ameresco.com © 2020 Ameresco, Inc. All rights reserved. Q4 2020 Supplemental Information March 1, 2021

2 Safe Harbor Forward Looking Statements Any statements in this presentation about future expectations, plans and prospects for Ameresco, Inc., including statements about market conditions, pipeline and backlog, as well as estimated future revenues and net income, and other statements containing the words “projects,” “believes,” “anticipates,” “plans,” “expects,” “will” and similar expressions, constitute forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those indicated by such forward looking statements as a result of various important factors, including the timing of, and ability to, enter into contracts for awarded projects on the terms proposed; the timing of work we do on projects where we recognize revenue on a percentage of completion basis, including the ability to perform under recently signed contracts without unusual delay; demand for our energy efficiency and renewable energy solutions; our ability to arrange financing for our projects; changes in federal, state and local government policies and programs related to energy efficiency and renewable energy; the ability of customers to cancel or defer contracts included in our backlog; the effects of our recent acquisitions and restructuring activities; seasonality in construction and in demand for our products and services; a customer’s decision to delay our work on, or other risks involved with, a particular project; availability and costs of labor and equipment; the addition of new customers or the loss of existing customers; market price of the Company's stock prevailing from time to time; the nature of other investment opportunities presented to the Company from time to time; the Company's cash flows from operations; and other factors discussed in our Annual Report on Form 10-K for the year ended December 31, 2019, filed with the U.S. Securities and Exchange Commission (SEC) on March 4, 2020, and in our Quarterly Report on Form 10-Q, filed with the SEC on May 5, 2020. Currently, one of the most significant factors, however, is the potential adverse effect of the current pandemic of the novel coronavirus, or COVID-19, on our financial condition, results of operations, cash flows and performance and the global economy and financial markets. The extent to which COVID-19 impacts us, suppliers, customers, employees and supply chains will depend on future developments, which are highly uncertain and cannot be predicted with confidence, including the scope, severity and duration of the pandemic, the actions taken to contain the pandemic or mitigate its impact, and the direct and indirect economic effects of the pandemic and containment measures, among others. Moreover, you should interpret many of the risks identified in our Annual Report and Quarterly Report as being heightened as a result of the ongoing and numerous adverse impacts of COVID-19. In addition, the forward-looking statements included in this presentation represent our views as of the date of this presentation. We anticipate that subsequent events and developments will cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we specifically disclaim any obligation to do so. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date of this presentation. Use of Non-GAAP Financial Measures This presentation and the accompanying tables include references to adjusted EBITDA, Non-GAAP EPS, Non-GAAP net income and adjusted cash from operations, which are Non-GAAP financial measures. For a description of these Non-GAAP financial measures, including the reasons management uses these measures, please see the section in the back of this presentation titled “Non-GAAP Financial Measures”. For a reconciliation of these Non-GAAP financial measures to the most directly comparable financial measures prepared in accordance with GAAP, please see the table at the end of this presentation titled “GAAP to Non-GAAP Reconciliation.”

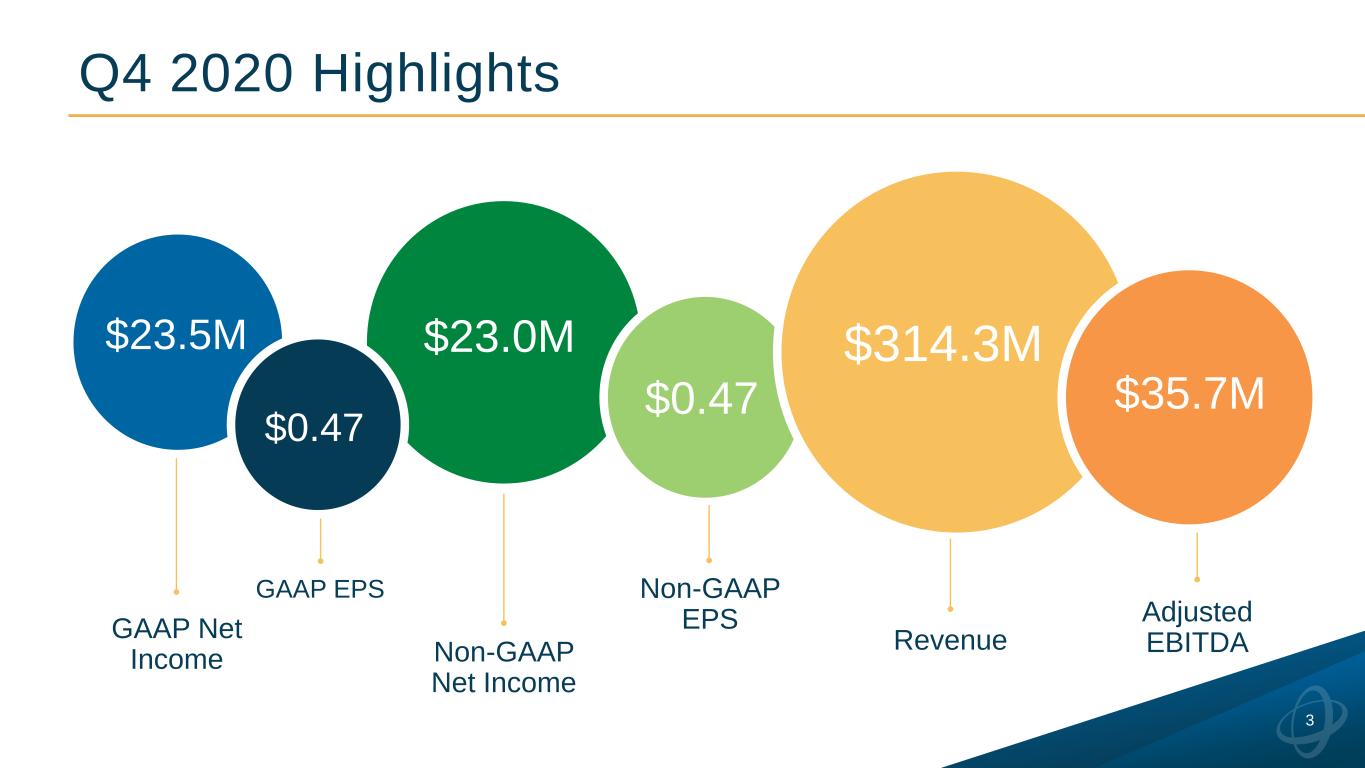

Q4 2020 Highlights 3 GAAP EPS Non-GAAP Net Income Non-GAAP EPS Adjusted EBITDARevenue GAAP Net Income $0.47 $35.7M$0.47 $23.5M $314.3M$23.0M

