Welcome to Ameresco’s First Investor Day George Sakellaris CEO & President

Safe Harbor Forward Looking Statements Any statements in this presentation about future expectations, plans and prospects for Ameresco, Inc., including statements about market conditions, pipeline and backlog, as well as expectation on estimated future financial results, statements about our long term outlook and our agreement with SCE, and other statements containing the words “projects,” “believes,” “anticipates,” “plans,” “expects,” “will” and similar expressions, constitute forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those indicated by such forward looking statements as a result of various important factors, including the timing of, and ability to, enter into contracts for awarded projects on the terms proposed or at all; the timing of work we do on projects where we recognize revenue on a percentage of completion basis, including the ability to perform under recently signed contracts without delay; demand for our energy efficiency and renewable energy solutions; our ability to arrange financing to fund our operations and projects and to comply with covenants in our existing debt agreements; changes in federal, state and local government policies and programs related to energy efficiency and renewable energy and the fiscal health of the government; the ability of customers to cancel or defer contracts included in our backlog; the effects of our acquisitions and joint ventures; seasonality in construction and in demand for our products and services; a customer’s decision to delay our work on, or other risks involved with, a particular project; availability and costs of labor and equipment particularly given global supply chain challenges; our reliance on third parties for our construction and installation work; the addition of new customers or the loss of existing customers including our reliance on the agreement with SCE for a significant portion of our revenues in 2022; the impact from Covid-19 on our business; market price of the Company's stock prevailing from time to time; the nature of other investment opportunities presented to the Company from time to time; the Company's cash flows from operations; cybersecurity incidents and breaches; and other factors discussed in our Annual Report on Form 10-K for the year ended December 31, 2021, filed with the U.S. Securities and Exchange Commission (SEC) on March 1, 2022. The forward-looking statements included herein represent our views as of the date hereof. We anticipate that subsequent events and developments will cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we specifically disclaim any obligation to do so. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date hereof. Use of Non-GAAP Financial Measures This presentation includes references to adjusted EBITDA which is a Non-GAAP financial measure. For a description of this Non-GAAP financial measure, the reasons management uses this measure, and a reconciliation of this Non-GAAP financial measure to the most directly comparable financial measure prepared in accordance with GAAP, please see the section titled “Non-GAAP Financial Measures” at the end of the supplemental earnings presentation for the fiscal year ended December 31, 2021 filed with the SEC on February 28, 2022 which is also available at Ameresco’s Investor Relations website at https://ir.ameresco.com/financial-results. Ameresco does not provide a reconciliation of non-GAAP measures that it discusses as part of its long-term outlook because certain significant information required for such reconciliation is not available without unreasonable efforts or at all.

CFO Welcome & Agenda Review Doran Hole Chief Financial Officer & EVP

2:30pm Welcome Overview and Market Opportunity 3:45pm Coffee Break 3:55pm Client Sessions Bank of America, GSA 4:25pm New Markets & Models, ESG, Southern California Edison (SCE) Update 5:10pm Future Financial Goals 5:15pm Q&A Agenda

George Sakellaris CEO & President Doran Hole CFO & EVP Nicole Bulgarino EVP & GM, Federal Michael Bakas EVP, Distributed Energy Systems Leila Dillon SVP, Marketing & Communications Bob Georgeoff EVP Britta MacIntosh SVP, Western & London Operations Lou Maltezos EVP Josh Baribeau VP, Finance & Corporate Treasury Mark Chiplock SVP & Chief Accounting Officer Jon Mancini SVP, Solar Project Business Pete Christakis SVP, Construction & Operations David Corrsin SVP, General Counsel, Corporate Secretary Nina Andersson Willard Assistant General Counsel Jim Bishop VP, Advanced Technology Solutions

Ameresco Overview and Market Opportunity George Sakellaris President & CEO SVP, Marketing & Communications Leila Dillon

About Ameresco 7 Ameresco, Inc. (NYSE:AMRC) is a leading cleantech integrator and renewable energy asset developer, owner & operator. Founded in 2000 | Public in 2010 1,200+ Employees | 60+ Off ices $11+ Bil l ion Energy Solut ions 340+ MWe Owned Assets in Operation 400+ MWe Assets in Development $5B+ Revenue Visibi l i ty Comprehensive Advanced Technology Portfolio Deep Bench of In-House Technical Expertise Objective Approach for the Unique Needs of Each Customer Integrated Offering from a Single Sustainability Partner Flexible Financing Drives Innovative Opportunities Global Customer Track Record Best-in-Class Value Proposition

Ameresco’s Three Complimentary Lines of Business 8 Diverse business model enables Ameresco to be nimble and resilient in changing market conditions Customer Projects Operations & Maintenance Ameresco Assets

9 Key Drivers Leading the Clean Energy Transformation Core Market Drivers • Cost Savings & Economics • Infrastructure Upgrades • Occupant Comfort Level New and Emerging Market Drivers Increasing our Addressable Market Resiliency & Energy Security Grid Stability Decarbonization to Net Zero Innovative Technology ESG Commitments Policy & Incentives

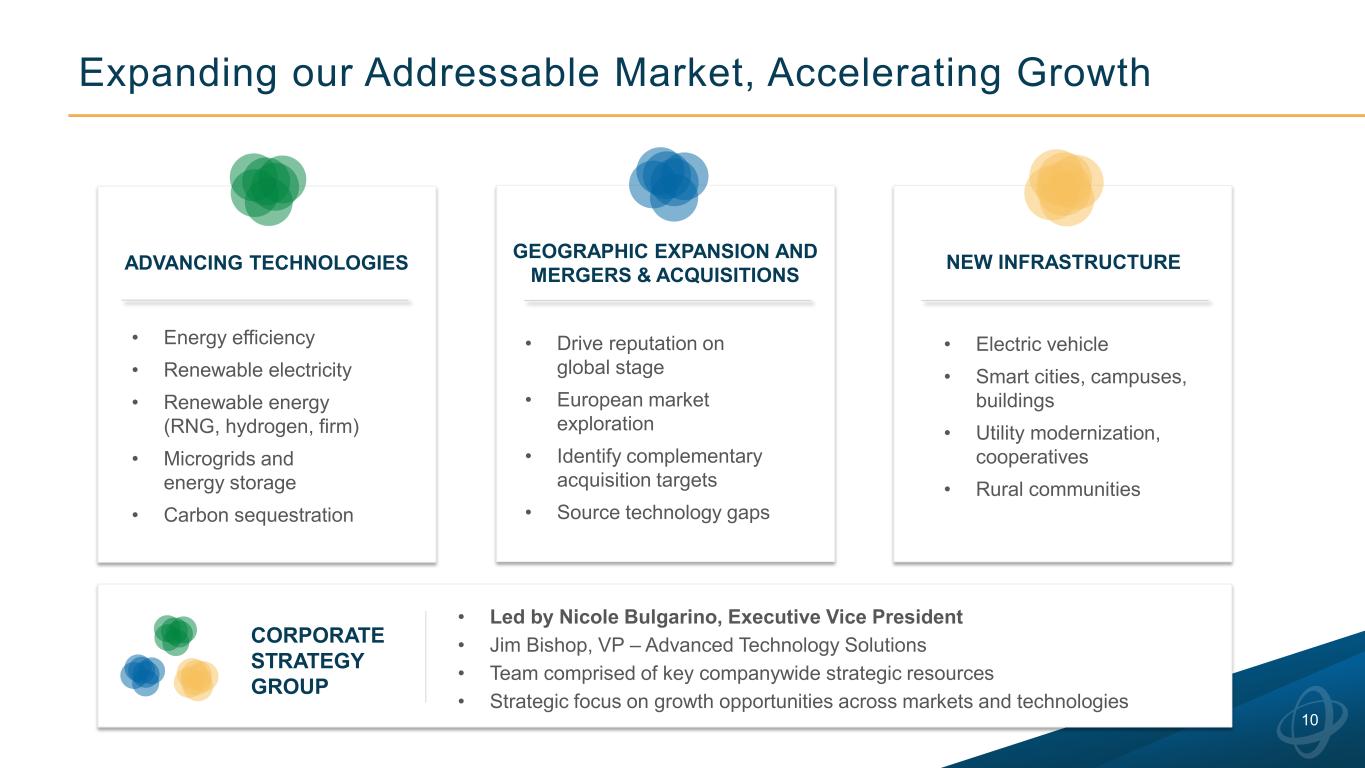

Expanding our Addressable Market, Accelerating Growth 10 ADVANCING TECHNOLOGIES • Energy efficiency • Renewable electricity • Renewable energy (RNG, hydrogen, firm) • Microgrids and energy storage • Carbon sequestration NEW INFRASTRUCTURE • Electric vehicle • Smart cities, campuses, buildings • Utility modernization, cooperatives • Rural communities GEOGRAPHIC EXPANSION AND MERGERS & ACQUISITIONS • Drive reputation on global stage • European market exploration • Identify complementary acquisition targets • Source technology gaps • Led by Nicole Bulgarino, Executive Vice President • Jim Bishop, VP – Advanced Technology Solutions • Team comprised of key companywide strategic resources • Strategic focus on growth opportunities across markets and technologies CORPORATE STRATEGY GROUP

