. 12

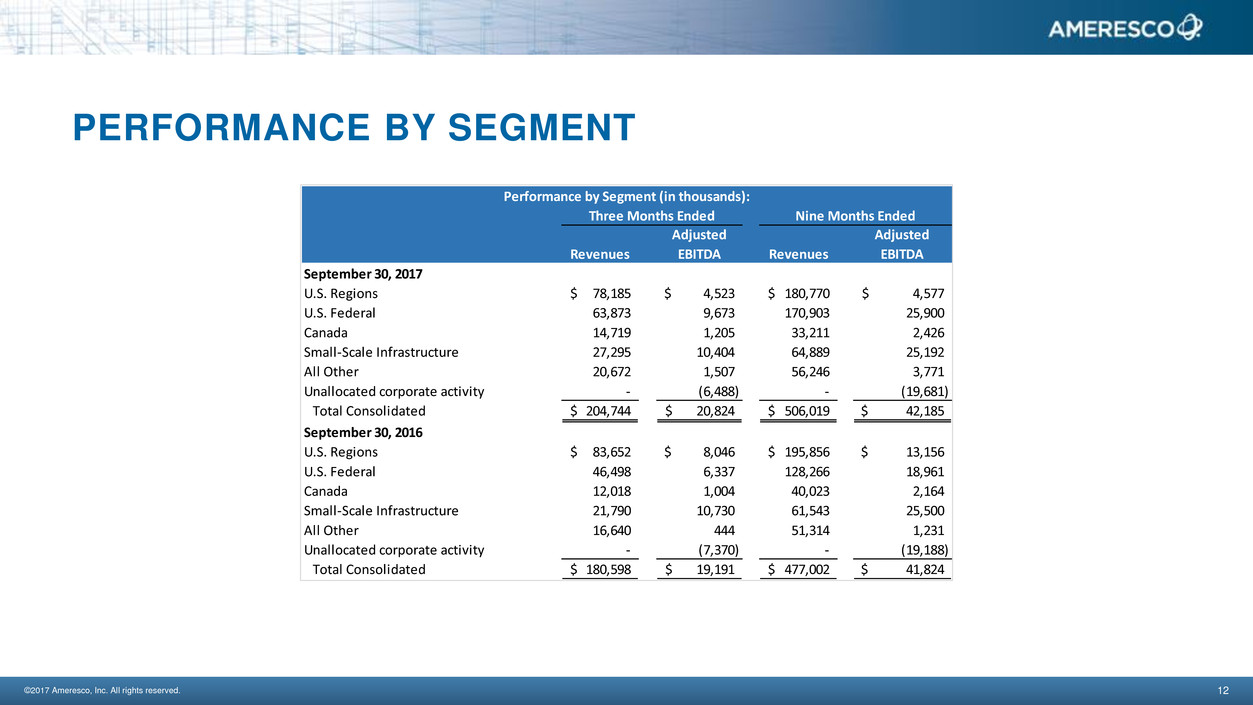

PERFORMANCE BY SEGMENT

Revenues

Adjusted

EBITDA Revenues

Adjusted

EBITDA

September 30, 2017

U.S. Regions 78,185$ 4,523$ 180,770$ 4,577$

U.S. Federal 63,873 9,673 170,903 25,900

Canada 14,719 1,205 33,211 2,426

Small-Scale Infrastructure 27,295 10,404 64,889 25,192

All Other 20,672 1,507 56,246 3,771

Unallocated corporate activity - (6,488) - (19,681)

Total Consolidated 204,744$ 20,824$ 506,019$ 42,185$

September 30, 2016

U.S. Regions 83,652$ 8,046$ 195,856$ 13,156$

U.S. Federal 46,498 6,337 128,266 18,961

Canada 12,018 1,004 40,023 2,164

Small-Scale Infrastructure 21,790 10,730 61,543 25,500

All Other 16,640 444 51,314 1,231

Unallocated corporate activity - (7,370) - (19,188)

Total Consolidated 180,598$ 19,191$ 477,002$ 41,824$

Three Months Ended Nine Months Ended

Performance by Segment (in thousands):