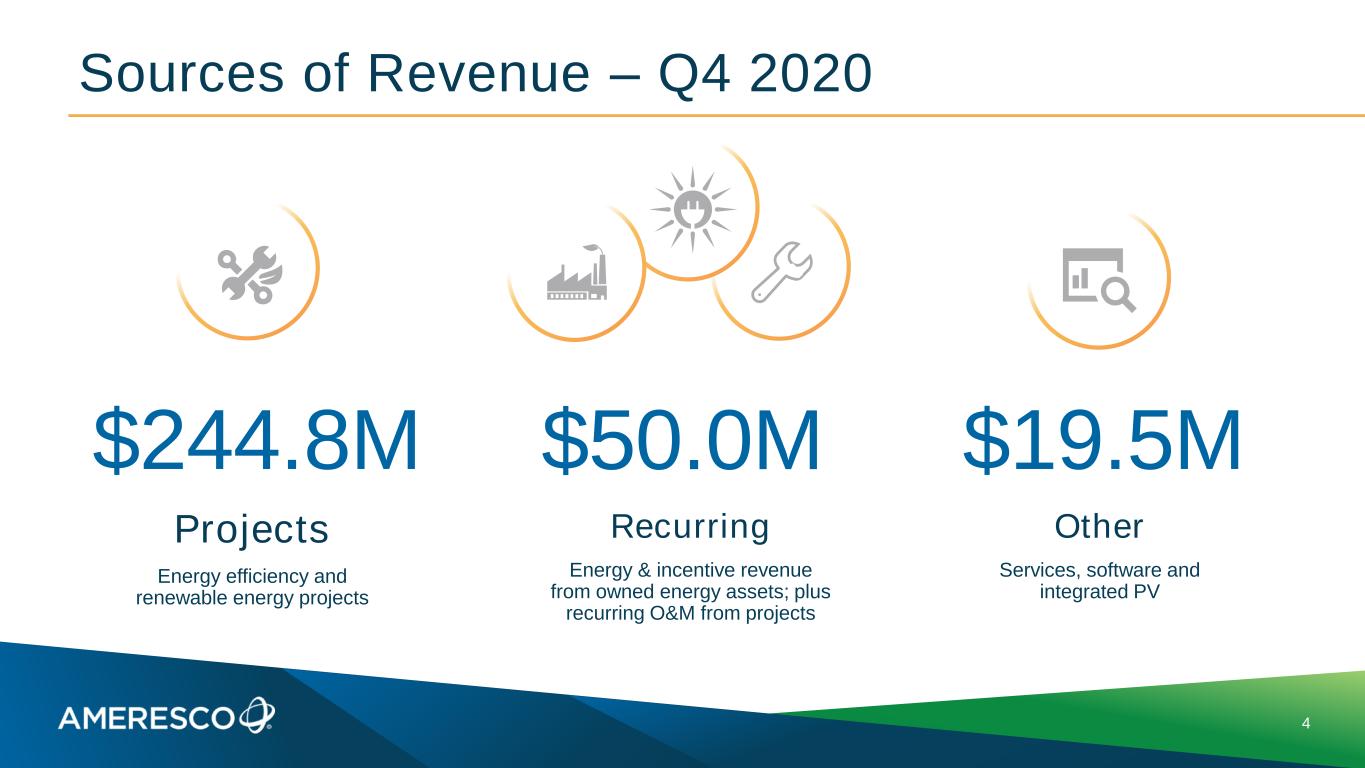

Sources of Revenue – Q4 2020 4 Projects Energy efficiency and renewable energy projects Recurring Energy & incentive revenue from owned energy assets; plus recurring O&M from projects Other Services, software and integrated PV $244.8M $50.0M $19.5M

