UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

þ Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material under §240.14a-12

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

þ No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

¨ Fee paid previously with preliminary materials.

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

NOTICE OF 2021 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 20, 2021

To Our Stockholders:

The 2021 annual meeting of stockholders of Ameresco, Inc., a Delaware corporation, will be held on May 20, 2021, at 10:00 a.m., Eastern Time, for the following purposes:

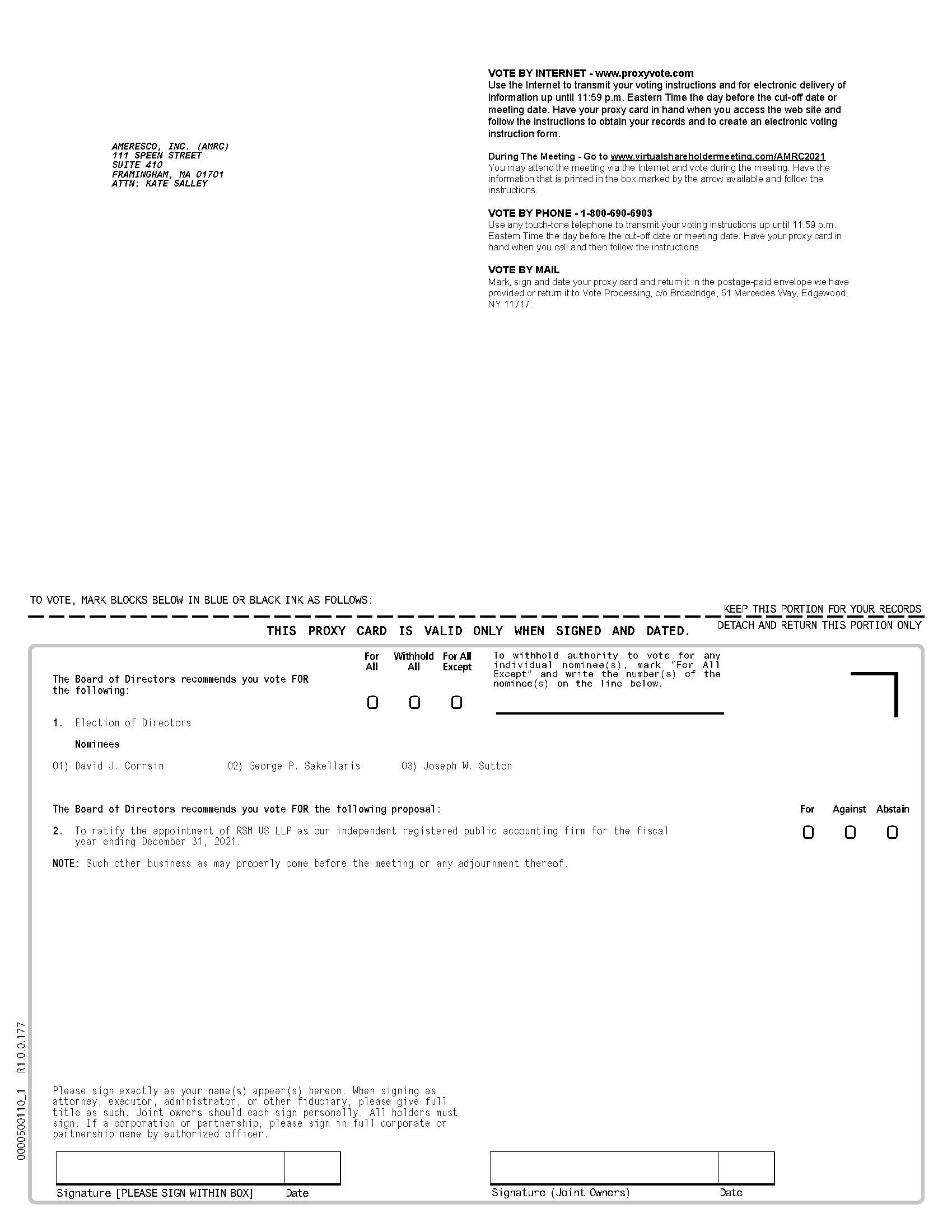

1. To elect the three nominees identified in the attached proxy statement as members of our board of directors to serve as class II directors for a term of three years.

2. To ratify the appointment of RSM US LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021.

3. To transact other business, if any, that may properly come before the annual meeting and any adjournment thereof.

This year, to proactively deal with the unprecedented impact of the coronavirus (COVID-19) outbreak and to mitigate risks to the health and safety of our stockholders and other stakeholders, we will hold our annual meeting of stockholders in a virtual meeting, via live audio webcast. You may virtually attend the meeting and vote your shares by visiting www.virtualshareholdermeeting.com/AMRC2021 as described in the accompanying proxy statement.

Only holders of our stock at the close of business on March 30, 2021 will be entitled to vote at the annual meeting and at any adjournments thereof. Our stock transfer books will remain open for the purchase and sale of our common stock. A complete list of registered stockholders will be available to stockholders of record during the annual meeting for examination at www.virtualshareholdermeeting.com/AMRC2021.

Included with this notice and the attached proxy statement is a copy of our annual report to stockholders for the year ended December 31, 2020, which contains our audited consolidated financial statements and other information that may be of interest to our stockholders.

If your shares are held in “street name”—that is, held for your account by a bank, broker or other intermediary—you should obtain instructions from that bank, broker or other intermediary on how to vote your shares at the annual meeting. You will need to follow those instructions for your shares to be voted.

Your vote is important. Whether or not you plan to attend the annual meeting online, please promptly complete, date and sign the enclosed proxy card and return it in the accompanying envelope. If you mail the proxy card in the United States, postage is prepaid. If you attend the annual meeting and vote during the meeting, any proxy that you may have submitted prior to the date of the annual meeting will not be used.

By Order of the Board of Directors,

David J. Corrsin

Secretary

April 27, 2021

TABLE OF CONTENTS

AMERESCO, INC.

111 Speen Street, Suite 410

Framingham, Massachusetts 01701

PROXY STATEMENT FOR 2021 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 20, 2021

GENERAL INFORMATION ABOUT THE MEETING AND VOTING

This proxy statement is furnished in connection with the solicitation of proxies by the board of directors of Ameresco, Inc. for use at the 2021 annual meeting of stockholders, or the Annual Meeting, to be held on May 20, 2021, at 10:00 a.m., local time, and at any adjournments of the Annual Meeting. We will hold our annual meeting of stockholders in a virtual meeting, via live audio webcast. You may virtually attend the meeting and vote your shares by visiting www.virtualshareholdermeeting.com/AMRC2021.

In this proxy statement, unless expressly stated or the context otherwise requires, the use of “Ameresco,” “the Company,” “our,” “we,” or “us” refers to Ameresco, Inc.

We are mailing this proxy statement, along with our annual report to stockholders for the fiscal year ended December 31, 2020, to our stockholders on or about April 27, 2021. Our annual report to stockholders includes a copy of our annual report on Form 10-K for the fiscal year ended December 31, 2020, as filed with the Securities and Exchange Commission, or the SEC, except for certain exhibits.

Important Notice Regarding the Availability of Proxy Materials

for the Stockholder Meeting to Be Held on May 20, 2021

The proxy statement and our annual report to stockholders are available for viewing, printing and downloading on-line at the “Investor Relations - Annual Meeting” section of our website at www.ameresco.com.

Record Date, Voting Rights and Outstanding Shares

Our board of directors has fixed March 30, 2021 as the record date for determining the holders of our capital stock who are entitled to vote at the annual meeting.

We have two classes of capital stock issued and outstanding: Class A common stock, $.0001 par value per share, and Class B common stock, $.0001 par value per share. We refer to our Class A common stock and our Class B common stock collectively as our common stock.

With respect to all of the matters submitted for vote at the Annual Meeting, each share of Class A common stock is entitled to one vote and each share of Class B common stock is entitled to five votes.