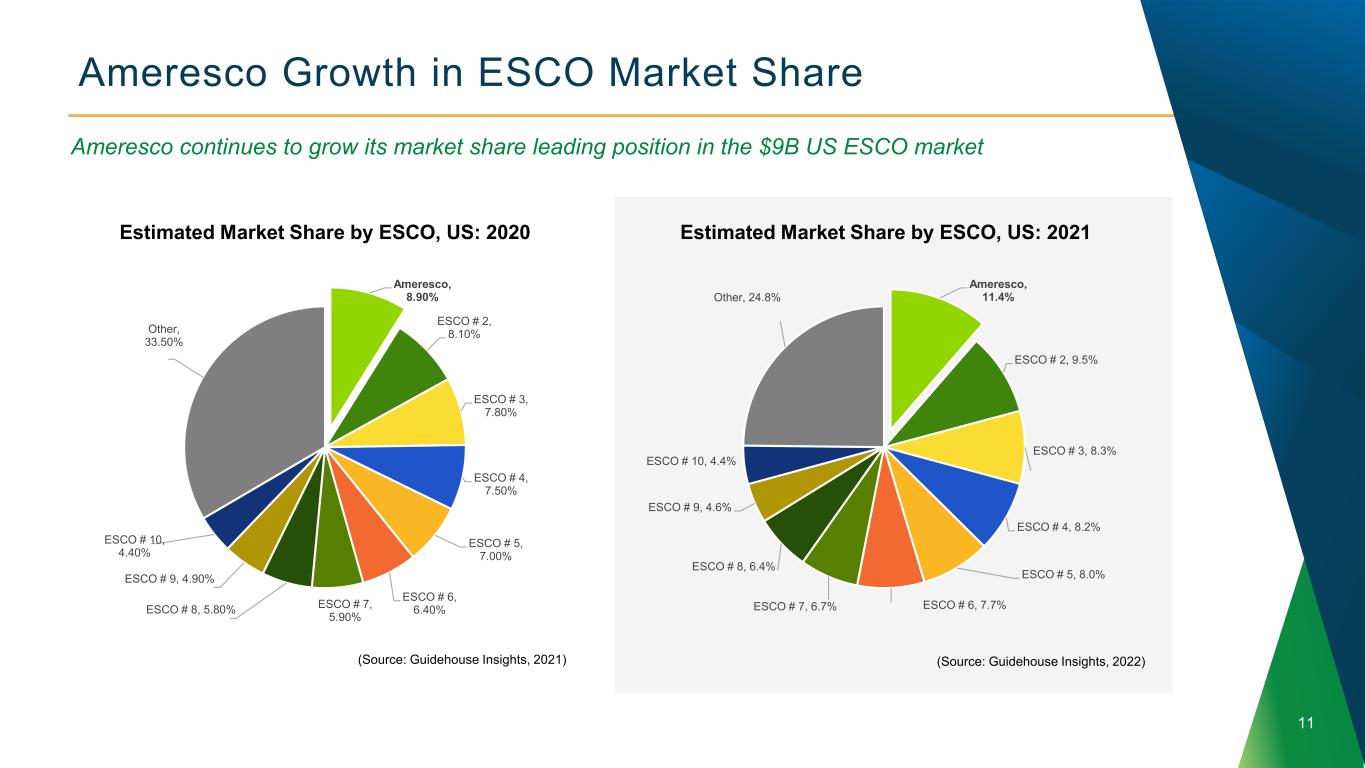

Ameresco Growth in ESCO Market Share 11 Ameresco continues to grow its market share leading position in the $9B US ESCO market Estimated Market Share by ESCO, US: 2021 (Source: Guidehouse Insights, 2022) Ameresco, 11.4% ESCO # 2, 9.5% ESCO # 3, 8.3% ESCO # 4, 8.2% ESCO # 5, 8.0% ESCO # 6, 7.7%ESCO # 7, 6.7% ESCO # 8, 6.4% ESCO # 9, 4.6% ESCO # 10, 4.4% Other, 24.8% Estimated Market Share by ESCO, US: 2020 Ameresco, 8.90% ESCO # 2, 8.10% ESCO # 3, 7.80% ESCO # 4, 7.50% ESCO # 5, 7.00% ESCO # 6, 6.40%ESCO # 7, 5.90%ESCO # 8, 5.80% ESCO # 9, 4.90% ESCO # 10, 4.40% Other, 33.50% (Source: Guidehouse Insights, 2021)

Expanding Ameresco’s Addressable Market 12 • Total addressable market growing from ~$80B in 2022 to ~$108B in 2026 • Projections for US Hydrogen addressable market (not included at left) growing from $18B in 2020 to $140B in 2030 • Technology market growth driven by solutions focused on decarbonization, resiliency, cost savings, infrastructure upgrades, favorable policy support, etc. $0 $20,000 $40,000 $60,000 $80,000 $100,000 $120,000 2022 2023 2024 2025 2026 ($ M illi on s) Solar PV Utility Scale Storage DESS CHP Intelligent Buildings Street Lighting ESCO - Energy Efficiency EaaS - Energy Efficiency RNG Biofuels EV Charging Ameresco Addressable Market by Select Technology Segments, North America: 2022-2026 (Source: Guidehouse Insights, 2022)

Transformational Growth in Project Business Nicole Bulgarino EVP & GM, Federal Solutions

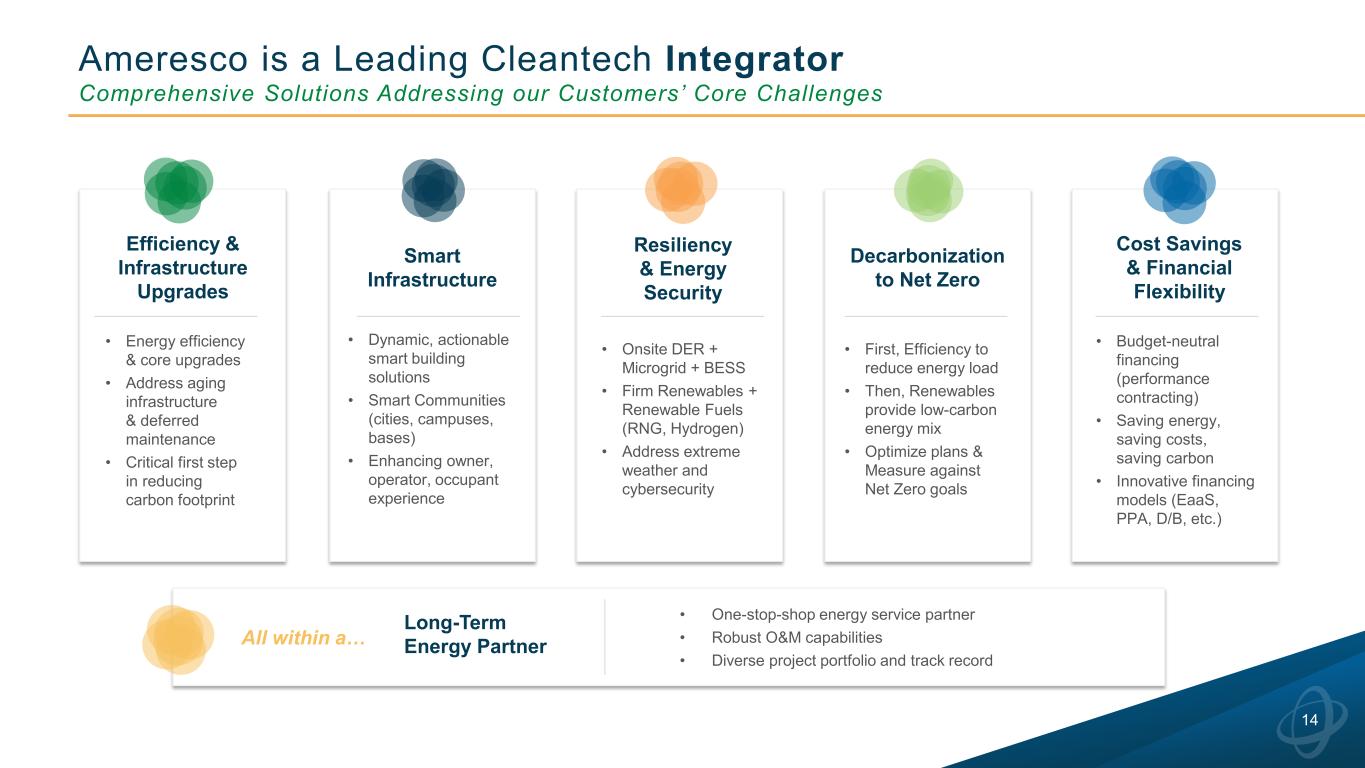

Ameresco is a Leading Cleantech Integrator Comprehensive Solutions Addressing our Customers’ Core Challenges 14 Efficiency & Infrastructure Upgrades • Energy efficiency & core upgrades • Address aging infrastructure & deferred maintenance • Critical first step in reducing carbon footprint Long-Term Energy Partner • One-stop-shop energy service partner • Robust O&M capabilities • Diverse project portfolio and track record Resiliency & Energy Security • Onsite DER + Microgrid + BESS • Firm Renewables + Renewable Fuels (RNG, Hydrogen) • Address extreme weather and cybersecurity Decarbonization to Net Zero • First, Efficiency to reduce energy load • Then, Renewables provide low-carbon energy mix • Optimize plans & Measure against Net Zero goals All within a… Smart Infrastructure • Dynamic, actionable smart building solutions • Smart Communities (cities, campuses, bases) • Enhancing owner, operator, occupant experience Cost Savings & Financial Flexibility • Budget-neutral financing (performance contracting) • Saving energy, saving costs, saving carbon • Innovative financing models (EaaS, PPA, D/B, etc.)

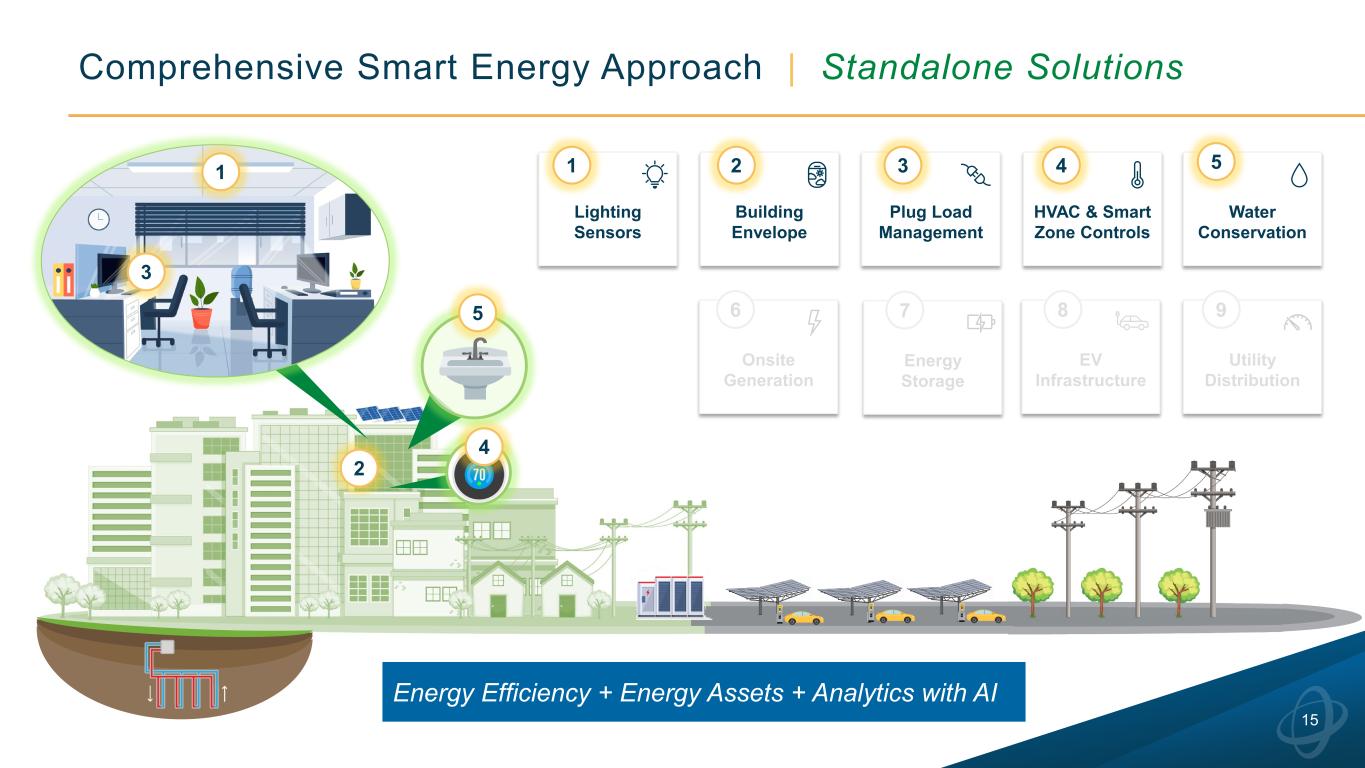

2 1 Energy Efficiency + Energy Assets + Analytics with AI Comprehensive Smart Energy Approach | Standalone Solutions 15 Lighting Sensors 1 Building Envelope 2 Plug Load Management 3 HVAC & Smart Zone Controls 4 3 4 Water Conservation 5 5 Onsite Generation 6 Energy Storage 7 EV Infrastructure 8 Utility Distribution 9