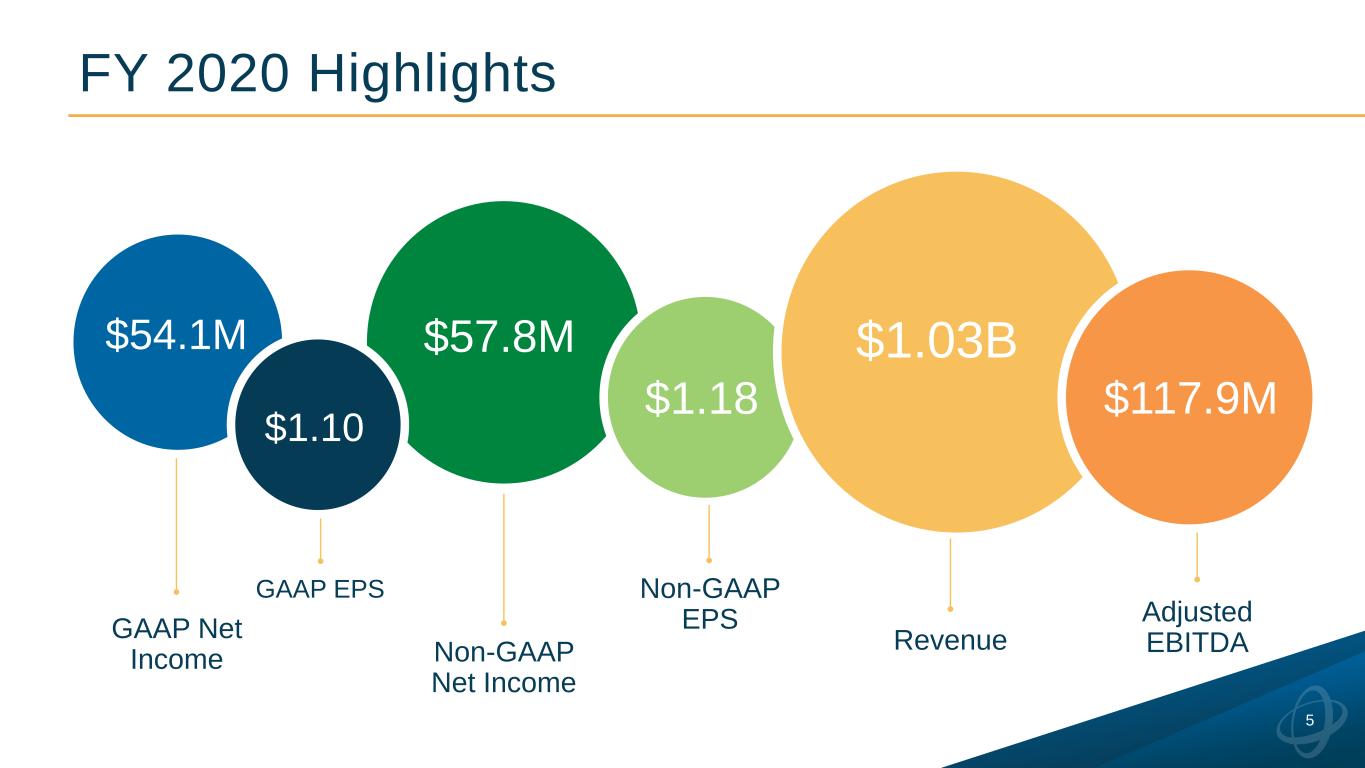

FY 2020 Highlights 5 GAAP EPS Non-GAAP Net Income Non-GAAP EPS Adjusted EBITDARevenue GAAP Net Income $1.10 $117.9M$1.18 $54.1M $1.03B$57.8M

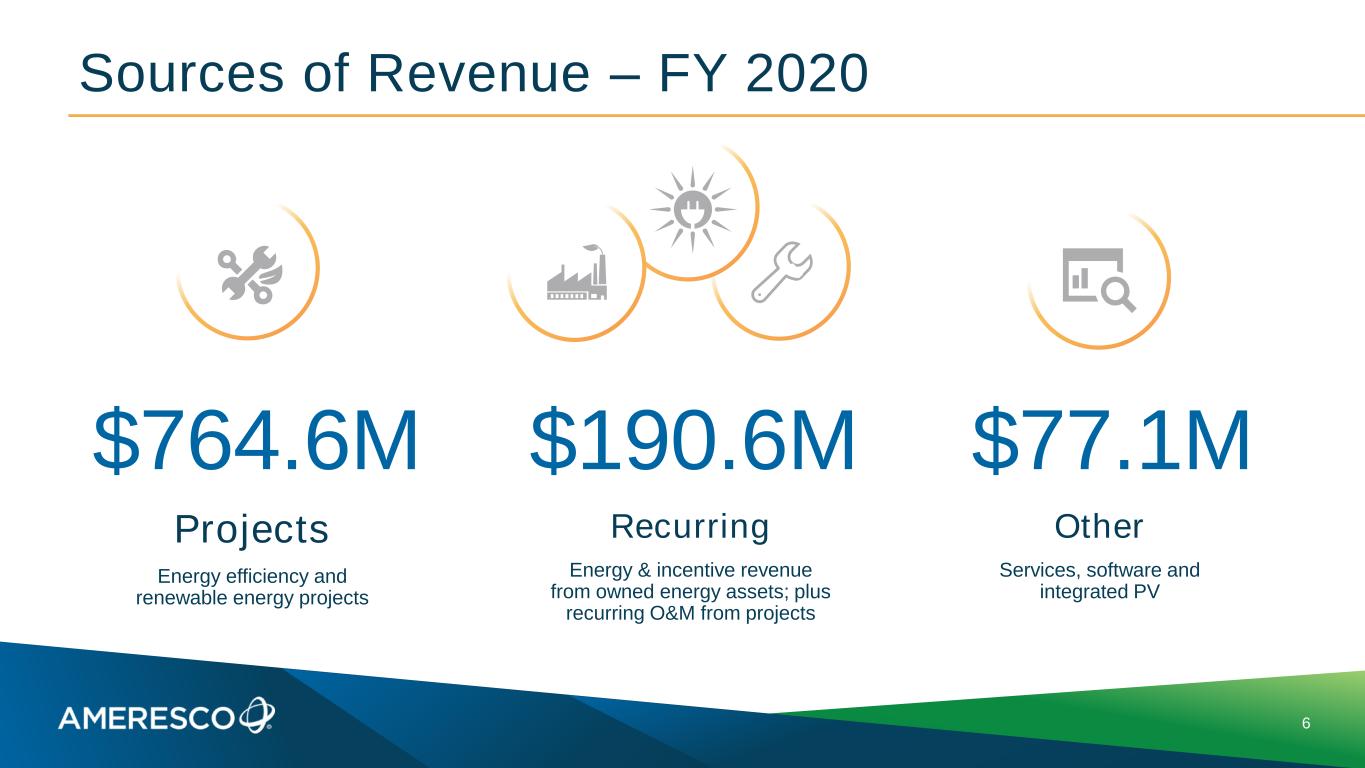

Sources of Revenue – FY 2020 6 Projects Energy efficiency and renewable energy projects Recurring Energy & incentive revenue from owned energy assets; plus recurring O&M from projects Other Services, software and integrated PV $764.6M $190.6M $77.1M