Our Class A common stock and Class B common stock will vote as a single class on each of the matters submitted at the Annual Meeting. On March 30, 2021, there were outstanding and entitled to vote 33,265,925 shares of Class A common stock and 18,000,000 shares of Class B common stock.

Quorum

In order for business to be conducted at the Annual Meeting, a quorum must be present at the meeting. A quorum for purposes of the Annual Meeting will exist if the holders of a majority of the voting power represented by the common stock issued and outstanding on March 30, 2021 attend the virtual meeting or are represented by proxy at the Annual Meeting. We will count broker non-votes (described below), votes withheld, and abstentions (including shares that abstain or do not vote with respect to one or more matters to be voted upon) as being present at the Annual Meeting for determining whether a quorum exists for the transaction of business at the Annual Meeting. If a quorum is not present at the Annual Meeting, the meeting will be adjourned until a quorum is obtained.

Required Votes

Election of directors (Proposal 1): The three director nominees identified in this proxy statement receiving a plurality, or the highest number, of votes cast at the Annual Meeting, regardless of whether that number represents a majority of the votes cast, will be elected.

Ratification of the appointment of RSM US LLP (Proposal 2): The affirmative vote of a majority in voting power of the votes cast by the holders of all of the shares present or represented by proxy at the Annual Meeting and voting

affirmatively or negatively on the proposal is needed to ratify the appointment of RSM US LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2021.

Voting; Voting by Proxy

If you are a stockholder of record, you can vote by attending the Annual Meeting online by accessing www.virtualshareholdermeeting.com/AMRC2021 and voting using the 16-digit control number included on your proxy card or by submitting a proxy card by mail. If you are attending the meeting, please log-on to the virtual meeting in advance to ensure that your vote will be counted. If you hold your shares through a bank, broker or other intermediary, which is sometimes referred to as holding your shares in “street name,” and you wish to attend the Annual Meeting to vote electronically at the Annual Meeting, you will need to obtain a proxy card from the holder of record (i.e., your bank, broker or other intermediary) in order to do so. To vote by mail, please sign, date, and complete the enclosed proxy card and return it in the enclosed self-addressed, postage prepaid envelope. A proxy card in the enclosed form, if received in time for voting at the Annual Meeting and not revoked, will be voted at the Annual Meeting according to the instructions on such proxy card. If no instructions are indicated on a proxy card, then the shares represented by that proxy card will be voted in favor of each of the nominees for director identified in this proxy statement and for each other proposal, as recommended by our board of directors.

If you hold your shares in “street name,” your bank, broker or intermediary will give you separate instructions for voting your shares. If you do not give instructions to your bank, broker or intermediary, your bank, broker or intermediary will only be entitled to vote your shares with respect to “discretionary” matters, as described below, but will not be permitted to vote the shares with respect to “non-discretionary” matters. A “broker non-vote” occurs when your bank, broker or intermediary submits a proxy for your shares (because the bank, broker or intermediary has either received instructions from you on one or more proposals, but not all, or has not received instructions from you but is entitled to vote on a particular “discretionary” matter) but does not indicate a vote for a particular proposal because the bank, broker or intermediary either does not have authority to vote on that proposal and has not received voting instructions from you or has discretionary authority to vote on a proposal but does not exercise it. “Broker non-votes” are not counted as votes for or against the proposal in question or as abstentions, nor are they counted to determine the number of votes present for the particular proposal. We do, however, count “broker non-votes” for the purpose of determining a quorum for the Annual Meeting.

Proposal 2 is considered to be a “discretionary” matter and, in the absence of your voting instructions, your bank, broker or other intermediary will be able to vote your shares for purposes of Proposal 2. The other proposals are not considered to be “discretionary” matters and, if you do not provide voting instructions, your bank, broker or other intermediary will not be able to vote your shares in its discretion in the election of directors (Proposal 1).

Abstentions

We will not count shares that abstain from voting on a particular matter or shares represented by broker non-votes as votes cast on that matter. Accordingly, abstentions and broker non-votes will have no effect on the outcome of voting on the matters to be voted on at the Annual Meeting.

Discretionary Voting by Proxies on Other Matters

We do not know of any other proposals that may be presented at the Annual Meeting. If another matter is properly presented for consideration at the meeting, the persons named in the accompanying proxy card will exercise their discretion in voting on the matter.

Revocability of Proxies

Any stockholder giving a proxy has the power to revoke it at any time before it is exercised. You may revoke the proxy by delivering a written notice or other instrument revoking your proxy or a duly executed proxy bearing a later date to our Secretary at our principal executive offices, 111 Speen Street, Suite 410, Framingham, Massachusetts 01701 at any time prior to its exercise at the Annual Meeting. You may also revoke your proxy by voting electronically at the Annual Meeting. If you do not revoke your proxy, we will vote the proxy at the Annual Meeting in accordance with the instructions indicated on your proxy card. If you own shares in “street name,” your bank, broker or other intermediary should provide you with appropriate instructions for changing your vote.

Voting Results

We will report the voting results from the Annual Meeting in a Current Report on Form 8-K, which we expect to file with the SEC within four business days after the Annual Meeting.

Expenses of Solicitation

We will bear the costs of soliciting proxies. We will, upon request, reimburse brokers, custodians and fiduciaries for reasonable out-of-pocket expenses incurred in forwarding proxy solicitation materials to the beneficial owners of stock held in their names. In addition to solicitations by mail, our directors, officers and employees may solicit proxies from stockholders in person or by other means of communication, including telephone, facsimile and e-mail, without additional remuneration.

PROPOSAL 1—ELECTION OF DIRECTORS

Our board of directors is divided into three classes, with one class being elected each year and members of each class holding office for a three-year term. We have three class II directors, whose terms expire at this Annual Meeting; three class III directors, whose terms expire at our 2022 annual meeting of stockholders; and three class I directors, whose terms expire at our 2023 annual meeting of stockholders. Our board of directors currently consists of nine members.

At this Annual Meeting, our stockholders will have an opportunity to vote for three nominees for class II directors: David J. Corrsin, George P. Sakellaris and Joseph W. Sutton, each of whom are currently directors of Ameresco. You can find more information about each of the nominees in “Corporate Governance—Our Board of Directors” below.

The persons named in the enclosed proxy card will vote to elect these three nominees as class II directors if you return a proxy in connection with the Annual Meeting, unless you withhold authority to vote for the election of one or more nominees by marking the proxy card to that effect. If elected, each of the nominees for class II director will hold office until the 2024 annual meeting of stockholders and until his successor is elected and qualified or until his earlier death, resignation or removal. Each of the nominees has indicated his willingness to serve if elected. However, if any nominee should be unable to serve, then either the persons named in the proxy card may vote the proxy for a substitute nominee if one is nominated by our board of directors, or we may maintain a vacancy on our board of directors until such time as our board of directors can find a suitable candidate to serve on the board, or our board of directors may reduce the number of directors.

Our board of directors recommends a vote FOR each of the three nominees for class II directors.

* * *

PROPOSAL 2—RATIFICATION OF THE SELECTION OF OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The audit committee of our board of directors has selected RSM US LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021. Although stockholder approval of our audit committee’s selection of RSM US LLP is not required by law, we believe that it is advisable to give stockholders an opportunity to ratify this selection. If our stockholders do not ratify this selection, our audit committee will reconsider the selection. We expect that a representative of RSM US LLP, which served as our independent registered public accounting firm for the fiscal year ended December 31, 2020, will attend the virtual Annual Meeting and will be offered the opportunity to make a statement if he or she wishes.