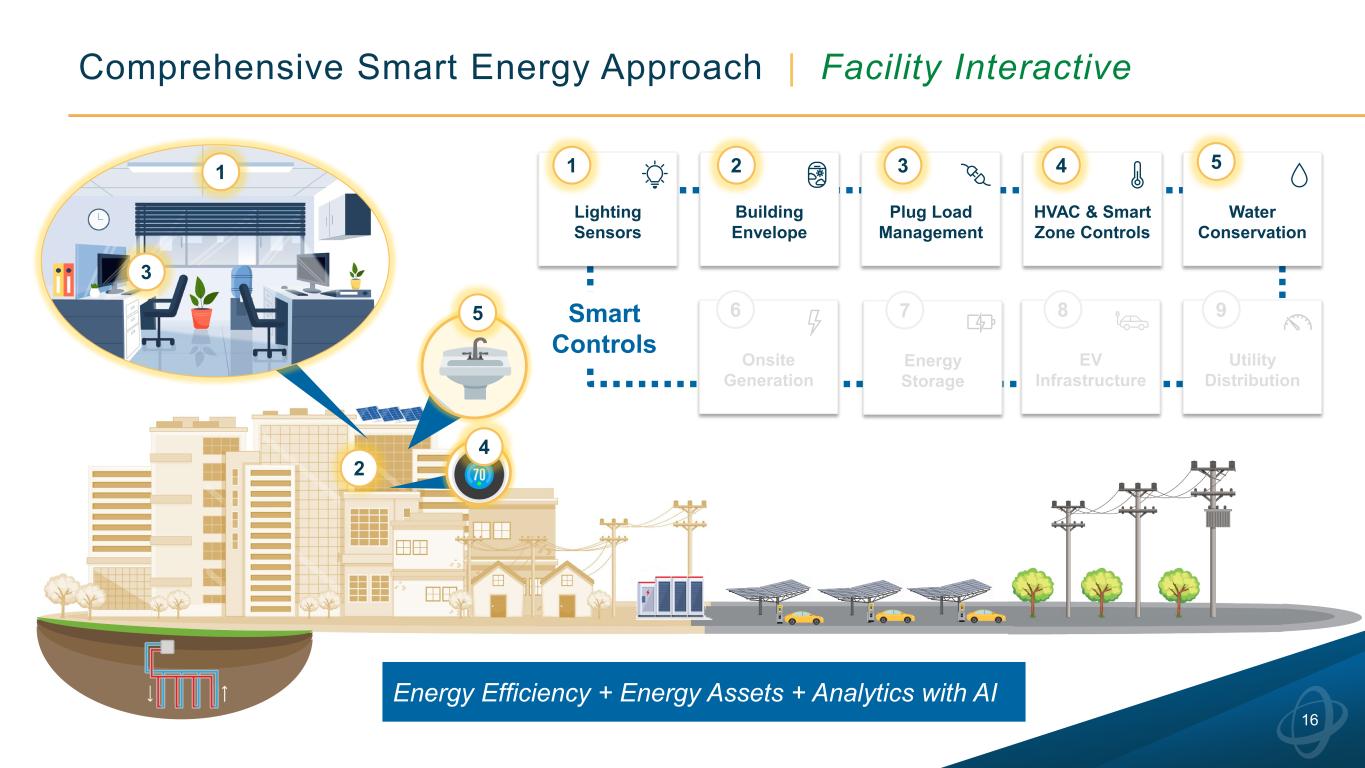

2 1 Energy Efficiency + Energy Assets + Analytics with AI Comprehensive Smart Energy Approach | Facility Interactive 16 3 4 5 Lighting Sensors 1 Building Envelope 2 Plug Load Management 3 HVAC & Smart Zone Controls 4 Water Conservation 5 Onsite Generation 6 Energy Storage 7 EV Infrastructure 8 Utility Distribution 9Smart Controls

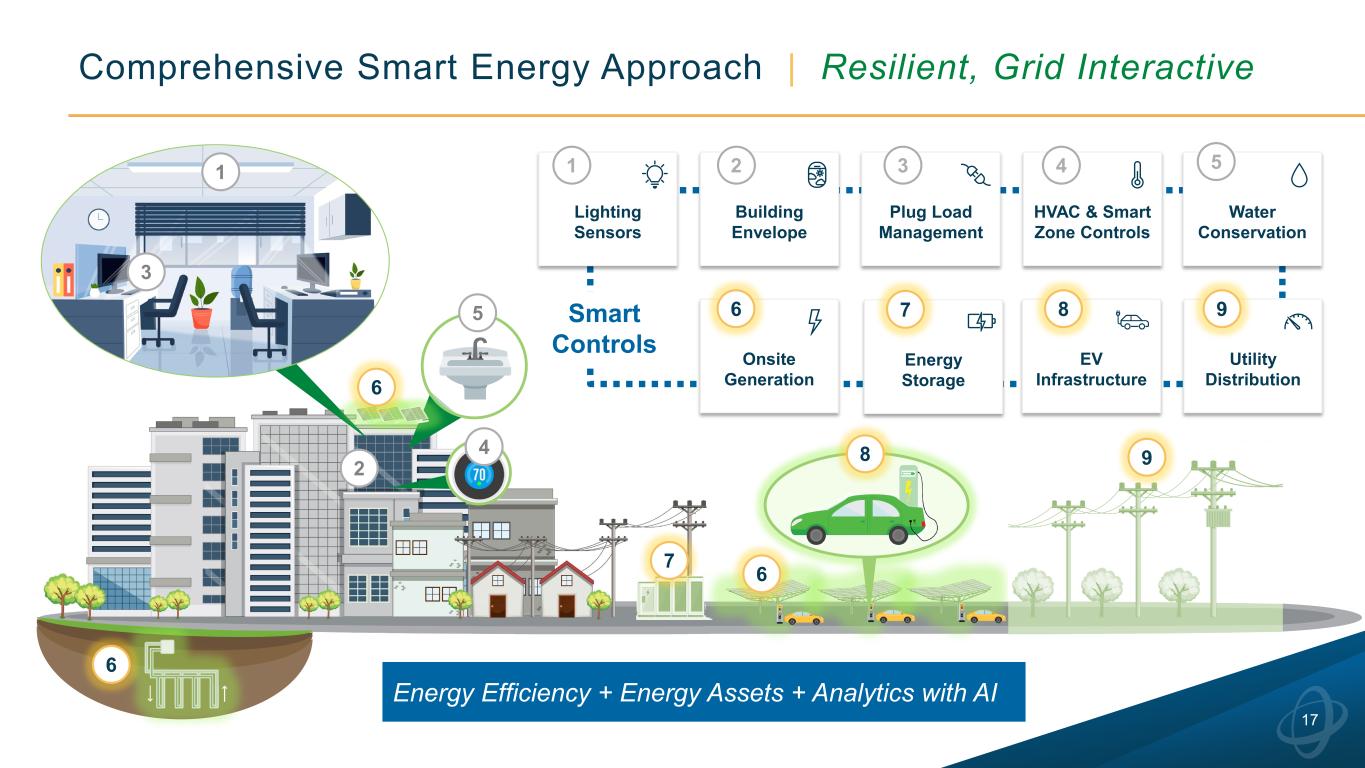

2 1 Energy Efficiency + Energy Assets + Analytics with AI Comprehensive Smart Energy Approach | Resilient, Grid Interactive 17 3 4 5 6 6 6 8 7 9 Lighting Sensors 1 Building Envelope 2 Plug Load Management 3 HVAC & Smart Zone Controls 4 Water Conservation 5 Smart Controls Onsite Generation 6 Energy Storage 7 EV Infrastructure 8 Utility Distribution 9

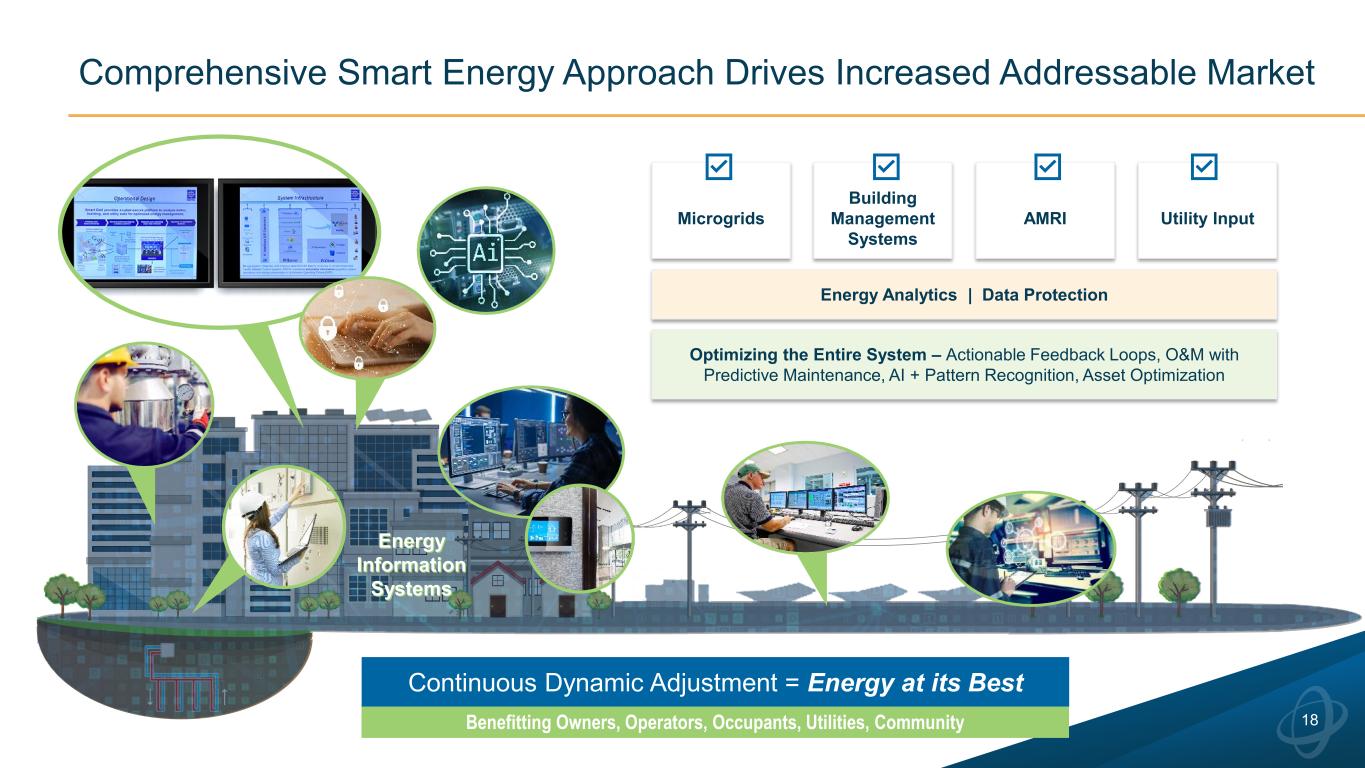

Comprehensive Smart Energy Approach Drives Increased Addressable Market 18Benefitting Owners, Operators, Occupants, Utilities, Community Continuous Dynamic Adjustment = Energy at its Best Energy Information Systems Microgrids Building Management Systems AMRI Utility Input Energy Analytics | Data Protection Optimizing the Entire System – Actionable Feedback Loops, O&M with Predictive Maintenance, AI + Pattern Recognition, Asset Optimization

Our Smart Approach is Applicable to All Markets 19 Military Bases College Campuses Commercial & Industrial K-12 Schools Healthcare Facilities Utilities Municipalities Transportation