©2017 Ameresco, Inc. All rights reserved. 13

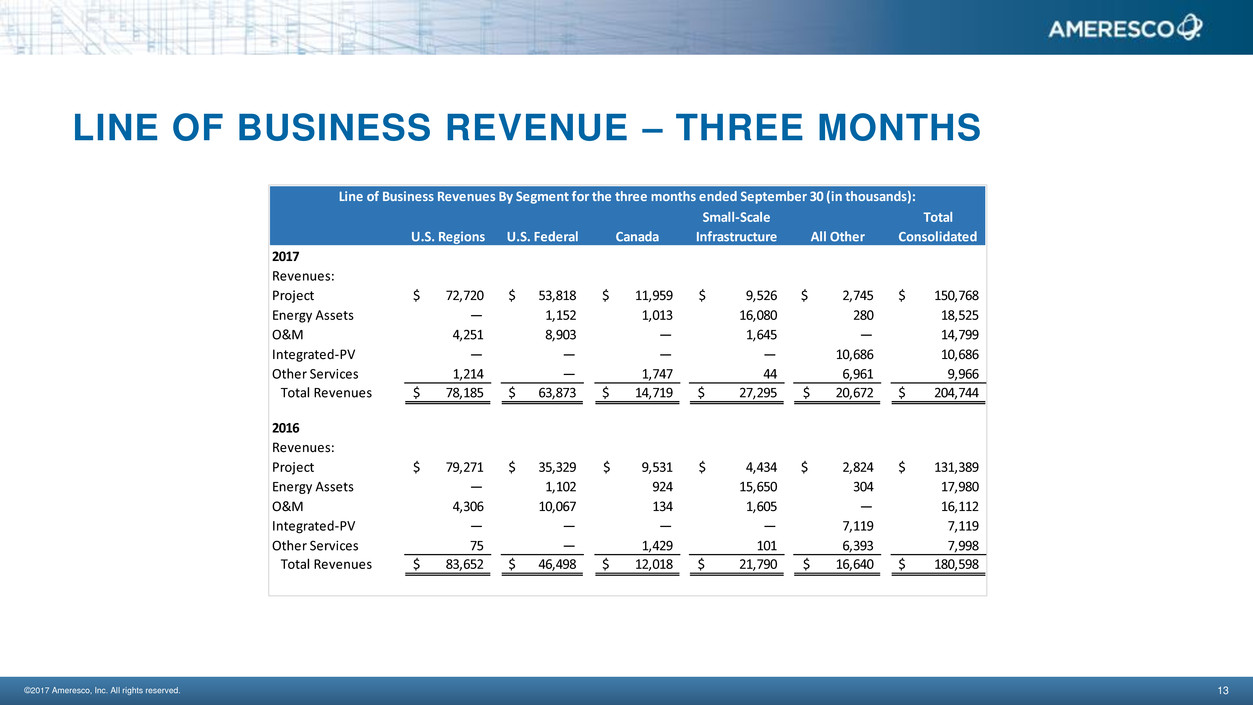

LINE OF BUSINESS REVENUE – THREE MONTHS

U.S. Regions U.S. Federal Canada

Small-Scale

Infrastructure All Other

Total

Consolidated

2017

Revenues:

Project 72,720$ 53,818$ 11,959$ 9,526$ 2,745$ 150,768$

Energy Assets — 1,152 1,013 16,080 280 18,525

O&M 4,251 8,903 — 1,645 — 14,799

Integrated-PV — — — — 10,686 10,686

Other Services 1,214 — 1,747 44 6,961 9,966

Total Revenues 78,185$ 63,873$ 14,719$ 27,295$ 20,672$ 204,744$

2016

Revenues:

Project 79,271$ 35,329$ 9,531$ 4,434$ 2,824$ 131,389$

Energy Assets — 1,102 924 15,650 304 17,980

O&M 4,306 10,067 134 1,605 — 16,112

Integrated-PV — — — — 7,119 7,119

Other Services 75 — 1,429 101 6,393 7,998

Total Revenues 83,652$ 46,498$ 12,018$ 21,790$ 16,640$ 180,598$

Line of Business Revenues By Segment for the three months ended September 30 (in thousands):