Audit and Other Fees

The following table shows fees billed for professional services rendered to us by RSM US LLP and affiliates for our fiscal years 2019 and 2020:

| | | | | | | | | | | |

| 2019 | | 2020 |

| Audit Fees | $ | 1,852,936 | | | $ | 1,816,215 | |

| Audit-Related Fees | — | | | 79,215 | |

| Tax Fees | 372,379 | | | 315,749 | |

| All Other Fees | — | | | 56,864 | |

| Total | $ | 2,225,315 | | | $ | 2,268,043 | |

Audit Fees includes the aggregate fees billed or accrued for each of the last two fiscal years for professional services rendered by the independent auditors for the audit of our annual financial statements and review of financial statements included or incorporated by reference in our Registration Statements on Form S-8 and Form S-3 and annual and quarterly

reports filed with the SEC or services that are normally provided by the accountant in connection with other statutory and regulatory filings or engagements for those fiscal years.

Audit-Related Fees includes the aggregate fees billed in each of the last two fiscal years for services by the independent auditors that are reasonably related to the performance of the audits of the financial statements and are not reported above under Audit Fees, including services related to the SEC’s review of our software-as-a-service business and our Registration Statement on Form S-8 filed during 2020.

Tax Fees includes the aggregate fees billed in each of the last two fiscal years for professional services rendered by the independent auditors for tax compliance, tax advice and tax planning.

All Other Fees includes the aggregate fees billed in each of the last two fiscal years for services by the independent auditors for services by the independent auditors that are not reported under Audit Fees, Audit-Related Fees or Tax Fees.

Policy on Pre-Approval of Audit and Non-Audit Services

Before an accountant is engaged by us to render audit or non-audit services, the engagement is approved by our audit committee. From time to time, our audit committee may pre-approve specified types of services that are expected to be provided to us by our registered public accounting firm during the next 12 months. Any such pre-approval would be detailed as to the particular service or type of services to be provided and also generally would be subject to a maximum dollar amount.

Our audit committee may delegate the authority to approve any audit or non-audit services to be provided to us by our registered public accounting firm to one or more subcommittees (including a subcommittee consisting of a single member). Any approval of services by a subcommittee of our audit committee pursuant to this delegated authority is reported at the next meeting of our audit committee. The chairman of our audit committee has been delegated this authority.

Our board of directors recommends a vote FOR this proposal.

* * *

STOCK OWNERSHIP

The following table sets forth certain information regarding the beneficial ownership of our Class A and Class B common stock as of the close of trading on March 30, 2021 (except as noted below) by: each of our directors and nominees; each of our named executive officers; all of our directors and executive officers as a group; and each person, or group of affiliated persons, who is known by us to beneficially own more than five percent of our Class A or Class B common stock.

Percentage ownership calculations for beneficial ownership in the table below are based on 33,265,925 shares of Class A common stock and 18,000,000 shares of our Class B common stock outstanding as of March 30, 2021.

Beneficial ownership is determined in accordance with the rules of the SEC. These rules generally attribute beneficial ownership of shares to persons who possess sole or shared voting power or investment power with respect to our shares. In computing the number of shares beneficially owned by an individual or entity and the percentage ownership of that person, shares subject to options, warrants or other rights held by such person that are currently exercisable or will become exercisable within 60 days of March 30, 2021 are considered outstanding, although these shares are not considered outstanding for purposes of computing the percentage ownership of any other person.

Except as otherwise indicated in the footnotes to the table below, all persons listed below have sole voting and investment power with respect to the shares beneficially owned by them, subject to applicable community property laws. The information presented in the table below is not necessarily indicative of beneficial ownership for any other purpose. Beneficial ownership representing less than one percent is denoted with an asterisk (*).

Percentage total voting power represents voting power of beneficially owned shares with respect to all shares of our Class A and Class B common stock, together as a single class. Each holder of Class A common stock is entitled to one vote per share of Class A common stock and each holder of Class B common stock is entitled to five votes per share of Class B common stock. Voting power of less than one percent is denoted with an asterisk (*).

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Class A Common Stock | | Class B Common Stock | | % Total

Voting

Power |

| Name | | Shares | | % | | Shares | | % | |

Directors, Nominees for Director and

Executive Officers | | | | | | |

George P. Sakellaris (1) | | 2,302,332 | | | 6.9 | % | | 18,000,000 | | | 100.0 | % | | 74.8 | % |

| David J. Anderson | | 35,000 | | | * | | — | | | * | | * |

David J. Corrsin (2) | | 44,401 | | | * | | — | | | * | | * |

Douglas I. Foy (3) | | 117,000 | | | * | | — | | | * | | * |

Jennifer L. Miller (4) | | 98,000 | | | * | | — | | | * | | * |

Thomas S. Murley (5) | | 28,500 | | | * | | — | | | * | | * |

Nickolas Stavropoulos (6) | | 22,000 | | | * | | — | | | * | | * |

Joseph W. Sutton (7) | | 326,355 | | | 1.0 | % | | — | | | * | | * |

Frank V. Wisneski (8) | | 116,676 | | | * | | — | | | * | | * |

| Spencer Doran Hole | | — | | | * | | — | | | * | | * |

Mark A. Chiplock (9) | | 8,000 | | | * | | — | | | * | | * |

Michael T. Bakas (10) | | 64,201 | | | * | | — | | | * | | * |

Nicole A. Bulgarino (11) | | 114,905 | | | * | | — | | | * | | * |

Directors and executive officers as a group (16 persons) (12) | | 3,368,549 | | | 9.9 | % | | 18,000,000 | | | 100.0 | % | | 75.3 | % |

| Other Five Percent Stockholders | | | | | | | | | | |

BlackRock Inc. (13) | | 1,651,689 | | | 5.0 | % | | — | | | * | | 1.3 | % |

Handelsbanken Fonder AB (14) | | 2,393,477 | | | 7.2 | % | | — | | | * | | 1.6 | % |

(1) Includes 65,000 shares of Class A common stock issuable upon exercise of options that are exercisable within 60 days of March 30, 2021. Also includes (i) 1,075,000 shares of Class A common stock held by the George P.

Sakellaris 2012 Delaware Dynasty Trust and (ii) 5,338,391 shares of Class B common stock held by the CGS 2010 Irrevocable Trust, in each case for which Mr. Sakellaris may be deemed the beneficial holder and to share voting and dispositive power; Mr. Sakellaris disclaims beneficial ownership of these shares. His address is c/o Ameresco, Inc., 111 Speen Street, Framingham, Massachusetts 01701.

(2) Consists of (i) 44,401 shares of Class A common stock issuable upon the exercise of options that are exercisable within 60 days of March 30, 2021 and (ii) 40 shares held by Mr. Corrsin’s spouse, of which Mr. Corrsin disclaims beneficial ownership.

(3) Includes 103,000 shares of Class A common stock issuable upon the exercise of options that are exercisable within 60 days of March 30, 2021.

(4) Includes 98,000 shares of Class A common stock issuable upon the exercise of options that are exercisable within 60 days of March 30, 2021.

(5) Includes 18,000 shares of Class A common stock issuable upon the exercise of options that are exercisable within 60 days of March 30, 2021.

(6) Includes 18,000 shares of Class A common stock issuable upon the exercise of options that are exercisable within 60 days of March 30, 2021.

(7) Consists of (i) 98,000 shares of Class A common stock issuable upon exercise of options that are exercisable within 60 days of March 30, 2021; and (ii) 228,355 shares of our Class A common stock held by Sutton Ventures LP. Mr. Sutton is managing member of Sutton Ventures Group LLC, which is the general partner of Sutton Ventures LP.

(8) Includes 58,000 shares of Class A common stock issuable upon the exercise of options that are exercisable within 60 days of March 30, 2021.

(9) Consists of 8,000 shares of Class A common stock issuable upon the exercise of options that are exercisable within 60 days of March 30, 2021.

(10) Consists of 64,201 shares of Class A common stock issuable upon the exercise of options that are exercisable within 60 days of March 30, 2021.

(11) Includes 95,264 shares of Class A common stock issuable upon the exercise of options that are exercisable within 60 days of March 30, 2021.