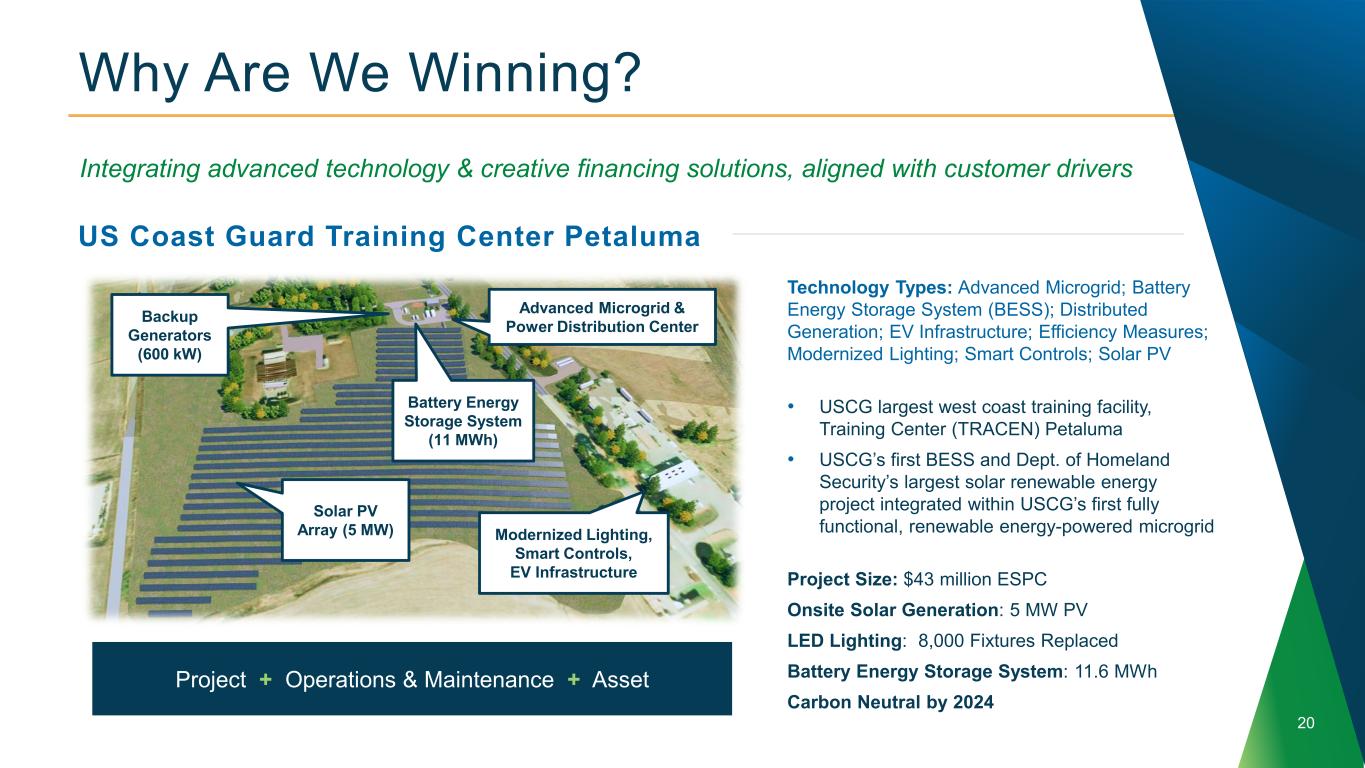

Why Are We Winning? 20 Integrating advanced technology & creative financing solutions, aligned with customer drivers US Coast Guard Training Center Petaluma Technology Types: Advanced Microgrid; Battery Energy Storage System (BESS); Distributed Generation; EV Infrastructure; Efficiency Measures; Modernized Lighting; Smart Controls; Solar PV • USCG largest west coast training facility, Training Center (TRACEN) Petaluma • USCG’s first BESS and Dept. of Homeland Security’s largest solar renewable energy project integrated within USCG’s first fully functional, renewable energy-powered microgrid Project Size: $43 million ESPC Onsite Solar Generation: 5 MW PV LED Lighting: 8,000 Fixtures Replaced Battery Energy Storage System: 11.6 MWh Carbon Neutral by 2024 Backup Generators (600 kW) Advanced Microgrid & Power Distribution Center Battery Energy Storage System (11 MWh) Solar PV Array (5 MW) Modernized Lighting, Smart Controls, EV Infrastructure Project + Operations & Maintenance + Asset

Policy Accelerates our Market Opportunity Historic infrastructure investment passed by Congress • Infrastructure Investment and Jobs Act included $550B (over 5 years) in new spending • Of this amount, $80B is directed towards climate-related programs • Largest investment in the Department of Energy since its creation Additional climate-focused legislation may still pass in 2022 • Slimmed down Build Back Better Act (reconciliation package) under development • May include deficit reduction + $550B in new climate/energy spending • Extension and expansion of clean energy tax credits supported by key moderate Dem Senators (Manchin and Sinema) Policy acts as an additional catalyst for the work that we are doing • Stimulates R&D of new tech – hydrogen, transmission line infrastructure, EV infrastructure, storage, microgrids, on-site generation • Provides additional incentive beyond project economics for clean energy transition • Drives new RFPs and expands the market through Federal procurement Ameresco advocates for supportive Federal policies and leverages Federal resources • Greater use of performance contracting at all levels of government • New Federal funding to support increased deployment of energy efficiency and clean energy solutions • Successful implementation of new clean energy laws • Address project bottlenecks when they arise 21

Transformational Growth in Project Business Nicole Bulgarino EVP & GM, Federal Solutions Questions & Answers

Energy Assets and the Future of Green Fuels Mike Bakas EVP Distributed Energy Systems

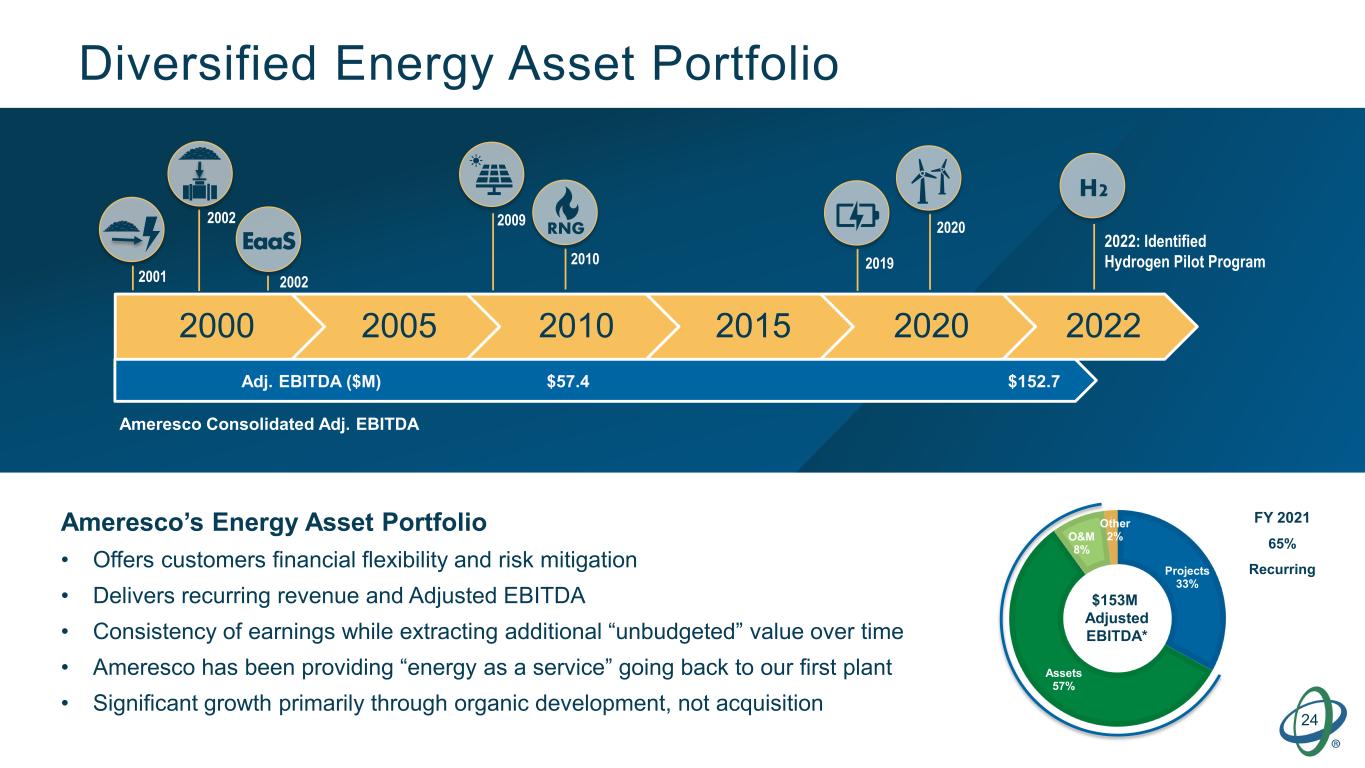

Diversified Energy Asset Portfolio 24 Ameresco’s Energy Asset Portfolio • Offers customers financial flexibility and risk mitigation • Delivers recurring revenue and Adjusted EBITDA • Consistency of earnings while extracting additional “unbudgeted” value over time • Ameresco has been providing “energy as a service” going back to our first plant • Significant growth primarily through organic development, not acquisition Projects 33% Assets 57% O&M 8% Other 2% $153M Adjusted EBITDA* FY 2021 65% Recurring 2000 2005 2010 2015 2020 2022 RNG H2 2022: Identified Hydrogen Pilot Program 2009 2010 2019 2020 2002 EaaS 2002 2001 Ameresco Consolidated Adj. EBITDA Adj. EBITDA ($M) $57.4 $152.7