©2017 Ameresco, Inc. All rights reserved. 14

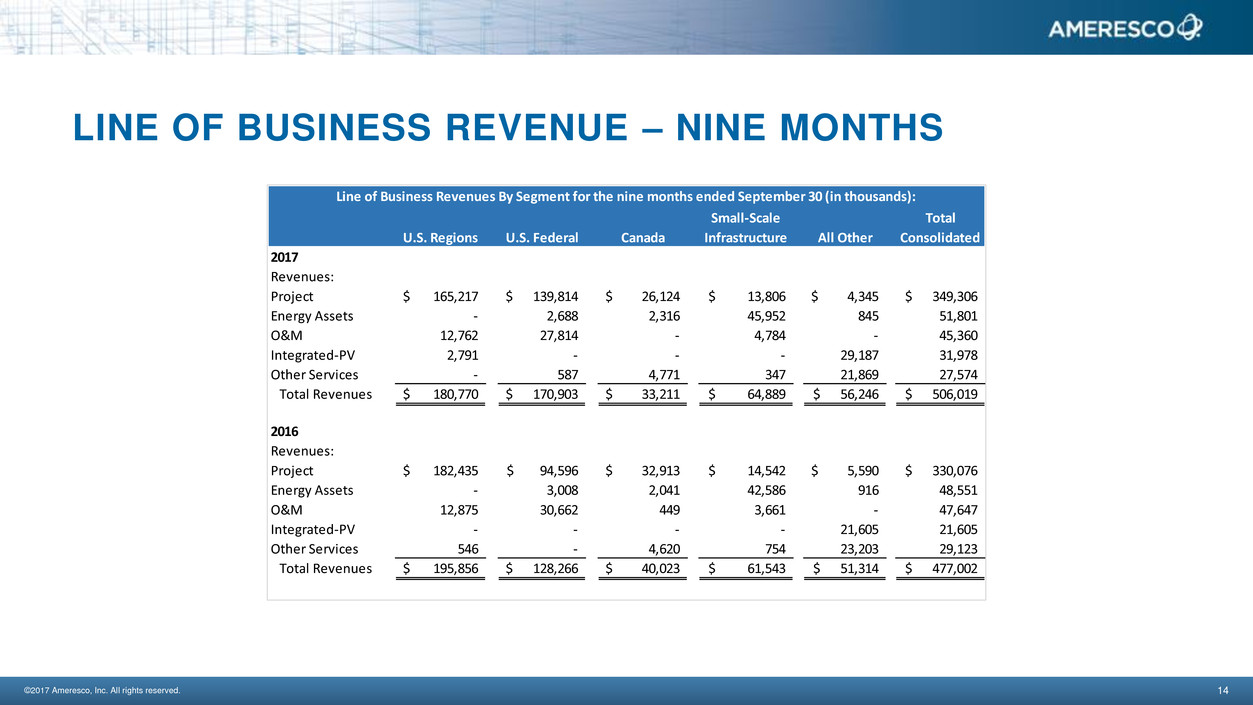

LINE OF BUSINESS REVENUE – NINE MONTHS

U.S. Regions U.S. Federal Canada

Small-Scale

Infrastructure All Other

Total

Consolidated

2017

Revenues:

Project 165,217$ 139,814$ 26,124$ 13,806$ 4,345$ 349,306$

Energy Assets - 2,688 2,316 45,952 845 51,801

O&M 12,762 27,814 - 4,784 - 45,360

Integrated-PV 2,791 - - - 29,187 31,978

Other Services - 587 4,771 347 21,869 27,574

Total Revenues 180,770$ 170,903$ 33,211$ 64,889$ 56,246$ 506,019$

2016

Revenues:

Project 182,435$ 94,596$ 32,913$ 14,542$ 5,590$ 330,076$

Energy Assets - 3,008 2,041 42,586 916 48,551

O&M 12,875 30,662 449 3,661 - 47,647

Integrated-PV - - - - 21,605 21,605

Other Services 546 - 4,620 754 23,203 29,123

Total Revenues 195,856$ 128,266$ 40,023$ 61,543$ 51,314$ 477,002$

Line of Business Revenues By Segment for the nine months ended September 30 (in thousands):

Your Trusted Sustainability Partner

ameresco.com