(12) Includes 719,005 shares of Class A common stock issuable upon the exercise of options that are exercisable within 60 days of March 30, 2021. None of the shares owned or rights to acquire shares are held in a margin account or subject to a pledge.

(13) BlackRock, Inc. has an address of 55 East 52nd Street New York, NY 10055. Based solely on information as of December 31, 2020 contained in a Schedule 13G/A filed with the SEC by BlackRock, Inc. on January 29, 2021.

(14) Handlesbanken Fonder AB has an address of SE-106 70, Stockholm, Sweden. Based in part on information as of December 31, 2020 contained in a Schedule 13G filed with the SEC by Handlesbanken Fonder AB on February 12, 2021.

DELINQUENT SECTION 16(a) REPORTS

Section 16(a) of the Exchange Act requires our executive officers, directors and persons who own more than 10% of our common stock to file reports of ownership and changes in ownership with the SEC. We are not aware that any of our directors, executive officers or 10% shareholders failed to comply with the filing requirements of Section 16(a) during the fiscal year ended December 31, 2020, except for David J. Anderson, a director and executive officer, for whom one Form 4, with respect to seven transactions, was filed late.

CORPORATE GOVERNANCE

Our Board of Directors

In accordance with the terms of our restated certificate of incorporation and by-laws, our board of directors is divided into three classes, each of which consists, as nearly as possible, of one-third of the total number of directors constituting our entire board of directors and each of whose members serve for staggered three-year terms. As a result, only one class of our board of directors will be elected each year. The members of the classes are as follows:

•the class I directors are David J. Anderson, Thomas S. Murley and Frank V. Wisneski, and their term expires at the annual meeting to be held in 2023;

•the class II directors are David J. Corrsin, George P. Sakellaris and Joseph W. Sutton, and their term expires at the Annual Meeting; and

•the class III directors are Douglas I. Foy, Jennifer L. Miller and Nickolas Stavropoulos, and their term expires at the annual meeting to be held in 2022.

Each director in a class will be eligible to be chosen as a nominee for a new three-year term at the annual meeting of stockholders in the year in which their term expires.

Below is information about each nominee for election as a class II director, as well as other members of our board of directors whose terms continue after the Annual Meeting. This information includes each director’s age as of March 30, 2021 and length of service as a director of Ameresco, his or her principal occupation and business experience for at least the past five years and the names of other publicly held companies or investment companies of which he or she has served as a director for at least the past five years.

In addition to the information presented below regarding each director’s specific experience, qualifications, attributes and skills that led our board of directors to the conclusion that he or she should serve as a director, we also believe that all of our directors have a reputation for integrity, honesty and adherence to high ethical standards. They each have demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment of service to us.

There are no family relationships among any of our directors, nominees for director and executive officers.

Director Nominees for Terms Expiring at the Annual Meeting (Class II Directors)

David J. Corrsin, age 62, has served as our executive vice president, general counsel and secretary, as well as a director, since 2000. From 1996 to 2000, Mr. Corrsin was executive vice president of Public Power International, Inc., an independent developer of power projects in Europe and southern Asia. We believe that Mr. Corrsin is qualified to serve as a director because of his extensive experience with energy regulations, federal, state and local regulatory authorities and complex energy construction and financing projects, gained through more than 30 years of energy-related legal practice, and his more than 20 years of service as an executive officer of our company.

George P. Sakellaris, age 74, who is our principal stockholder, has served as chairman of our board of directors and our president and chief executive officer since founding Ameresco in 2000. Mr. Sakellaris previously founded Noresco in 1989 and served as its president and chief executive officer until 2000. Mr. Sakellaris was a founding member and previously served as the president, and is currently a director, of the National Association of Energy Service Companies, a national trade organization representing the energy efficiency industry. We believe that Mr. Sakellaris is qualified to serve as a director because of his more than 35 years of experience in the energy services and renewable energy industries, his leadership experience, skill and familiarity with our business gained from serving as our chief executive officer for over 20 years, as well as his experience developed through founding and serving as chief executive officer of two previous energy services companies.

Joseph W. Sutton, age 73, has served as a director since 2002. Since 2000, Mr. Sutton has been the manager of Sutton Ventures Group, LLC, an energy investment firm that he founded. In 2007, he founded and has since led Consolidated Asset Management Services, or CAMS, which provides asset management, operations and maintenance, information technology, budgeting, contract management and development services to power plant ventures, oil and gas companies, renewable energy companies and other energy businesses. From 1992 to November 2000, Mr. Sutton worked for Enron Corporation, an energy company, where he most recently served as vice chairman and as chief executive officer of Enron International. We believe that Mr. Sutton is qualified to serve as a director because of his prior experience in the energy

industry. For example, at both Sutton Ventures and CAMS, he has had significant experience in energy industry capital raising transactions, as well as in the ownership and management of, and the provision of advisory and other services to, a wide range of energy-related businesses. At Enron, Mr. Sutton was responsible for budgeting, financial reporting and planning for Enron’s international business unit and oversaw the development, construction, financing, operation and management of numerous energy projects.

Directors Whose Terms Expire in 2022 (Class III Directors)

Douglas I. Foy, age 74, has served as a director since May 2010. Since 2006, Mr. Foy has served as president of Serrafix Corporation, a strategic consulting firm focused on energy, the environment, transportation, and climate change, which he founded. From January 2003 to February 2006, Mr. Foy served as the first secretary of the Massachusetts Office for Commonwealth Development, where he oversaw the Executive Office of Transportation, the Executive Office of Environmental Affairs, the Department of Housing and Community Development and the Department of Energy Resources. Prior to his service with the Massachusetts Office for Commonwealth Development, Mr. Foy served for 25 years as president of the Conservation Law Foundation, an environmental advocacy organization. We believe that Mr. Foy is qualified to serve as a director because of his extensive leadership experience in environmental policy and the energy and sustainable development industries, including as president of Serrafix and the Conservation Law Foundation.

Jennifer L. Miller, age 65, has served as a director since 2015. From September 2015 through April 2020, Ms. Miller has served as Chief Business Sustainability Officer of Sappi North America, the U.S. subsidiary of Sappi Limited, a producer of diversified cellulosic products including packaging and specialty papers, printing papers, biomaterials and biochemicals. From 2002 to August 2015, Ms. Miller held senior management positions at Sappi North America, including Executive Vice President and Chief Sustainability Officer, Executive Vice President – Strategic Marketing and Executive Vice President – Publishing. We believe that Ms. Miller is qualified to serve as a director because of her qualifications and experience, including in the energy utility industry, where she previously served as general counsel for a gas utility, and more recently her sustainability leadership role at a multi-national manufacturing company. We believe her direct experience and understanding of how commercial/industrial enterprises evaluate and plan for energy efficiency initiatives are particularly valuable to the Board and management as they continue to develop strategies for the commercial/industrial market.

Nickolas Stavropoulos, age 63, has served as a director since April 2019. Mr. Stavropoulos served as the President and Chief Operating Officer of Pacific Gas and Electric Company from March 2017 through September 2018, as President, Gas from August 2015 through February 2017 and Executive Vice President, Gas Operations from June 2011 to August 2015. In January 2019, Pacific Gas and Electric Company and its parent company, PG&E Corporation, filed voluntary petitions for reorganization under Chapter 11 of the U.S. Bankruptcy Code. Before joining Pacific Gas and Electric Company, Mr. Stavropoulos served as Executive Vice President and Chief Operating Officer of National Grid from 2007 through 2011. Prior to that role, Mr. Stavropoulos was President of KeySpan Energy Delivery, and has also held several senior leadership roles at Colonial Gas Company and Boston Gas. Mr. Stavropoulos has also served as the director of Enterprise Bancorp, a publicly traded bank holding company. We believe that Mr. Stavropoulos is qualified to serve as a director because of his more than 35 years of experience in the energy industry, as well as detailed knowledge of the U.S. natural gas sector. He has extensive executive management, business, and leadership experience in areas such as safety, utility operations, information technology, regulatory affairs, strategic planning, supply chain, finance, sales, business development, and marketing.