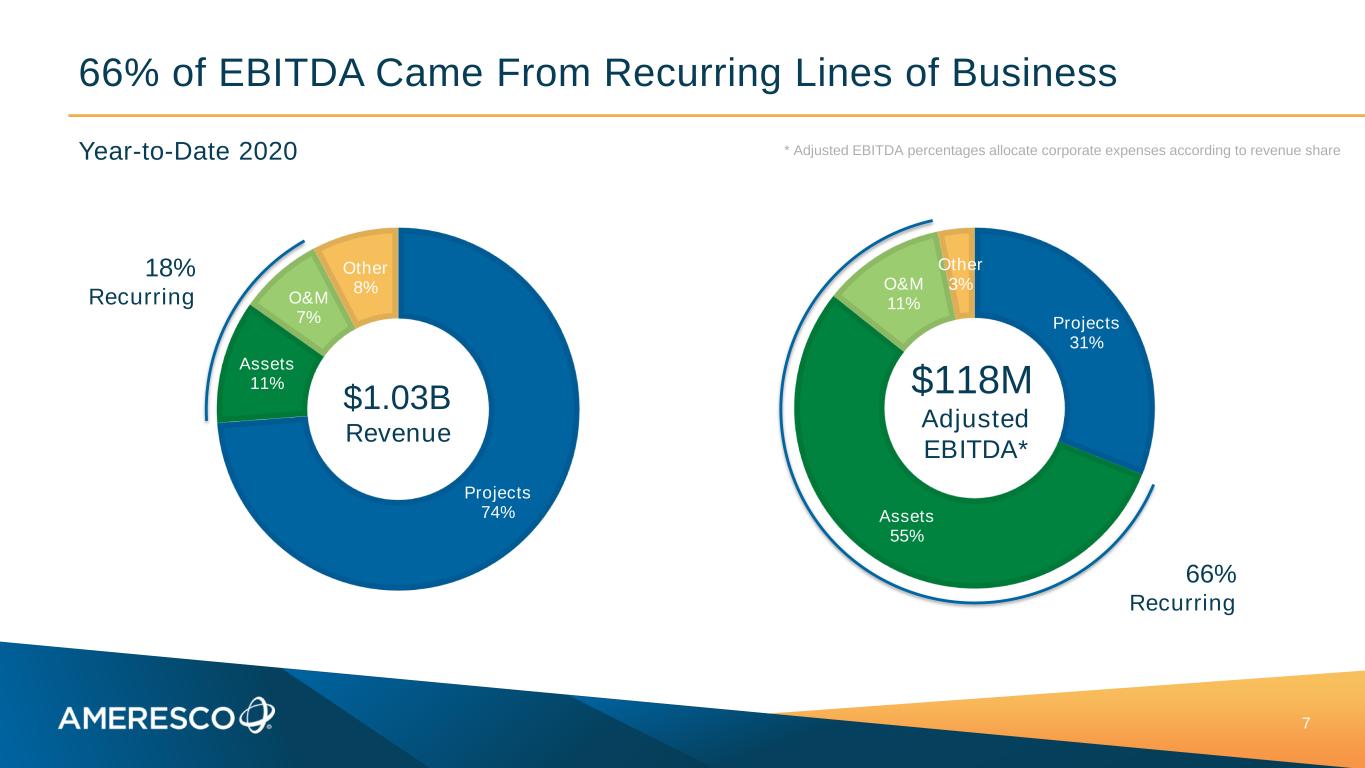

66% of EBITDA Came From Recurring Lines of Business 7 Projects 74% Assets 11% O&M 7% Other 8% 18% Recurring $1.03B Revenue Projects 31% Assets 55% O&M 11% Other 3% $118M Adjusted EBITDA* 66% Recurring * Adjusted EBITDA percentages allocate corporate expenses according to revenue shareYear-to-Date 2020

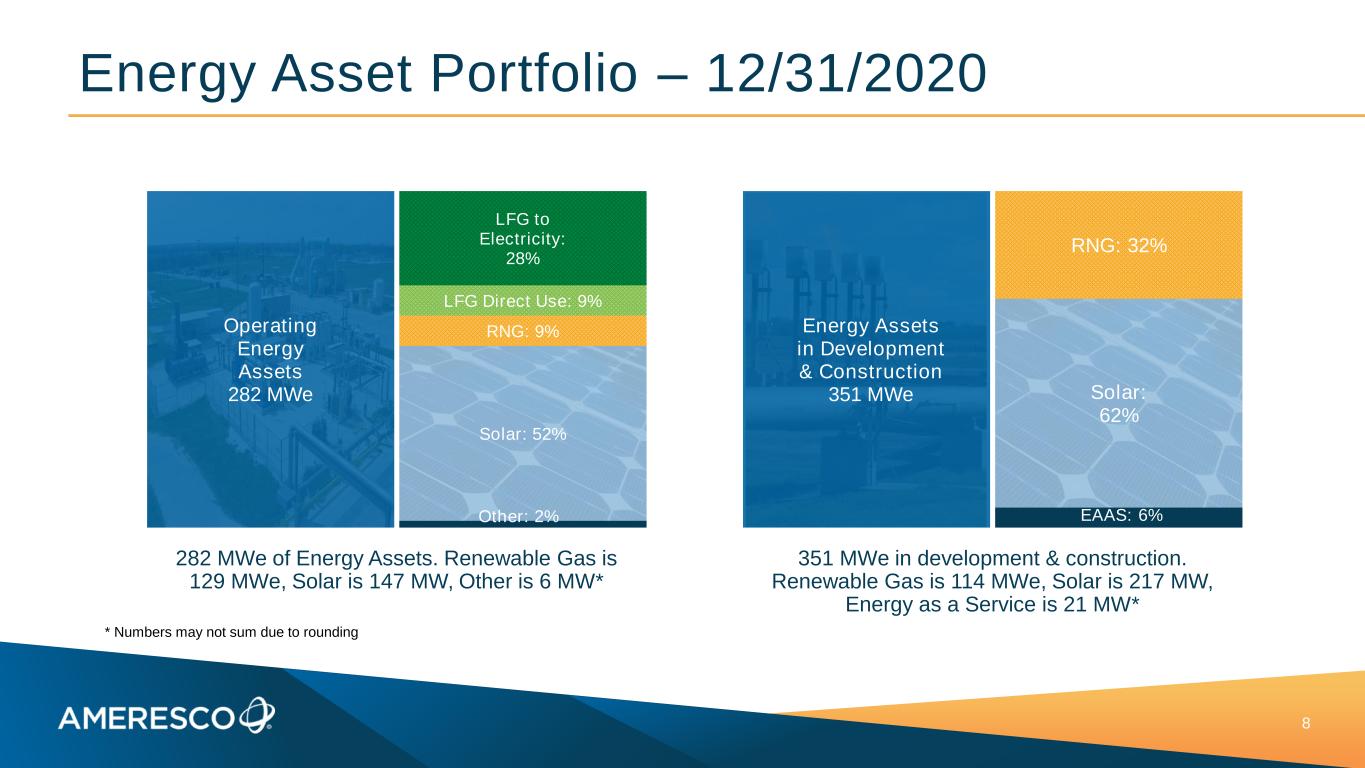

Energy Asset Portfolio – 12/31/2020 8 282 MWe of Energy Assets. Renewable Gas is 129 MWe, Solar is 147 MW, Other is 6 MW* 351 MWe in development & construction. Renewable Gas is 114 MWe, Solar is 217 MW, Energy as a Service is 21 MW* Operating Energy Assets 282 MWe Other: 2% Solar: 52% RNG: 9% LFG Direct Use: 9% LFG to Electricity: 28% Energy Assets in Development & Construction 351 MWe EAAS: 6% Solar: 62% RNG: 32% * Numbers may not sum due to rounding