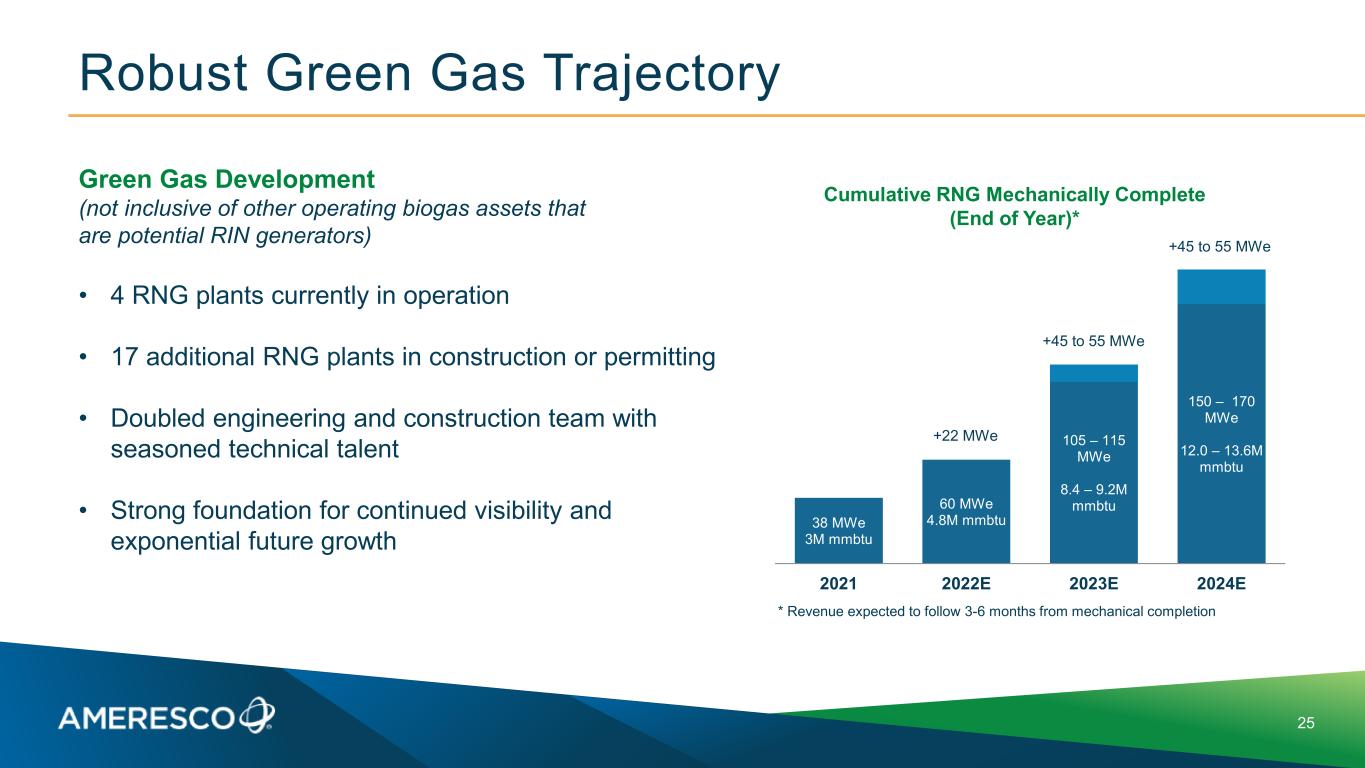

Robust Green Gas Trajectory Green Gas Development (not inclusive of other operating biogas assets that are potential RIN generators) • 4 RNG plants currently in operation • 17 additional RNG plants in construction or permitting • Doubled engineering and construction team with seasoned technical talent • Strong foundation for continued visibility and exponential future growth 38 MWe 3M mmbtu 60 MWe 4.8M mmbtu 105 – 115 MWe 8.4 – 9.2M mmbtu 150 – 170 MWe 12.0 – 13.6M mmbtu 2021 2022E 2023E 2024E Cumulative RNG Mechanically Complete (End of Year)* +45 to 55 MWe +22 MWe * Revenue expected to follow 3-6 months from mechanical completion +45 to 55 MWe 25

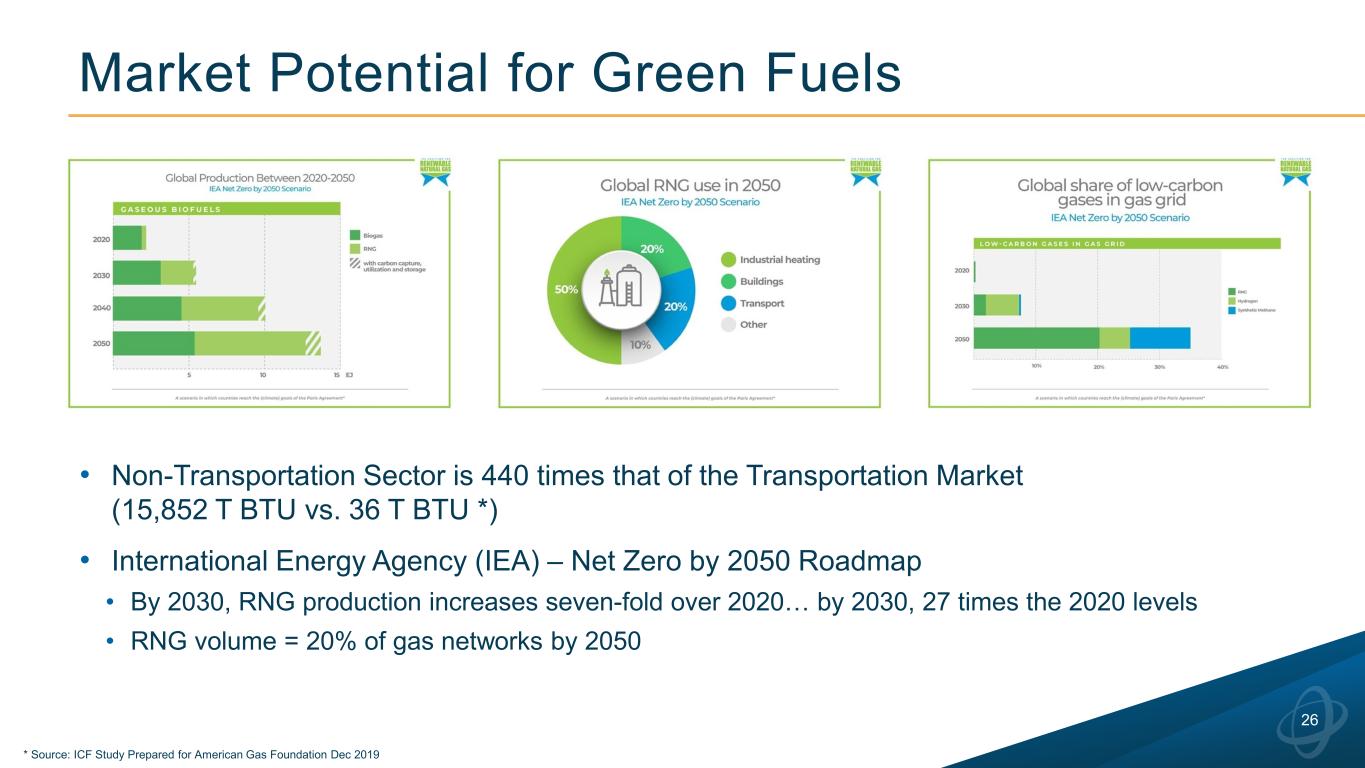

Market Potential for Green Fuels 26 • Non-Transportation Sector is 440 times that of the Transportation Market (15,852 T BTU vs. 36 T BTU *) • International Energy Agency (IEA) – Net Zero by 2050 Roadmap • By 2030, RNG production increases seven-fold over 2020… by 2030, 27 times the 2020 levels • RNG volume = 20% of gas networks by 2050 * Source: ICF Study Prepared for American Gas Foundation Dec 2019

“It’s Not a Sprint… but a Marathon” 27 • Sustainability/Decarbonization of the Pipes….Removing Carbon Risk from the Balance Sheet • Security of Supply Through Domestic Resources • Dispatchable, Base-Load Green Energy to Support Resiliency Objectives Growth Drivers • CPUC Approves Biomethane Procurement Targets Under SB 1440 • Organic Diversion : CA SB-1383 • 34 States - Utility Programs, Legislative/Regulatory Actions Promoting RNG (up 89% from 2019) • ESG Mandates Driven by Investors, Institutions, Gen Z, etc. • Price Competitive on a $/metric ton CO2 Reduced Basis New Opportunities for Ameresco • Expansion of LFG/WWTP Asset Base to Serve Non-Transportation Sector • Expand Development to Include Agricultural RNG Assets to Serve the Transportation Sector • Carbon Capture & Storage • Green Hydrogen • Organic Diversion • Leverage Green Power Plant Assets for Potential of ERINs • Leverage RNG Assets for Potential of Hydrogen Pathway Market Trends

Ameresco’s Competitive Advantage 28 Historical, Proven Track Record • Ameresco has been developing biogas projects from the beginning First operating plant (BMW) in 20th year of Commercial Operations • All operating biogas plants were developed from greenfield by Ameresco…not secured through acquisition • Ameresco has developed many projects where others had failed Positioned for Future Markets (Non-Transportation Sector) • Diverse offering supported by robust distribution network • Ameresco is not a pure-play RNG Developer with only 1 Customer (Transportation Sector) • Ameresco’s Project business develops and maintains partnerships across multiple markets, all of whom will be looking to incorporate Green Fuels as part of their overall Sustainability Strategies Vertically Integrated, Deep Bench of Talent • In-house development, permitting, engineering, project management, compliance, legal and operations staff • Diverse mix of high- performing, operating assets speaks volumes to Ameresco’s talent

Energy Assets and the Future of Green Fuels Mike Bakas EVP Distributed Energy Systems Questions & Answers

Ameresco’s Investment Strategy Mike Bakas EVP, Distributed Energy Systems Josh Baribeau VP, Finance & Corporate Treasury Jon Mancini Mark Chiplock SVP, Solar Project Development SVP & Chief Accounting Officer

Break

Key Drivers in Sustainability Lisa Shpritz SVP, Environmental Operations, Bank of America Client Session

Enterprise Climate Strategy and Environmental Programs Lisa Shpritz March 23, 2022

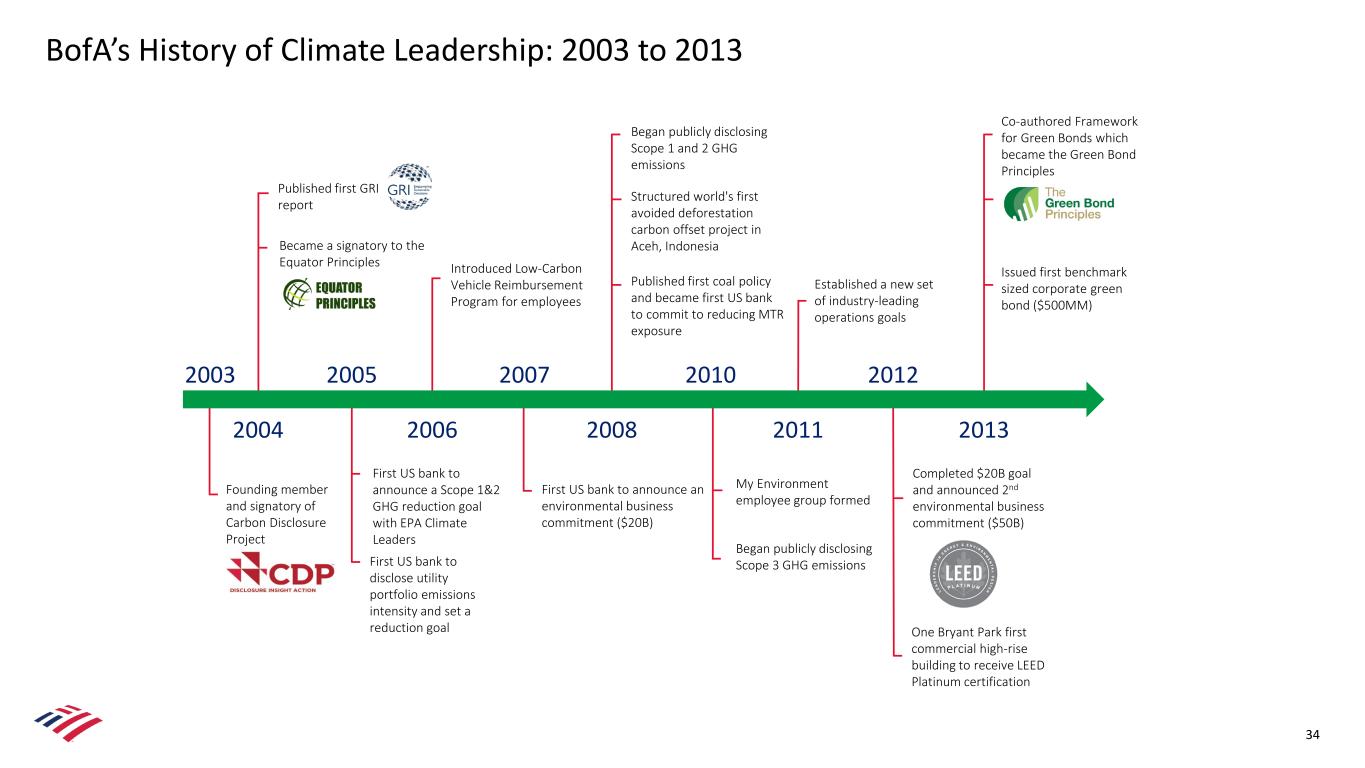

34 BofA’s History of Climate Leadership: 2003 to 2013 Founding member and signatory of Carbon Disclosure Project Became a signatory to the Equator Principles Published first GRI report First US bank to announce a Scope 1&2 GHG reduction goal with EPA Climate Leaders First US bank to disclose utility portfolio emissions intensity and set a reduction goal Introduced Low-Carbon Vehicle Reimbursement Program for employees 2003 2005 2007 20112004 2006 2008 2012 First US bank to announce an environmental business commitment ($20B) Published first coal policy and became first US bank to commit to reducing MTR exposure Structured world's first avoided deforestation carbon offset project in Aceh, Indonesia Established a new set of industry-leading operations goals One Bryant Park first commercial high-rise building to receive LEED Platinum certification Completed $20B goal and announced 2nd environmental business commitment ($50B) 2010 My Environment employee group formed Began publicly disclosing Scope 1 and 2 GHG emissions Began publicly disclosing Scope 3 GHG emissions Co-authored Framework for Green Bonds which became the Green Bond Principles Issued first benchmark sized corporate green bond ($500MM) 2013