Directors Whose Terms Expire in 2023 (Class I Directors)

David J. Anderson, age 60, has served as our executive vice president, as well as a director, since 2000. From 1992 to 2000, Mr. Anderson was a senior vice president at Noresco, an energy services company, that was acquired by Equitable Resources, Inc. in 1997. We believe that Mr. Anderson is qualified to serve as a director because of his extensive knowledge of our business, gained through more than 20 years as an executive officer, and his more than 30 years of experience in the energy services and renewable energy industries. We also believe that Mr. Anderson brings a deep understanding of operations and strategy in the energy services industry to our board of directors.

Thomas S. Murley, age 63, has served as a director since 2016. Since June 2016, Mr. Murley has served as principal at Two Lights Consulting, which he founded. Mr. Murley also served as Chairman and Senior Advisor to HgCapital’s Renewable Power Partners Funds, which he co-founded and led for HgCapital from 2004 to June 2016. We believe that

Mr. Murley is qualified to serve as a director because of his more than 20 years of experience strategically managing funds in the conventional and renewable energy sectors.

Frank V. Wisneski, age 74, has served as a director since 2011. Prior to retiring in 2001, Mr. Wisneski was a Partner and Senior Vice President at Wellington Management Company, LLP, an institutional asset manager serving clients globally, where he had worked since 1969. Since retiring, Mr. Wisneski has served as a trustee or director of several non-profit organizations. We believe that Mr. Wisneski is qualified to serve as a director because of his prior experience conducting financial and strategic analysis of companies, including emerging areas and companies, and establishing and building new investment products for institutional asset management clients. Since retiring, Mr. Wisneski has maintained a focus on financial and strategic analysis by serving on investment, finance and executive committees at several nonprofit organizations. We believe his experience analyzing companies to support investment decisions contributes a valuable viewpoint to our board.

Director Independence

A majority of our board of directors consists of “independent” directors. To be considered independent by our board of directors, a director must be independent as determined under Section 303A.02(b) of the NYSE Listed Company Manual and in our board of directors’ judgment, the director must not have a material relationship with Ameresco (either directly or as a partner, shareholder or officer of an organization that has a relationship with Ameresco).

Under Section 303A.02(b) of the NYSE Listed Company Manual, a director will qualify as “independent” if our board of directors affirmatively determines that he or she has no material relationship with Ameresco (either directly or as a partner, stockholder or officer of an organization that has a relationship with us). Our board of directors has established corporate governance guidelines to assist it in determining whether a director has such a material relationship. Under these guidelines, a director is not considered to have a material relationship with Ameresco if he or she is independent under Section 303A.02(b) of the NYSE Listed Company Manual and he or she:

•is an executive officer of another company which is indebted to us, or to which we are indebted, unless the total amount of either company’s indebtedness to the other is more than one percent of the total consolidated assets of the company he or she serves as an executive officer; or

•serves as an officer, director or trustee of a tax exempt organization, unless our discretionary contributions to such organization are more than the greater of $1 million or two percent of that organization’s consolidated gross revenue.

In addition, under the corporate governance guidelines established by our board of directors, ownership of a significant amount of our stock, by itself, does not constitute a material relationship so long as such director is otherwise independent under Section 303A.02(b) of the NYSE Listed Company Manual.

For relationships not covered by the guidelines set forth above, the determination of whether a material relationship exists is made by the other members of the board of directors who are independent at the time of such determination.

Pursuant to applicable NYSE rules and our corporate governance guidelines, a director employed by us cannot be deemed to be an “independent director,” and consequently none of Messrs. Sakellaris, Corrsin or Anderson qualifies as an independent director.

Our board has determined that each of Ms. Miller and Messrs. Foy, Murley, Stavropoulos, Sutton and Wisneski meet the standards for being independent under Section 303A.02(b) of the NYSE Listed Company Manual and our corporate governance guidelines and that none of these directors has or had a material relationship with us.

Board Leadership Structure and Risk Oversight

George P. Sakellaris currently serves as both our chairman of the board and chief executive officer. Our board of directors does not have a policy regarding the separation of the roles of chairman and chief executive officer, as the board believes it is in our stockholders’ best interests that we make this determination based on an assessment of the current condition of our company and composition of the board. Our board of directors believes that having Mr. Sakellaris serve in both roles is in the best interests of our stockholders at this time because it makes the best use of Mr. Sakellaris’s extensive knowledge of the Company and our industry, and fosters greater communication between management and the board of directors.

In light of the dual role played by Mr. Sakellaris in our corporate governance structure, we also have established a position of a lead independent director. Mr. Sutton is our lead independent director. Mr. Sutton is an independent director within the meaning of applicable NYSE rules. The duties of the lead director include the following:

•chairing any meeting of our non-management or independent directors in executive session;

•meeting with any director who is not adequately performing his or her duties as a member of our board of directors or any committee;

•facilitating communications between other members of our board of directors and the chairman of our board of directors and/or the chief executive officer; however, each director is free to communicate directly with the chairman of our board of directors and with the chief executive officer;

•monitoring, with the assistance of our general counsel, communications from stockholders and other interested parties and providing copies or summaries to the other directors as he considers appropriate;

•working with the chairman of our board in the preparation of the agenda for each board of directors meeting and in determining the need for special meetings of the board of directors; and

•otherwise consulting with the chairman of our board of directors and/or the chief executive officer on matters relating to corporate governance and the performance of our board of directors.

Our board of directors oversees our risk management processes directly and through its committees. Our management is responsible for risk management on a day-to-day basis. The role of our board and its committees is to oversee the risk management activities of management. Our audit committee focuses on financial risk, including internal control over financial reporting. Our corporate governance and nominating committee focuses on the management of risks associated with board organization, membership and structure, succession planning for our directors and executive officers and corporate governance. Finally, our compensation committee assists the board in fulfilling its oversight responsibilities with respect to the management of risks arising from our compensation policies and programs.

Committees of our Board of Directors

Our board of directors has established an audit committee, a compensation committee and a nominating and corporate governance committee. Each committee operates under a charter approved by our board of directors. Copies of each committee’s charter are posted on the Investor Relations section of our website, which is located at www.ameresco.com.

All of the members of our board’s three standing committees described below have been determined to be independent as defined under applicable NYSE rules and in the case of all members of the audit committee, the independence requirements set forth in Rule 10A-3 under the Exchange Act.

Audit Committee

The members of our audit committee are Messrs. Stavropoulos, Sutton and Wisneski and Ms. Miller. Our board of directors has determined that each of the current members of our audit committee satisfy the requirements for financial literacy and independence under applicable NYSE and SEC rules and regulations. Mr. Wisneski is the chair of the audit committee and is also an “audit committee financial expert,” as defined by SEC rules and satisfies the financial sophistication requirements of applicable NYSE rules. Our audit committee assists our board of directors in its oversight of our accounting and financial reporting process and the audits of our financial statements.

The audit committee’s responsibilities include:

•appointing, approving the compensation of, and assessing the independence of our registered public accounting firm;

•overseeing the work of our registered public accounting firm, including through the receipt and consideration of reports from such firm;

•reviewing and discussing with management and our registered public accounting firm our annual and quarterly financial statements and related disclosures;

•monitoring our internal control over financial reporting, disclosure controls and procedures and code of business conduct and ethics;

•overseeing our internal audit function;

•overseeing our risk assessment and risk management policies;

•establishing policies regarding hiring employees from our registered public accounting firm and procedures for the receipt and retention of accounting related complaints and concerns;

•meeting independently with our internal auditing staff, registered public accounting firm and management;

•reviewing and approving or ratifying any related person transactions; and

•preparing the audit committee report required by SEC rules to be included in our proxy statement for our annual meeting of stockholders.