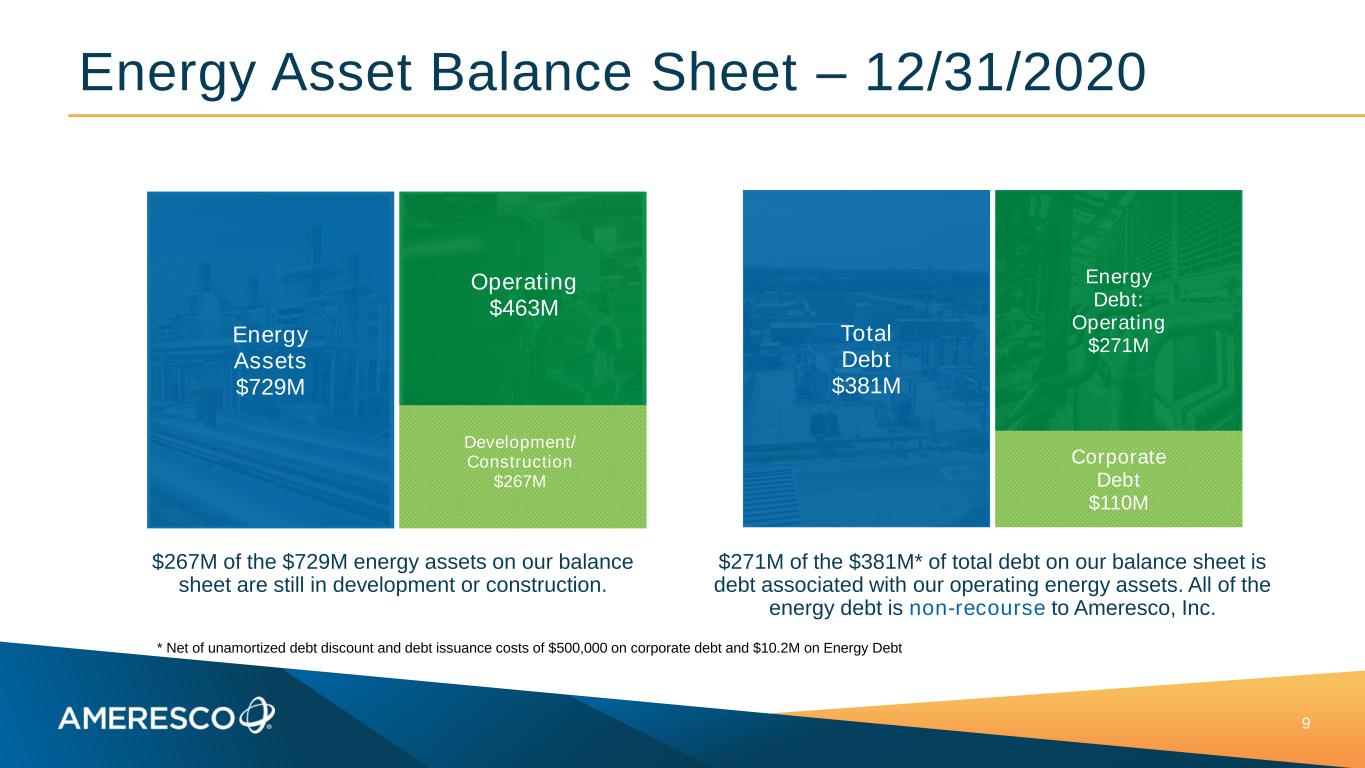

Energy Asset Balance Sheet – 12/31/2020 9 $267M of the $729M energy assets on our balance sheet are still in development or construction. $271M of the $381M* of total debt on our balance sheet is debt associated with our operating energy assets. All of the energy debt is non-recourse to Ameresco, Inc. Total Debt $381M Corporate Debt $110M Energy Debt: Operating $271M Energy Assets $729M Development/ Construction $267M Operating $463M * Net of unamortized debt discount and debt issuance costs of $500,000 on corporate debt and $10.2M on Energy Debt