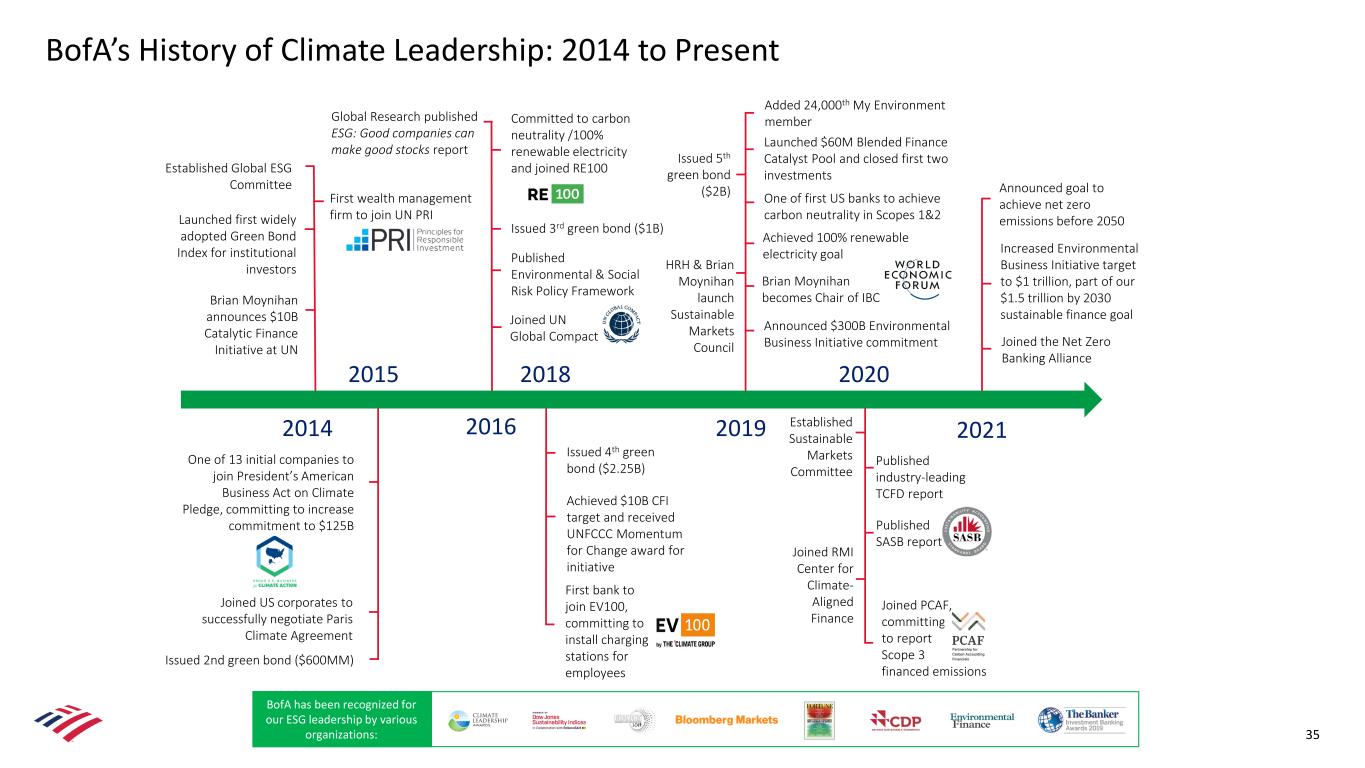

35 BofA’s History of Climate Leadership: 2014 to Present BofA has been recognized for our ESG leadership by various organizations: Launched first widely adopted Green Bond Index for institutional investors Established Global ESG Committee One of 13 initial companies to join President’s American Business Act on Climate Pledge, committing to increase commitment to $125B Joined US corporates to successfully negotiate Paris Climate Agreement Published Environmental & Social Risk Policy Framework Issued 4th green bond ($2.25B) Announced $300B Environmental Business Initiative commitment First bank to join EV100, committing to install charging stations for employees Established Sustainable Markets Committee Brian Moynihan announces $10B Catalytic Finance Initiative at UN First wealth management firm to join UN PRI Issued 2nd green bond ($600MM) Joined UN Global Compact Issued 3rd green bond ($1B) Committed to carbon neutrality /100% renewable electricity and joined RE100 Global Research published ESG: Good companies can make good stocks report Brian Moynihan becomes Chair of IBC HRH & Brian Moynihan launch Sustainable Markets Council One of first US banks to achieve carbon neutrality in Scopes 1&2 Achieved 100% renewable electricity goal Issued 5th green bond ($2B) Launched $60M Blended Finance Catalyst Pool and closed first two investments Published industry-leading TCFD report Published SASB report Joined RMI Center for Climate- Aligned Finance Joined PCAF, committing to report Scope 3 financed emissions Achieved $10B CFI target and received UNFCCC Momentum for Change award for initiative Added 24,000th My Environment member 2015 2014 2016 2019 2018 2020 Announced goal to achieve net zero emissions before 2050 Joined the Net Zero Banking Alliance 2021 Increased Environmental Business Initiative target to $1 trillion, part of our $1.5 trillion by 2030 sustainable finance goal

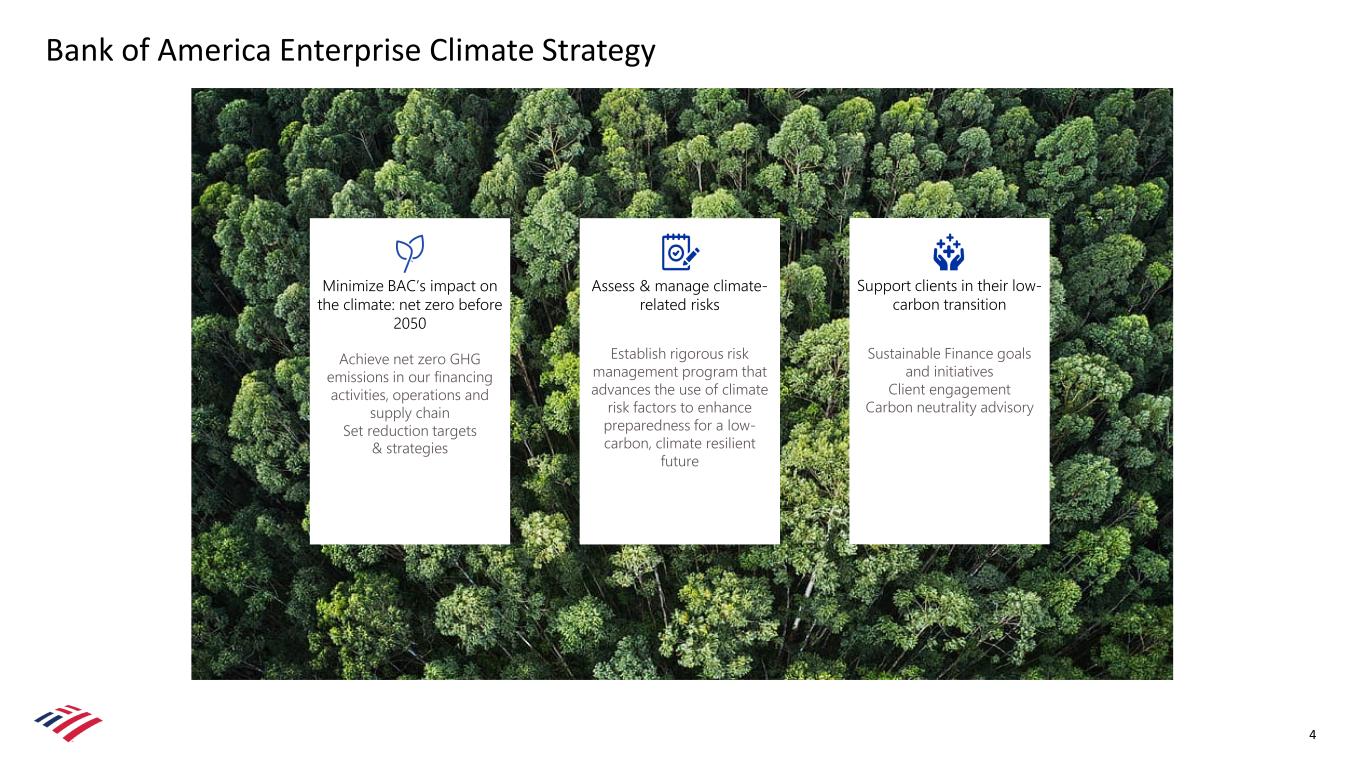

Support clients in their low- carbon transition Sustainable Finance goals and initiatives Client engagement Carbon neutrality advisory Assess & manage climate- related risks Establish rigorous risk management program that advances the use of climate risk factors to enhance preparedness for a low- carbon, climate resilient future Minimize BAC’s impact on the climate: net zero before 2050 Achieve net zero GHG emissions in our financing activities, operations and supply chain Set reduction targets & strategies 4 Bank of America Enterprise Climate Strategy