Our audit committee met five times and did not act by written consent in 2020.

All audit services and all non-audit services, other than de minimis non-audit services, to be provided to us by our registered public accounting firm must be approved in advance by our audit committee. For more information regarding our audit committee, see “—Audit Committee Report” below.

Compensation Committee

The members of our compensation committee are Messrs. Foy, Murley, Stavropoulos and Sutton. Mr. Sutton is the chair of the compensation committee. Our compensation committee assists our board of directors in the discharge of its responsibilities relating to the compensation of our executive officers. The compensation committee’s responsibilities include:

•annually reviewing and approving corporate goals and objectives relevant to CEO compensation;

•determining our CEO’s compensation;

•reviewing and approving, or making recommendations to our board of directors with respect to, the compensation of our other executive officers;

•overseeing an evaluation of our senior executives;

•overseeing and administering our cash and equity incentive plans;

•reviewing and making recommendations to our board of directors with respect to director compensation;

•reviewing and discussing annually with management our “Compensation Discussion and Analysis” required by SEC rules; and

•preparing the compensation committee report required by SEC rules, which is included below under “Executive Compensation and Related Information—Compensation Committee Report.”

The processes and procedures followed by our compensation committee in considering and determining executive compensation are described under “Executive Compensation and Related Information—Compensation Discussion and Analysis” below.

The compensation committee has the authority to retain compensation consultants and other outside advisors to assist in the evaluation of executive officer compensation. For further information, see “Executive Compensation and Related Information—Compensation Discussion and Analysis” below. Additionally, the compensation committee may delegate authority to one or more subcommittees as it deems appropriate.

Our compensation committee met once and did not act by written consent in 2020.

Nominating and Corporate Governance Committee

The members of our nominating and corporate governance committee are Ms. Miller and Messrs. Foy and Wisneski. Mr. Foy is the chair of the nominating and corporate governance committee. The nominating and corporate governance committee’s responsibilities include:

•identifying individuals qualified to become members of our board of directors;

•recommending to our board of directors the persons to be nominated for election as directors and to each of the committees of our board of directors;

•reviewing and making recommendations to our board of directors with respect to our board of directors’ leadership structure;

•reviewing and making recommendations to our board of directors with respect to management succession planning;

•developing and recommending to our board of directors corporate governance principles; and

•overseeing an annual evaluation of our board of directors.

Our nominating and corporate governance committee met three times and did not act by written consent in 2020.

The processes and procedures followed by our nominating and corporate governance committee in identifying and evaluating director candidates are described below under the heading “Director Nomination Process.”

Board Meetings and Attendance

Our board of directors met seven times and did not act by written consent in 2020. During 2020, each director attended at least 75% of the aggregate number both of board meetings and of meetings held by all committees on which he or she then served.

Director Attendance at Annual Meeting

Our corporate governance guidelines provide that directors are responsible for attending each annual meeting of our stockholders. All of our directors attended our 2020 our annual meeting of stockholders.

Director Compensation

None of Messrs. Sakellaris, Anderson or Corrsin, each an executive officer, has ever received any compensation in any form in connection with his service as a director. The compensation that we pay to Mr. Sakellaris in his capacity as our chief executive officer is discussed below under “Executive Compensation and Related Information—Compensation Discussion and Analysis.”

We do provide compensation and expense reimbursement for reasonable travel and other expenses incurred in connection with attending board of director, committee and stockholder meetings to our non-employee directors. Ms. Miller and Messrs. Foy, Murley, Stavropoulos, Sutton and Wisneski are our non-employee directors.

The following summarizes the terms of our non-employee director program, as most recently amended in 2012.

Cash Compensation. Each non-employee director receives a $25,000 annual retainer. The chair of the audit committee receives an additional annual retainer of $12,000; the chair of the compensation committee receives an additional annual retainer of $8,000; and the chair of the nominating and corporate governance committee receives an additional annual retainer of $6,000. Each non-employee director, other than the chair, who serves on the audit committee receives an additional $2,500 annual retainer; each non-employee director, other than the chair, who serves on the compensation committee receives an additional $2,000 annual retainer; and each non-employee director, other than the chair, who serves on the nominating and corporate governance committee receives an additional annual retainer of $1,000. Each non-employee director receives $1,000 for each board meeting or committee meeting (if not on the same day as a board meeting) he or she attends, whether in person or by telephone conference call.

Equity Compensation. Upon his or her initial election to the board of directors, each non-employee director is granted an option to purchase 40,000 shares of our Class A common stock. On the date of each annual meeting of stockholders other than in the year of his or her initial election, each non-employee director receives an option to purchase 10,000 shares of our Class A common stock. Both the initial and annual options become exercisable as to 20% of the shares subject to the option on each of the first five anniversaries of the option grant date, subject to the director’s continued service on our board of directors. All such options have an exercise price equal to the fair market value of the Class A common stock on the date of grant and become exercisable in full upon a change in control of Ameresco.

In addition, from time to time, our directors have received options in addition to the annual grants. During 2017, each of Messrs. Foy, Sutton and Wisneski and Ms. Miller received an option to purchase 30,000 shares of our Class A common stock that vests fully upon the earlier of (a) the company achieving adjusted EBITDA of at least $100 million or (b) the three year anniversary of the grant. During 2019, each of our directors were granted an option to purchase 30,000 shares of our Class A common stock that will vest three years from the date of grant based upon certain performance goals relating

to the performance period from January 1, 2019 through December 31, 2021, including the achievement of our three-year cumulative performance goals, including revenue, adjusted EBITDA, contracted sales, new awards, energy assets placed into operation, O&M sales and return on equity.

Employee directors are not compensated for their service on our board of directors.

The following table sets forth information regarding compensation earned by our non-employee directors during 2020.

| | | | | | | | | | | | | | | | | | | | |

| Name | | Fees Earned or

Paid in Cash ($) | | Option Awards

($)(1) | | Total

($) |

Douglas I. Foy (2) | | 45,000 | | 98,614 | | 143,614 |

Jennifer L. Miller (3) | | 44,500 | | 98,614 | | 143,114 |

Thomas S. Murley (4) | | 36,000 | | 98,614 | | 134,614 |

Nickolas Stavropoulos (5) | | 43,500 | | 98,614 | | 142,114 |

Joseph W. Sutton (6) | | 49,500 | | 98,614 | | 148,114 |

Frank V. Wisneski (7) | | 54,000 | | 98,614 | | 152,614 |

(1) Value is equal to the aggregate grant date fair value of stock options computed in accordance with FASB ASC Topic 718. These amounts do not represent the actual amounts paid to or realized by the director with respect to these option grants. The assumptions used by us with respect to the valuation of option awards are the same as those set forth in Note 14 to our consolidated financial statements included in our annual report on Form 10-K filed with the SEC on March 2, 2021.

(2) As of December 31, 2020, Mr. Foy held options to purchase an aggregate of 155,000 shares of our Class A common stock with a weighted average exercise price of $10.19.

(3) As of December 31, 2020, Ms. Miller held options to purchase an aggregate of 150,000 shares of our Class A common stock with a weighted average exercise price of $9.39.

(4) As of December 31, 2020, Mr. Murley held options to purchase 78,000 shares of our Class A common stock with a weighted average exercise price of $12.01 per share.

(5) As of December 31, 2020, Mr. Stavropoulos held options to purchase 80,000 shares of our Class A common stock with a weighted average exercise price of $15.86 per share.

(6) As of December 31, 2020, Mr. Sutton held options to purchase an aggregate of 150,000 shares of our Class A common stock with a weighted average exercise price of $10.04.

(7) As of December 31, 2020, Mr. Wisneski held options to purchase an aggregate of 110,000 shares of our Class A common stock with a weighted average exercise price of $10.68.