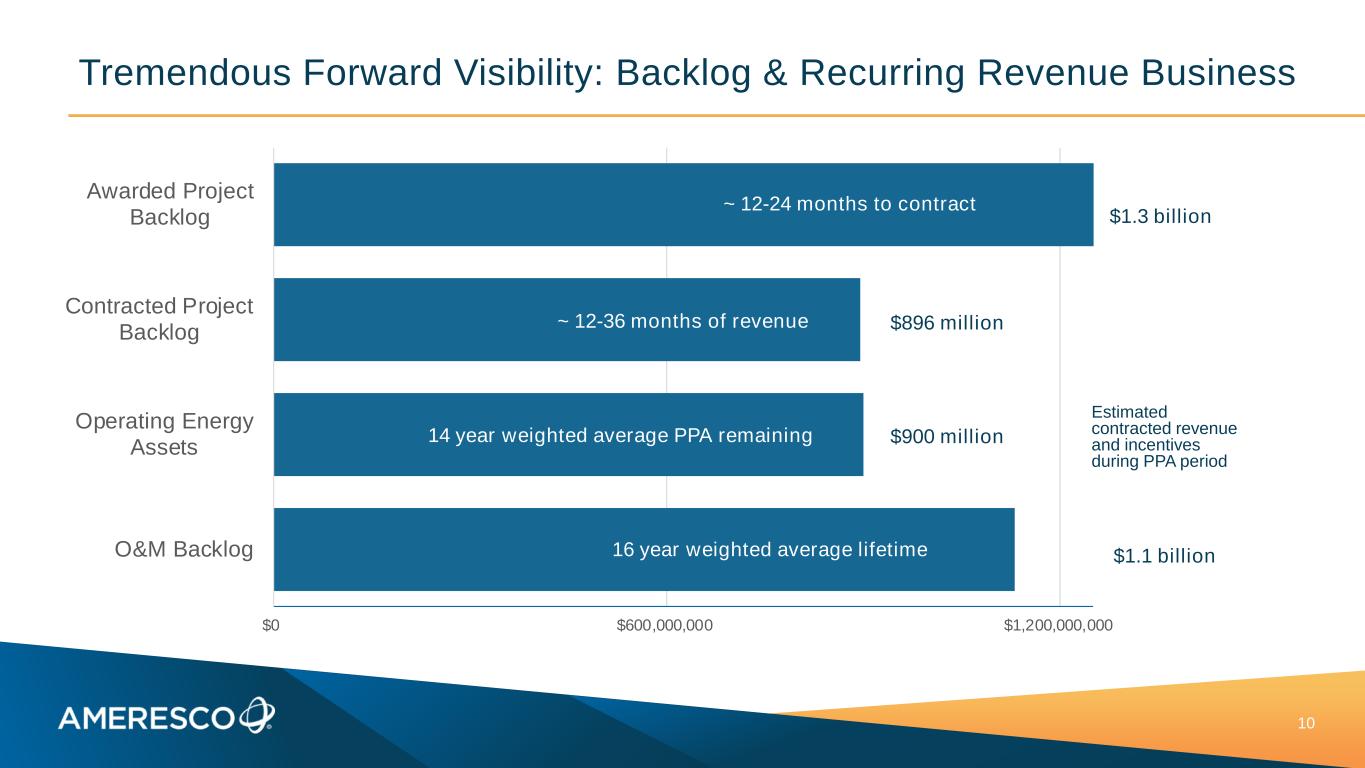

$0 $600,000,000 $1,200,000,000 Awarded Project Backlog Contracted Project Backlog Operating Energy Assets O&M Backlog Tremendous Forward Visibility: Backlog & Recurring Revenue Business 10 ~ 12-24 months to contract ~ 12-36 months of revenue 14 year weighted average PPA remaining 16 year weighted average lifetime Estimated contracted revenue and incentives during PPA period $1.3 billion $896 million $900 million $1.1 billion

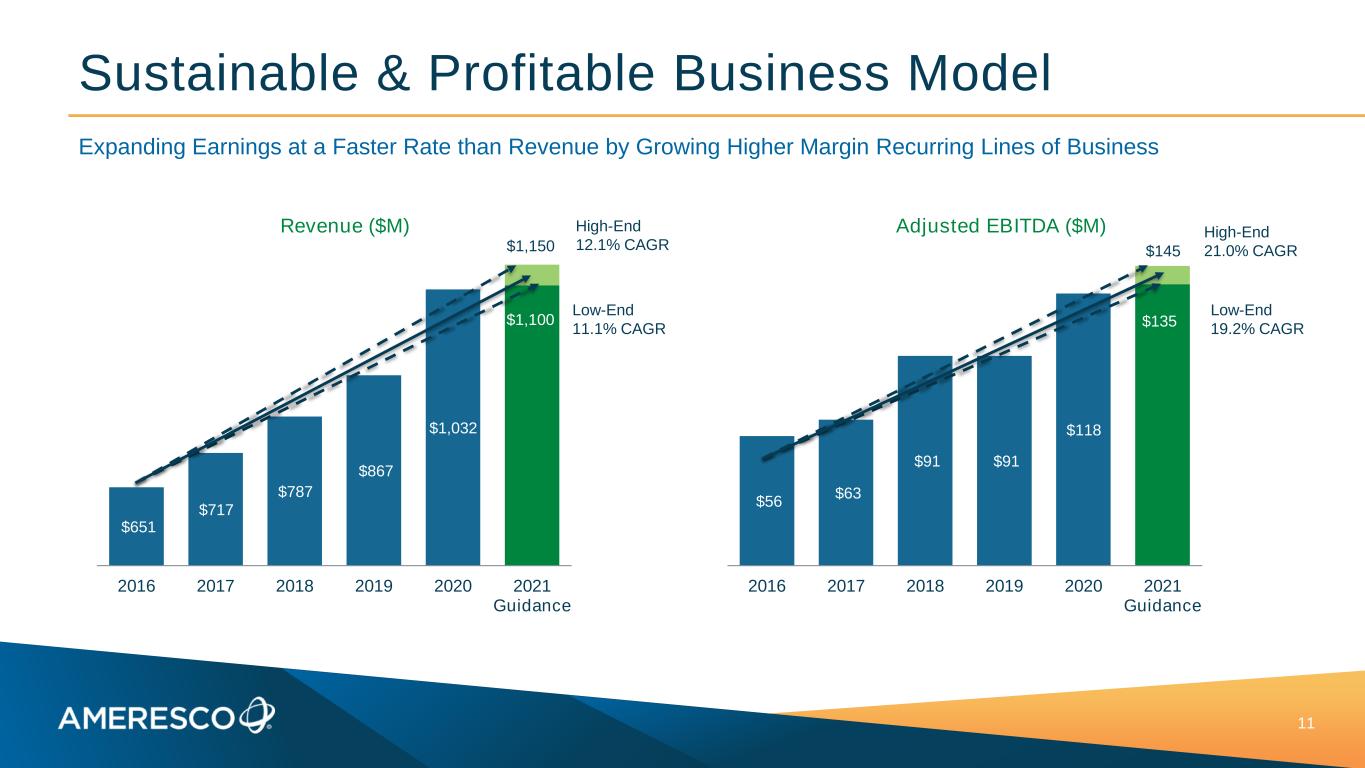

Sustainable & Profitable Business Model 11 Revenue ($M) $651 $717 $787 $867 $1,032 $1,100 2016 2017 2018 2019 2020 2021 Guidance $1,150 High-End 12.1% CAGR Low-End 11.1% CAGR Adjusted EBITDA ($M) $56 $63 $91 $91 $118 $135 2016 2017 2018 2019 2020 2021 Guidance $145 High-End 21.0% CAGR Low-End 19.2% CAGR Expanding Earnings at a Faster Rate than Revenue by Growing Higher Margin Recurring Lines of Business