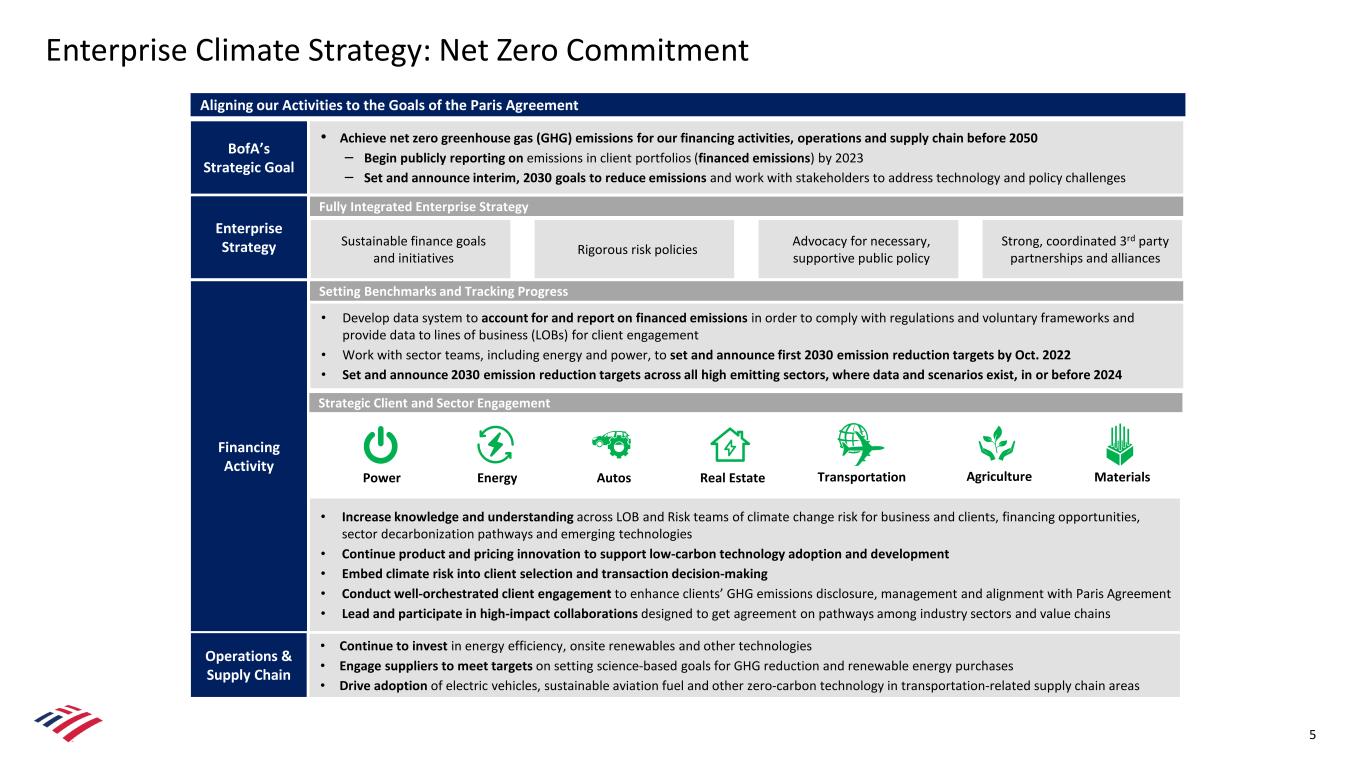

Enterprise Climate Strategy: Net Zero Commitment 5 Rigorous risk policies Advocacy for necessary, supportive public policy Strong, coordinated 3rd party partnerships and alliances Aligning our Activities to the Goals of the Paris Agreement • Achieve net zero greenhouse gas (GHG) emissions for our financing activities, operations and supply chain before 2050 – Begin publicly reporting on emissions in client portfolios (financed emissions) by 2023 – Set and announce interim, 2030 goals to reduce emissions and work with stakeholders to address technology and policy challenges • Develop data system to account for and report on financed emissions in order to comply with regulations and voluntary frameworks and provide data to lines of business (LOBs) for client engagement • Work with sector teams, including energy and power, to set and announce first 2030 emission reduction targets by Oct. 2022 • Set and announce 2030 emission reduction targets across all high emitting sectors, where data and scenarios exist, in or before 2024 Setting Benchmarks and Tracking Progress Sustainable finance goals and initiatives Fully Integrated Enterprise Strategy Strategic Client and Sector Engagement • Increase knowledge and understanding across LOB and Risk teams of climate change risk for business and clients, financing opportunities, sector decarbonization pathways and emerging technologies • Continue product and pricing innovation to support low-carbon technology adoption and development • Embed climate risk into client selection and transaction decision-making • Conduct well-orchestrated client engagement to enhance clients’ GHG emissions disclosure, management and alignment with Paris Agreement • Lead and participate in high-impact collaborations designed to get agreement on pathways among industry sectors and value chains BofA’s Strategic Goal Materials Enterprise Strategy Financing Activity AgricultureTransportationAutosEnergyPower Operations & Supply Chain • Continue to invest in energy efficiency, onsite renewables and other technologies • Engage suppliers to meet targets on setting science-based goals for GHG reduction and renewable energy purchases • Drive adoption of electric vehicles, sustainable aviation fuel and other zero-carbon technology in transportation-related supply chain areas Real Estate

• Aviation accounts for 2.5% of global GHG emissions; in 2019, 98 billion gallons of jet fuel were used globally. In 2021, SAF production totaled ~70 million gallons globally. • BofA’s 2030 goal includes: • $2B in financing, capital deployment for SAF production and other low-carbon aviation solutions • 20% use of SAF by 2030 (3M gallons), covering 100% of corporate jet fuel usage and substantial % of commercial flight jet fuel usage • Currently purchasing SAF, purchasing offtakes, paying portions of green premiums • Further reinforcing these goals, Bank of America: July 2021: • Became a founding member of the Sustainable Aviation Buyers Alliance (SABA) • Signed 10-yr contract with SkyNRG to support production of 1.2M gal SAF/yr. 2025-2034 September 2021: • Joined Breakthrough Energy Catalyst Fund as an anchor partner • Signed the WEF Clean Skies for Tomorrow ambition statement November 2021: • Formally joined WEF’s Clean Skies for Tomorrow and First Movers’ Coalition • Signed agreement with American Airlines supporting their purchase of 1M gallons of SAF per year (2021-2023) • Collaborating with groups developing a SAF certificate (SAFc) tracking registry 2030 SAF Goal: Announced February 11 2022 6 Bank of America will support the financing, production and use of 1 billion gallons of SAF by 2030. The company will catalyze the market through $2 billion in financing and capital deployment and 20% use of SAF for corporate and commercial flights, including 100% of corporate jet fuel usage.

Lisa Shpritz, 980-386-6989 lisa.shpritz@bofa.com

Key Drivers in Federal Government Kevin Kampschroer GSA Chief Sustainability Officer Office of Federal High-Performance Green Buildings Client Session

U.S. General Services Administration GSA Overview Office of Federal High-Performance Green Buildings

U.S. General Services Administration ● Established in 1949 by President Truman ○ To Streamline the Administrative Work of the Federal Government ● GSA’s Mission ○ “Deliver value and savings in real estate, acquisition, technology, and other mission- support services across government.”

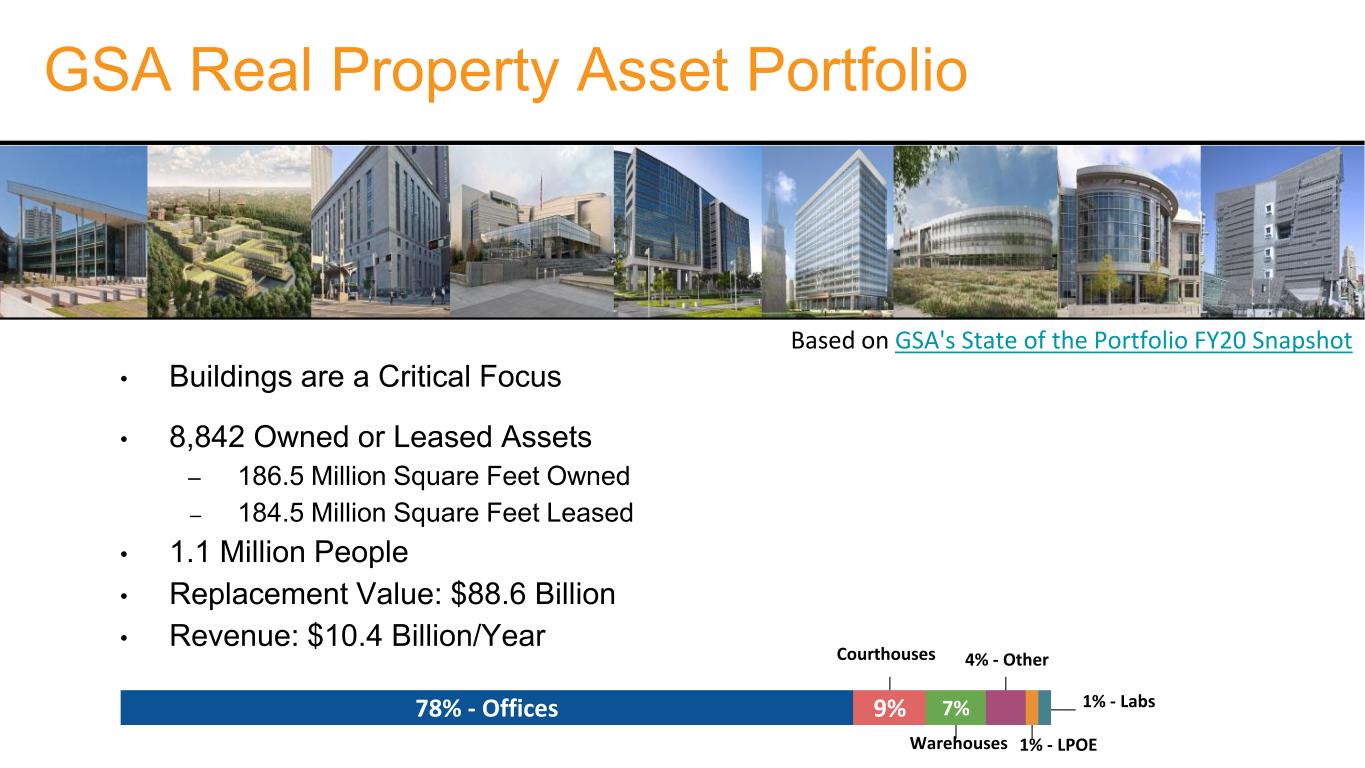

GSA Real Property Asset Portfolio • Buildings are a Critical Focus • 8,842 Owned or Leased Assets – 186.5 Million Square Feet Owned – 184.5 Million Square Feet Leased • 1.1 Million People • Replacement Value: $88.6 Billion • Revenue: $10.4 Billion/Year Based on GSA's State of the Portfolio FY20 Snapshot 2 78% - Offices 9% 7% Courthouses Warehouses 4% - Other 1% - LPOE 1% - Labs

Federal Acquisition Service (FAS) Acquisition expertise Electronic tools Innovative techniques Services Products Solutions What We OfferWhat We Deliver What We Achieve Buying power of the Federal government Best value for our taxpayers and Federal customers Total FAS employees (Oct 2020): 3,603 FY20 Total Business Volume: $75.22 B