Director Stock Ownership Guidelines

Our board of directors has adopted stock ownership guidelines for our non-employee directors. Each non-employee director is expected to own 2,000 shares of our Class A common stock by the first anniversary of his or her initial election as a director, 4,000 shares of by the second anniversary, 6,000 shares by the third anniversary, 8,000 shares by the fourth anniversary, and 10,000 shares by the fifth anniversary and thereafter. Each of our directors is currently in compliance with these guidelines.

Director Nomination Process

The process followed by our nominating and corporate governance committee to identify and evaluate director candidates includes requests to board members and others for recommendations, conferring from time to time to evaluate biographical information and background material relating to potential candidates and interviews of selected candidates by members of the nominating and corporate governance committee, the board of directors and members of senior management. The nominating and corporate governance committee also has the authority to retain the services of an executive search firm to help identify and evaluate potential director candidates.

In considering whether to recommend any particular candidate for inclusion in the board of directors’ slate of recommended director nominees, our nominating and corporate governance committee applies the criteria set forth in our corporate governance guidelines. These criteria include the candidate’s integrity, business acumen, knowledge of our

business and industry, experience, diligence, conflicts of interest and the ability to act in the interests of all stockholders. The nominating and corporate governance committee also considers diversity, such as diversity of gender, race and national origin, education, professional experience and differences in viewpoints and skills. The committee does not assign specific weights to particular criteria and no particular criterion is a prerequisite for any prospective nominee. Our board of directors believes that the backgrounds and qualifications of its directors, considered as a group, should provide a composite mix of experience, knowledge and abilities that will allow it to fulfill its responsibilities. The nominating and corporate governance committee has always endeavored to have a broad, inclusive process for identifying highly qualified, diverse candidates. In ongoing support of this, in January 2020, the committee specifically committed to include women and minority candidates in the initial pool of qualified candidates from which the committee selects director candidates going forward.

When recommending to the board of directors the nominees for election as directors, our nominating and corporate governance committee shall consider candidates proposed by stockholders and shall apply the same criteria, and shall follow substantially the same process in considering them, as it does in considering other candidates. To recommend director candidates for consideration by the nominating and corporate governance committee, a stockholder must send a written notice to our corporate secretary at the address under “Miscellaneous—Stockholder Proposals” below. Our bylaws specify the information that must be included in any such notice, including the stockholder’s name, address and number of shares of Ameresco stock held, as well as the candidate’s name, age, address, principal occupation and number of shares of Ameresco stock. If a stockholder would like a candidate to be considered for inclusion in the proxy statement for our 2022 annual meeting, the stockholder must follow the procedures for stockholder proposals outlined under “Miscellaneous—Stockholder Proposals” below. You can find more detailed information on our process for selecting board members and our criteria for board nominees in the corporate governance guidelines posted on the “Investor Relations” section of our website, which is located at www.ameresco.com.

Alternatively, our bylaws provide that stockholders may nominate director candidates for consideration at the 2022 annual meeting directly without approval of the nominating and corporate governance committee. In order to nominate candidates directly, stockholders must follow the procedures outlined under “Miscellaneous—Stockholder Proposals” below.

Communicating with our Board of Directors

Our board of directors will give appropriate attention to written communications that are submitted by stockholders and other interested parties, and will respond if and as appropriate. Our lead director, subject to the advice and assistance of our general counsel, is primarily responsible for monitoring communications from stockholders and other interested parties and for providing copies or summaries to the other directors as he considers appropriate.

Communications are forwarded to all directors if they relate to important substantive matters and include suggestions or comments that the lead director considers to be important for the directors to know. In general, communications relating to corporate governance and corporate strategy are more likely to be forwarded than communications relating to ordinary business affairs, personal grievances and matters as to which we receive repetitive or duplicative communications.

Stockholders and other interested parties who wish to send communications on any topic to our board should address such communications to: Board of Directors, c/o Secretary, Ameresco, Inc., 111 Speen Street, Suite 410, Framingham, Massachusetts 01701.

Corporate Governance Materials

Our board of directors has adopted corporate governance guidelines to assist the board in the exercise of its duties and responsibilities and to serve the best interests of our company and our stockholders. These guidelines, which provide a framework for the conduct of our board’s business, provide that:

•our board’s principal responsibility is to oversee the management of Ameresco;

•a majority of the members of our board of directors shall be independent directors;

•the non-management directors meet regularly in executive session;

•directors have full and free access to management and employees of our company, and the right to hire and consult with independent advisors at our expense;

•new directors participate in an orientation program and all directors are expected to participate in continuing director education on an ongoing basis; and

•at least annually, our board of directors and its committees will conduct self-evaluations to determine whether they are functioning effectively.

We have adopted a written code of business conduct and ethics that applies to our directors, officers and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, and persons performing similar functions. A copy of the code of business conduct and ethics is posted on the Investor Relations section of our website, which is located at www.ameresco.com. In addition, we intend to post on our website all disclosures that are required by law or applicable NYSE listing standards concerning any amendments to, or waivers from, any provision of the code.

Complete copies of our corporate governance guidelines, code of business conduct and ethics and the charters for our audit, compensation and nominating and corporate governance committees are available on the Investor Relations section of our website, which is located at www.ameresco.com. Alternatively, you may request a copy of any of these documents free of charge by writing to:

Ameresco, Inc.

111 Speen Street, Suite 410

Framingham, Massachusetts 01701

Attention: Investor Relations Department

Audit Committee Report

The audit committee has reviewed and discussed with our management our audited consolidated financial statements for the year ended December 31, 2020. The audit committee has also reviewed and discussed with RSM US LLP, our independent registered public accounting firm, our audited consolidated financial statements and the matters required by the applicable requirements of the Public Company Accounting Oversight Board and the SEC.

The audit committee has also received from RSM US LLP the written disclosures and the letter required by the applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the audit committee concerning independence. The audit committee has discussed with RSM US LLP the matters disclosed in the letter and its independence with respect to Ameresco, including a review of audit and non-audit fees and services, and concluded that RSM US LLP is independent.

Based on its discussions with management and RSM US LLP, and its review of the representations and information referred to above provided by management and RSM US LLP, the audit committee recommended to the board of directors that Ameresco’s audited consolidated financial statements be included in Ameresco’s annual report on Form 10-K for the year ended December 31, 2020 for filing with the SEC.

By the Audit Committee

of the Board of Directors of Ameresco, Inc.

Frank V. Wisneski, Chairman

Jennifer L. Miller

Nickolas Stavropoulos

Joseph W. Sutton

Compensation Committee Interlocks and Insider Participation

None of our executive officers serves as a member of the board of directors or compensation committee, or other committee serving an equivalent function, of any entity that has one or more executive officers who serve as members of our board of directors or our compensation committee. None of the members of our compensation committee is an officer or employee of our company, nor have they ever been an officer or employee of our company.

EXECUTIVE COMPENSATION AND RELATED INFORMATION

Compensation Discussion and Analysis

This section discusses the material elements of our executive compensation policies and decisions and the most important factors relevant to an analysis of these policies and decisions. It provides qualitative information regarding the manner and context in which compensation is awarded to and earned by our executive officers and is intended to place in perspective the data presented in the tables and narrative that follow.

During 2020, we continued reviewing all elements of our executive compensation program, including the function and design of our annual incentive bonus and equity incentive programs. We also continued to evaluate the need for revisions to our executive compensation program to ensure our program is competitive with the companies with which we compete for executive talent and is appropriate for a public company, including the extent to which our compensation policies will reward the achievement of long-term operating and strategic goals and minimizing the extent to which they serve to encourage taking excessive risk.

Overview of Executive Compensation Process

Roles of Our Board, Chief Executive Officer and Compensation Committee in Compensation Decisions. Our compensation committee oversees our executive compensation program. Our compensation committee, either as a committee or together with the other independent directors, makes all compensation decisions regarding our chief executive officer. Our chief executive officer may make recommendations to the compensation committee regarding the compensation of our executive officers other than the chief executive officer, but the compensation committee either makes all compensation decisions regarding our other executive officers or makes recommendations concerning executive compensation to our board of directors, with the independent directors ultimately making such decisions. Our chief executive officer is not present for compensation committee or board discussions regarding his compensation; similarly, no other executive officers are present for compensation committee or board discussions regarding other executive officer compensation.