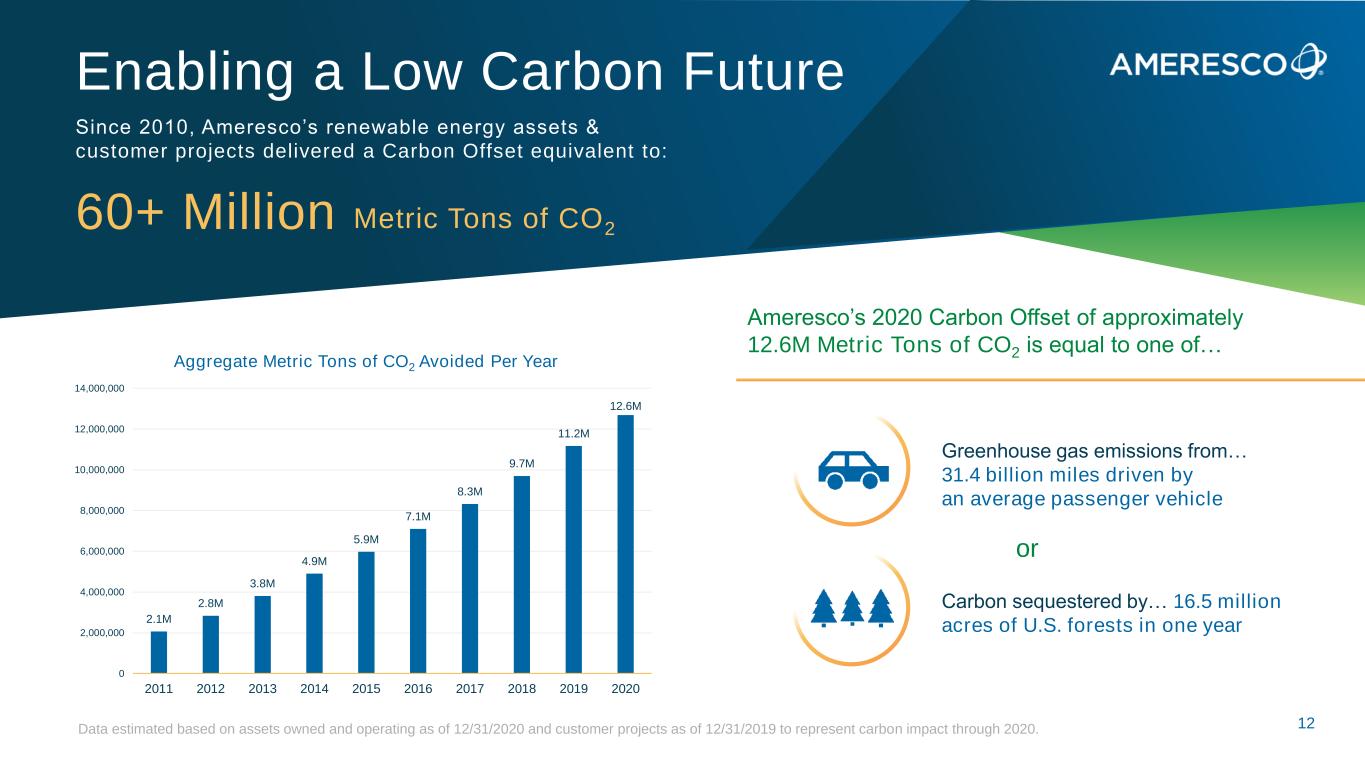

Enabling a Low Carbon Future Since 2010, Ameresco’s renewable energy assets & customer projects delivered a Carbon Offset equivalent to: Greenhouse gas emissions from… 31.4 billion miles driven by an average passenger vehicle Carbon sequestered by… 16.5 million acres of U.S. forests in one year or Data estimated based on assets owned and operating as of 12/31/2020 and customer projects as of 12/31/2019 to represent carbon impact through 2020. 60+ Million Metric Tons of CO2 Ameresco’s 2020 Carbon Offset of approximately 12.6M Metric Tons of CO2 is equal to one of… 2.1M 2.8M 3.8M 4.9M 5.9M 7.1M 8.3M 9.7M 11.2M 12.6M 0 2,000,000 4,000,000 6,000,000 8,000,000 10,000,000 12,000,000 14,000,000 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Aggregate Metric Tons of CO2 Avoided Per Year 12

ameresco.com © 2020 Ameresco, Inc. All rights reserved. to Our Customers, Employees, and Shareholders Thank You

14 Non-GAAP Financial Measures We use the Non-GAAP financial measures defined and discussed below to provide investors and others with useful supplemental information to our financial results prepared in accordance with GAAP. These Non-GAAP financial measures should not be considered as an alternative to any measure of financial performance calculated and presented in accordance with GAAP. For a reconciliation of these Non-GAAP measures to the most directly comparable financial measures prepared in accordance with GAAP, please see the table at the end of this presentation titled “GAAP to Non-GAAP Reconciliation.” We understand that, although measures similar to these Non- GAAP financial measures are frequently used by investors and securities analysts in their evaluation of companies, they have limitations as analytical tools, and investors should not consider them in isolation or as a substitute for the most directly comparable GAAP financial measures or an analysis of our results of operations as reported under GAAP. To properly and prudently evaluate our business, we encourage investors to review our GAAP financial statements and not to rely on any single financial measure to evaluate our business. Adjusted EBITDA and Adjusted EBITDA Margin We define adjusted EBITDA as operating income before depreciation, amortization of intangible assets, accretion of asset retirement obligations, contingent consideration expense, stock-based compensation expense, restructuring charges, and gain or loss upon deconsolidation of a variable interest entity ("VIE"). We believe adjusted EBITDA is useful to investors in evaluating our operating performance for the following reasons: adjusted EBITDA and similar Non-GAAP measures are widely used by investors to measure a company's operating performance without regard to items that can vary substantially from company to company depending upon financing and accounting methods, book values of assets, capital structures and the methods by which assets were acquired; securities analysts often use adjusted EBITDA and similar non-GAAP measures as supplemental measures to evaluate the overall operating performance of companies; and by comparing our adjusted EBITDA in different historical periods, investors can evaluate our operating results without the additional variations of depreciation and amortization expense, accretion of asset retirement obligations, contingent consideration expense, stock-based compensation expense, restructuring charges, and gain or loss upon deconsolidation of a VIE. We define adjusted EBITDA margin as adjusted EBITDA stated as a percentage of revenue. Our management uses adjusted EBITDA and adjusted EBITDA margin as measures of operating performance, because they do not include the impact of items that we do not consider indicative of our core operating performance; for planning purposes, including the preparation of our annual operating budget; to allocate resources to enhance the financial performance of the business; to evaluate the effectiveness of our business strategies; and in communications with the board of directors and investors concerning our financial performance. Non-GAAP Net Income and EPS We define Non-GAAP net income and earnings per share ("EPS") to exclude certain discrete items that management does not consider representative of our ongoing operations, including restructuring charges, gain or loss upon deconsolidation of a VIE and impact from redeemable noncontrolling interest. We consider Non-GAAP net income and Non-GAAP EPS to be important indicators of our operational strength and performance of our business because they eliminate the effects of events that are not part of the Company's core operations. Adjusted Cash from Operations We define adjusted cash from operations as cash flows from operating activities plus proceeds from Federal ESPC projects. Cash received in payment of Federal ESPC projects is treated as a financing cash flow under GAAP due to the unusual financing structure for these projects. These cash flows, however, correspond to the revenue generated by these projects. Thus we believe that adjusting operating cash flow to include the cash generated by our Federal ESPC projects provides investors with a useful measure for evaluating the cash generating ability of our core operating business. Our management uses adjusted cash from operations as a measure of liquidity because it captures all sources of cash associated with our revenue generated by operations.