Competitive Market Data and Use of Compensation Consultants. While we generally rely on the business judgment and experience in the energy services and engineering consulting industries of our chief executive officer and our executive management team, we also review publicly available materials and information made available through Equilar, which provides an online database gathered from proxy statements and annual reports at similar companies. We have developed substantial information about compensation practices and levels at comparable companies through extensive recruiting, networking and industry research. Our compensation committee may elect to engage an independent compensation consulting firm to provide advice regarding our executive compensation program and general information regarding executive compensation practices in our industry, but it did not do so in 2020. Although the compensation committee would consider such a compensation firm’s advice in establishing and approving the various elements of our executive compensation program, the compensation committee would ultimately make its own decisions, or make recommendations to our board of directors, about these matters.

We periodically review executive officer compensation against a peer group, using the comparison only as a competitive reference point and not as the sole determinative factor when making executive compensation decisions. The compensation committee periodically assesses the relevancy of the companies within the peer group and makes changes when appropriate.

Beginning in January 2017, the compensation committee defined our peer group based upon information provided by Equilar regarding compensation at public and private companies in the energy services industry with revenues in the same range as ours. In 2020, the compensation committee used the following peer group: Aegion Corp., Argan Inc., Broadwind Energy, Inc., Enernoc, Inc., ESCO Technologies, Inc., Hill International, Inc., IES Holdings, Inc., Magna International Inc., Matrix Service Co., Mistras Group, Inc., MYR Group Inc., NV5 Global, Inc., Powell Industries Inc. and TRC Companies Inc.

Objectives and Philosophy of Our Executive Compensation Program. Our primary objective with respect to executive compensation is to attract, retain and motivate highly talented individuals who have the skills and experience to successfully execute our business strategy. Our executive compensation program is designed to:

•reward the achievement of our annual and long-term operating and strategic goals;

•recognize individual contributions;

•align the interests of our executives with those of our stockholders by rewarding performance that meets or exceeds established goals, with the ultimate objective of increasing stockholder value; and

•retain and build our executive management team.

To achieve these objectives, our executive compensation program ties a portion of each executive’s overall compensation—annual incentive bonuses—to key corporate financial goals and to individual goals. From time to time we

have also provided a portion of our executive compensation in the form of restricted stock and option awards that vest over time. We believe this approach helps to retain our executive officers and aligns their interests with those of our stockholders by allowing them to participate in our long-term performance as reflected in the trading price of shares of our Class A common stock.

Elements of Our Executive Compensation Program. The primary elements of our executive compensation program are:

•base salaries;

•annual incentive bonuses;

•equity incentive awards; and

•other employee benefits.

We have not adopted any formal or informal policies or guidelines for allocating compensation among these elements.

Base Salaries. We use what we believe to be competitive base salaries to attract and retain qualified candidates to help us achieve our growth and performance goals. Base salaries are intended to recognize an executive officer’s immediate contribution to our organization, as well as his or her experience, knowledge and responsibilities.

Our compensation committee annually evaluates and considers adjustments to executive officer base salary levels based on factors determined to be relevant, including:

•the executive officer’s skills and experience;

•the particular importance of the executive officer’s position to us;

•the executive officer’s individual performance;

•the executive officer’s growth in his or her position; and

•base salaries for comparable positions within our company and at other companies.

Although it did not do so in 2020, the compensation committee may in the future obtain the input of a compensation firm and peer group benchmarking data in making any adjustments to executive officer base salary levels.

In 2020, our compensation committee approved increases in the base salaries of Messrs. Bakas and Corrsin and Ms. Bulgarino by 10.3%, 5% and 5.7%, respectively, all effective as of May 1, 2020, resulting in annual base salaries of $375,000, $363,064 and $385,000, respectively. The increases were both in recognition of the performance of such executive officers during 2019 and to encourage retention.

For Mr. Sakellaris, in 2020 our compensation committee recommended and our independent directors approved, a 21.2% increase in base salary, based on his performance during 2019, resulting in annual base salary of $1 million.

Annual Incentive Bonus Program. Incentive bonus payments may be made to our executive officers, as well as most of our other full-time employees, at the discretion of the compensation committee and management based on certain performance goals established in the early part of each year. These annual incentive bonuses are intended to compensate our executive officers for our achievement of corporate financial goals, as well as individual performance goals.

For 2020, as in past years, the maximum total amount payable under our incentive bonus program, or our total bonus pool, was determined based on our performance with respect to corporate financial goals. The corporate goals for 2020 consisted of achievement of predetermined levels of revenue; EBITDA; contracted sales; new awards; operating expenses and combined growth factor. Combined growth factor is based on growth in year-over-year revenue, EBITDA, contracted sales and awards, weighted equally.

The target and relative weight for each of these goals assigned for 2020 are set forth in the table below:

| | | | | | | | | | | | | | |

| Goal | | Target | | Weight Assigned

for 2020 |

Revenue | | $1 billion | | 20% |

| EBITDA | | $109 million | | 20% |

New contracts(1) | | ESPC/EPC Construction - $725 million

Distributed Generation EPC/PPA - 125 MWe | | 15%

7.5% |

| New awards | | ESPC/EPC Construction - $920 million

Distributed Generation EPC/PPA - 140 MWe | | 15%

7.5% |

| Operating expenses | | Manage Operating Expenses(2)

to $125 million or less and 13.8% of total revenue | | 10% |

Combined growth factor(3) | | Achieve 10% or better combined growth factor | | 5% |

| Total | | | | 100% |

(1) Includes energy savings performance contracts, or ESPC, engineering, procurement and construction contracts or EPC, and power purchase agreements, as indicated.

(2) Excluding stock compensation, internal mergers and acquisitions expenses, IRC Section 179D deduction certification costs and other one-time or unusual charges.

(3) Combined growth factor is based on growth in year-over-year revenue, EBITDA, contracted sales and awards, weighted equally.

If any of the above goals were not achieved at least 90%, that particular goal was to be given a value of zero.

These weights and the specific targets were established by the independent members of our board of directors based on the recommendation of our compensation committee and with input from our chief executive officer and other executive officers. The goals were based on our historical operating results and growth rates, as well as our expected future results, and were designed to require significant effort and operational success on the part of our company.

The total bonus pool permitted under our incentive bonus program can be up to ten percent of our adjusted EBITDA from continuing operations for the year, with the actual amount based on our performance against the goals described above, provided that the aggregate weighted achievement based on actual performance for all goals exceeds 90%.

The table below shows, for each of the goals used in determining whether a bonus pool would be established under our 2020 incentive bonus program, the specific target, our actual performance against that target (for corporate financial goals) and the actual contribution of each goal’s achievement to the aggregate weighted achievement based on the relative weights assigned:

| | | | | | | | | | | | | | | | | | | | |

| Goal | | Target | | Result | | Achievement Percentage Contribution |

Revenue | | $1 billion | | $1.029 billion | | 20% |

EBITDA(1) | | $109 million | | $117.9 million | | 20% |

New contracts(2) | | ESPC/EPC Construction - $725 million

Distributed Generation EPC/PPA - 125 MWe | | $527 million(3) 135.6 MWe | | 15%

7.5% |

| New awards | | ESPC/EPC Construction - $920 million

Distributed Generation EPC/PPA - 140 MWe | | $930 million

159 MWe | | 15%

7.5% |

| Operating expenses | | Manage Operating Expenses(4)

to $125 million or less and 13.8% of total revenue | | $113.8 million

11% | | 10% |

Combined growth factor(5) | | Achieve 10% or better combined growth factor | | Achieved | | 5% |

Total | | | | | | 100% |