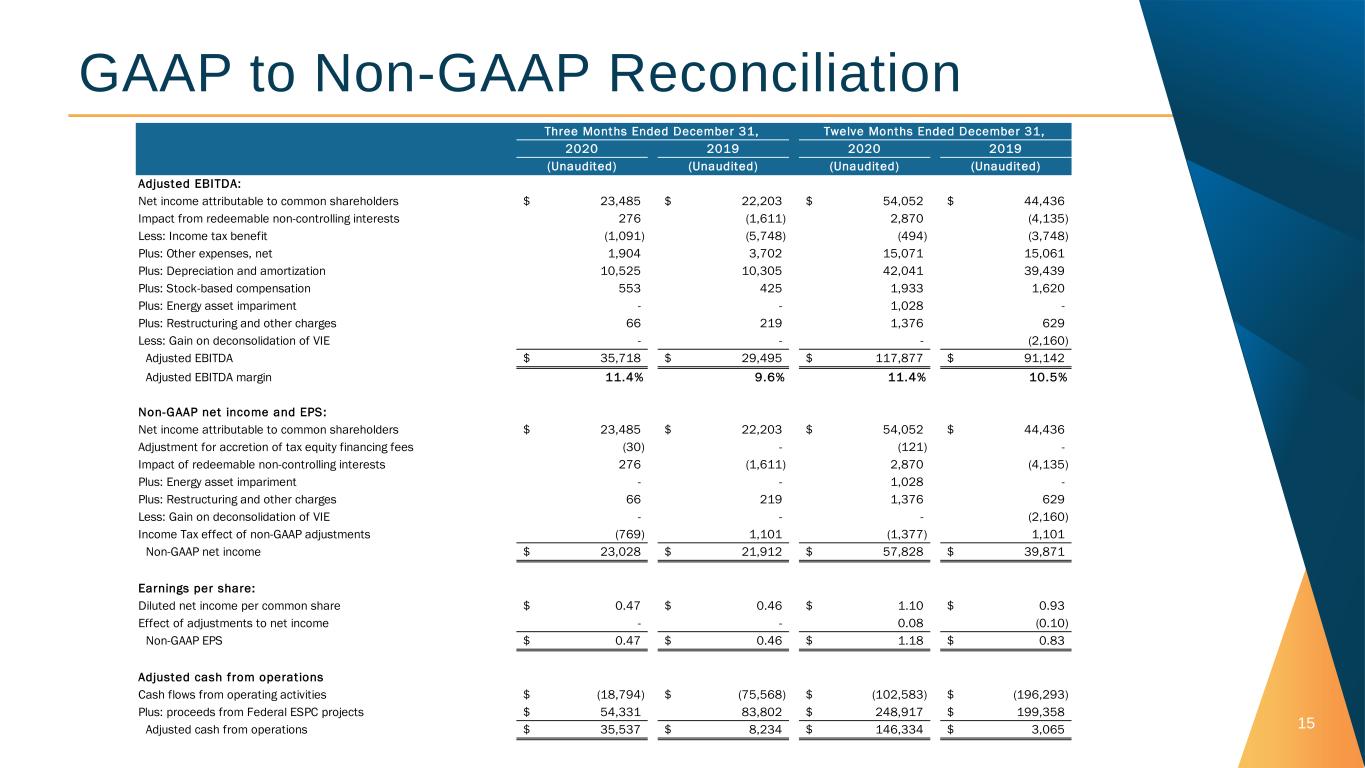

GAAP to Non-GAAP Reconciliation 15 (Unaudited) (Unaudited) (Unaudited) (Unaudited) Adjusted EBITDA: Net income attributable to common shareholders 23,485$ 22,203$ 54,052$ 44,436$ Impact from redeemable non-controlling interests 276 (1,611) 2,870 (4,135) Less: Income tax benefit (1,091) (5,748) (494) (3,748) Plus: Other expenses, net 1,904 3,702 15,071 15,061 Plus: Depreciation and amortization 10,525 10,305 42,041 39,439 Plus: Stock-based compensation 553 425 1,933 1,620 Plus: Energy asset impariment - - 1,028 - Plus: Restructuring and other charges 66 219 1,376 629 Less: Gain on deconsolidation of VIE - - - (2,160) Adjusted EBITDA 35,718$ 29,495$ 117,877$ 91,142$ Adjusted EBITDA margin 11.4% 9.6% 11.4% 10.5% Revenue 314,319 306,612 1,032,275 866,933 Non-GAAP net income and EPS: Net income attributable to common shareholders 23,485$ 22,203$ 54,052$ 44,436$ Adjustment for accretion of tax equity financing fees (30) - (121) - Impact of redeemable non-controlling interests 276 (1,611) 2,870 (4,135) Plus: Energy asset impariment - - 1,028 - Plus: Restructuring and other charges 66 219 1,376 629 Less: Gain on deconsolidation of VIE - - - (2,160) Income Tax effect of non-GAAP adjustments (769) 1,101 (1,377) 1,101 Non-GAAP net income 23,028$ 21,912$ 57,828$ 39,871$ Earnings per share: Diluted net income per common share 0.47$ 0.46$ 1.10$ 0.93$ Effect of adjustments to net income - - 0.08 (0.10) Non-GAAP EPS 0.47$ 0.46$ 1.18$ 0.83$ Adjusted cash from operations Cash flows from operating activities (18,794)$ (75,568)$ (102,583)$ (196,293)$ Plus: proceeds from Federal ESPC projects 54,331$ 83,802 248,917$ 199,358$ Adjusted cash from operations 35,537$ 8,234$ 146,334$ 3,065$ 2020 2019 2020 2019 Twelve Months Ended December 31,Three Months Ended December 31,