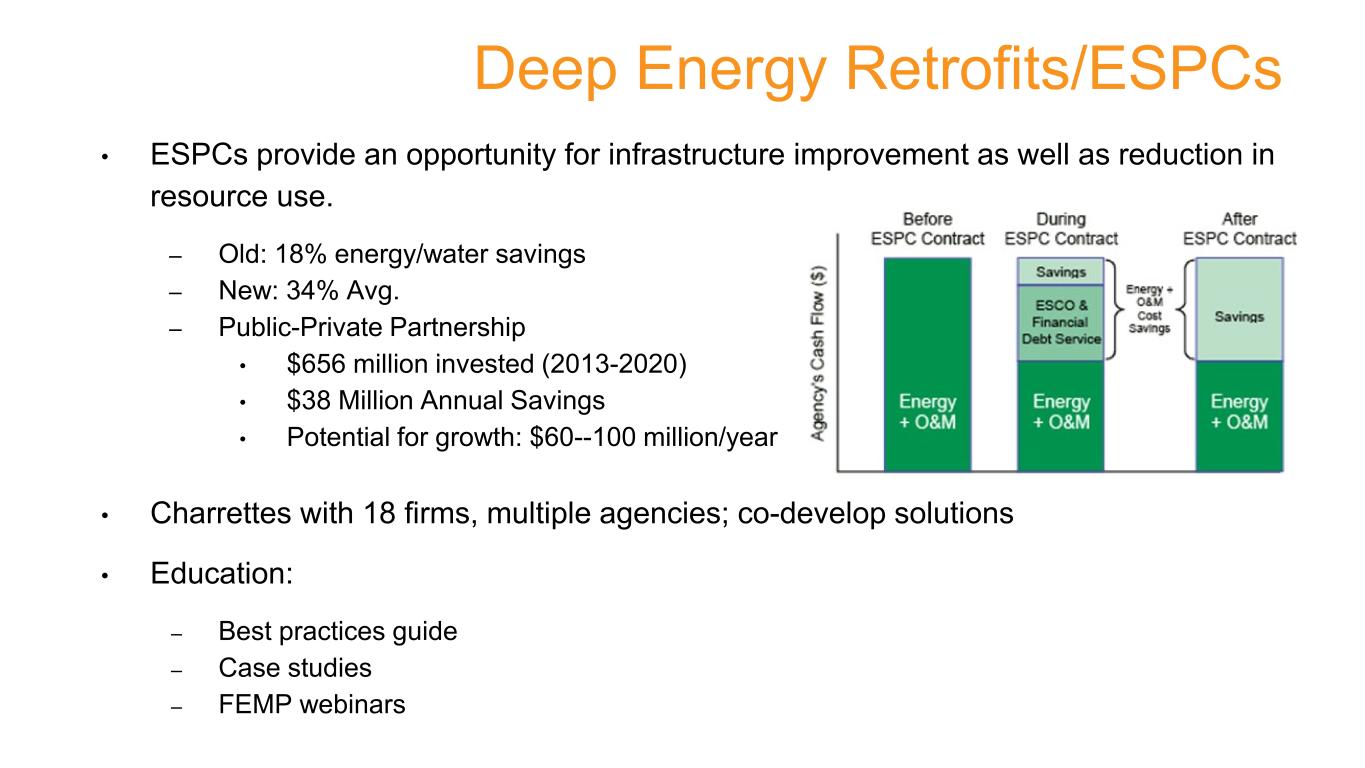

Deep Energy Retrofits/ESPCs • ESPCs provide an opportunity for infrastructure improvement as well as reduction in resource use. – Old: 18% energy/water savings – New: 34% Avg. – Public-Private Partnership • $656 million invested (2013-2020) • $38 Million Annual Savings • Potential for growth: $60--100 million/year • Charrettes with 18 firms, multiple agencies; co-develop solutions • Education: – Best practices guide – Case studies – FEMP webinars

Client Sessions – Key Drivers Questions & Answers SVP, Environmental Operations, Bank of America Lisa Shpritz GSA Chief Sustainability Officer Office of Federal High- Performance Green Buildings Kevin Kampschroer

New Markets and Models in Ameresco’s Regions Executive Vice President Bob Georgeoff SVP, Western & London Operations Britta MacIntosh Executive Vice President Lou Maltezos SVP, Marketing & Communications Leila Dillon

Ameresco’s ESG Impact CFO & EVP Doran Hole SVP, Marketing & Communications Leila Dillon

Doing Well by Doing Good: Innovation. Action. Integrity. 49 Access Ameresco’s 2021 ESG Report online: ameresco.com/2021-esg-report *All figures through 09/30/2021

ESG in 2021 50 ESG is in our DNA – Doing Well by Doing Good • ESG Ambassadors (9 cross-functional team members) • Subcommittees for Environmental, Social, Governance • Dedicated resource focused on formalized reporting frameworks • 2021 Focus: Innovation. Action. Integrity. • After our inaugural 2020 report was published, our team of ESG Ambassadors set out to engage stakeholders companywide in bringing Ameresco’s goals to fruition. • 2021 report highlights practices pertaining to business and operations, environmental impact, employee engagement, giving back to local communities, health & safety, and corporate responsibility. • Energizing a Sustainable World – Since 2010, Ameresco’s renewable energy assets and customer projects delivered a cumulative carbon offset equivalent to 75+ million metric tons of CO2. This is equal to one of… Greenhouse gas emissions from… 188 billion miles driven by an average passenger vehicle Carbon sequestered by… 91 million acres of U.S. forests in one year

Ameresco’s ESG Commitments 51 Committed to our vision of energizing a sustainable world by “doing well by doing good”

SCE Roadmap and Future Corporate Impact Doran Hole Chief Financial Officer & EVP

SCE Project Update • Placed POs for batteries, transformers, inverters and switchgear • Executed major subcontracts for civil, electrical and mechanical work • Completed factory acceptance testing for a majority of equipment • Required site permits in hand • Mobilized on all sites in preparation for equipment deliveries and expects civil work to commence imminently • Secured corporate credit facility expansion • Working closely with suppliers to ensure timely equipment delivery • Actively managing supply chain challenges and expects to finish on schedule 53

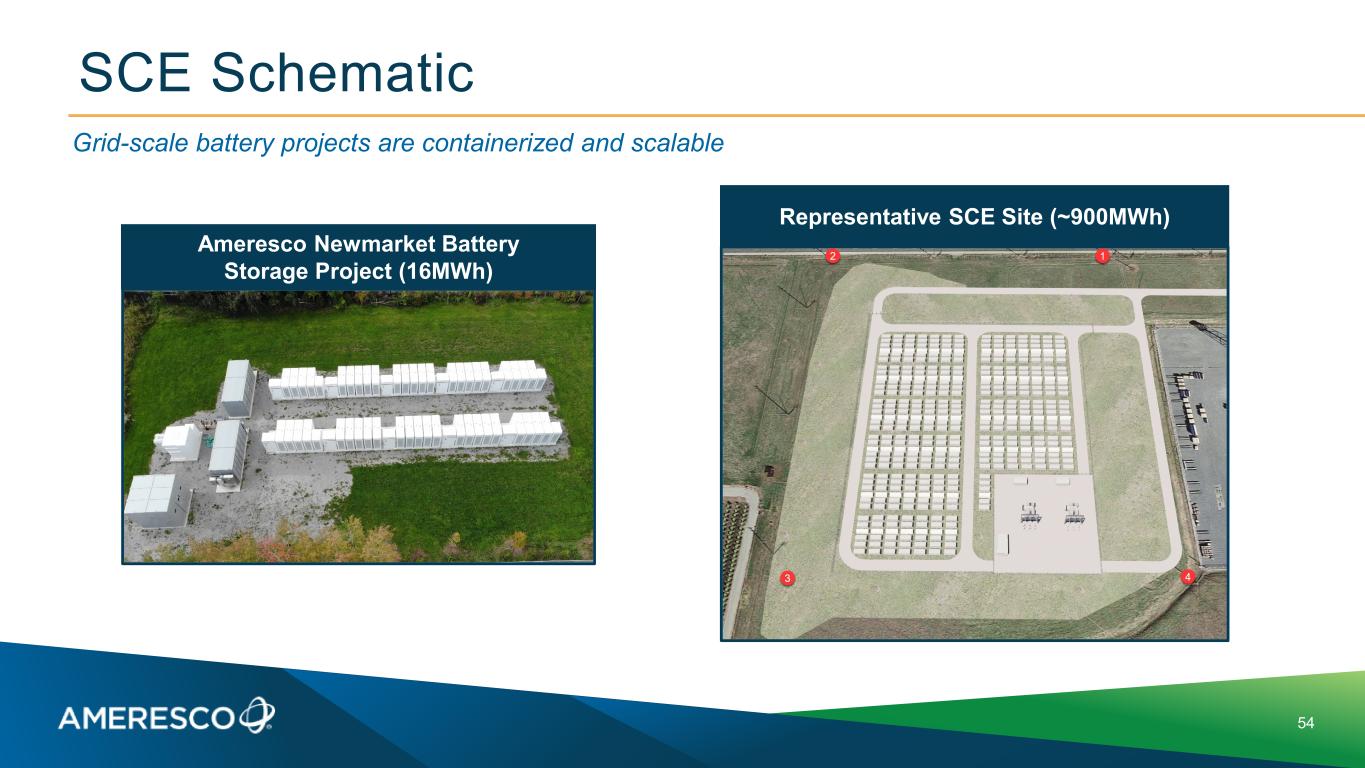

SCE Schematic 54 Grid-scale battery projects are containerized and scalable Ameresco Newmarket Battery Storage Project (16MWh) Representative SCE Site (~900MWh)

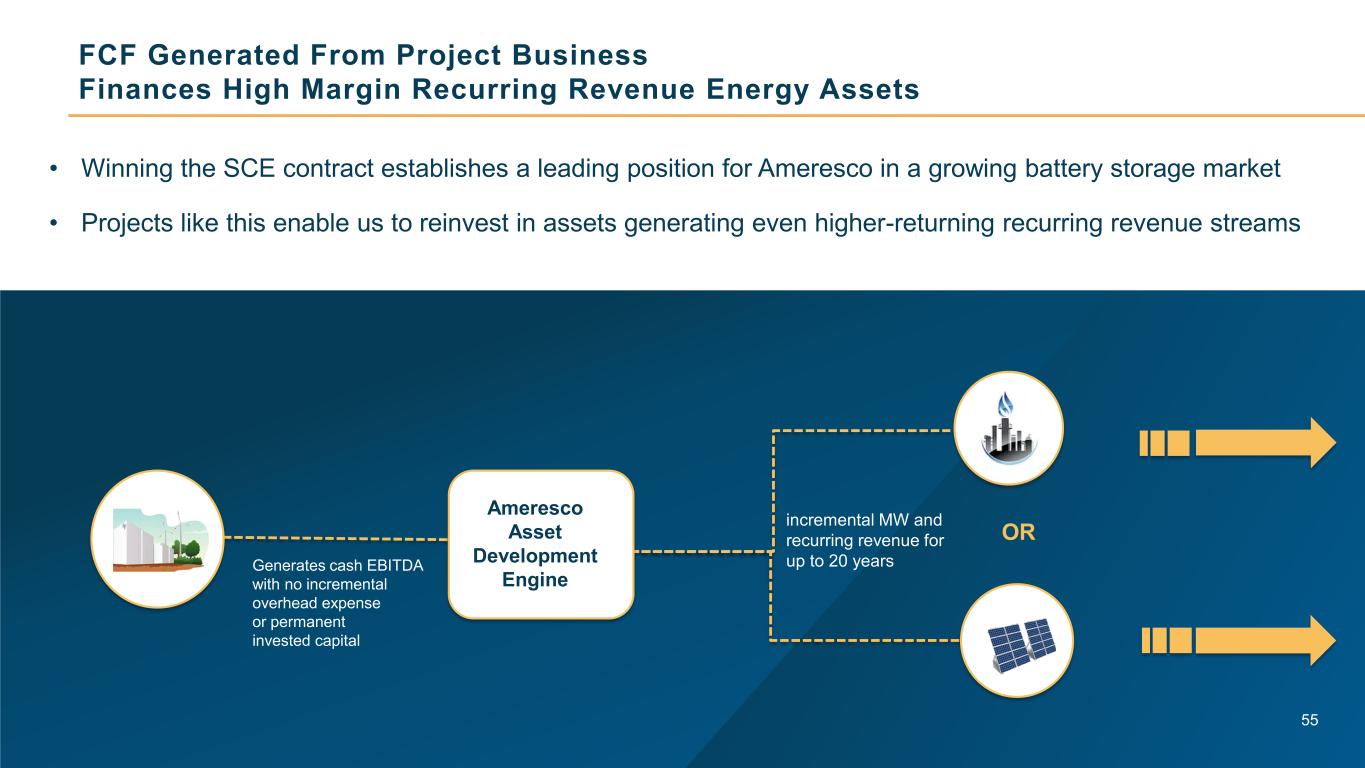

FCF Generated From Project Business Finances High Margin Recurring Revenue Energy Assets 55 Generates cash EBITDA with no incremental overhead expense or permanent invested capital incremental MW and recurring revenue for up to 20 years OR • Winning the SCE contract establishes a leading position for Ameresco in a growing battery storage market • Projects like this enable us to reinvest in assets generating even higher-returning recurring revenue streams Ameresco Asset Development Engine

Ameresco’s Financial Goals President and CEO George Sakellaris CFO and EVP Doran Hole

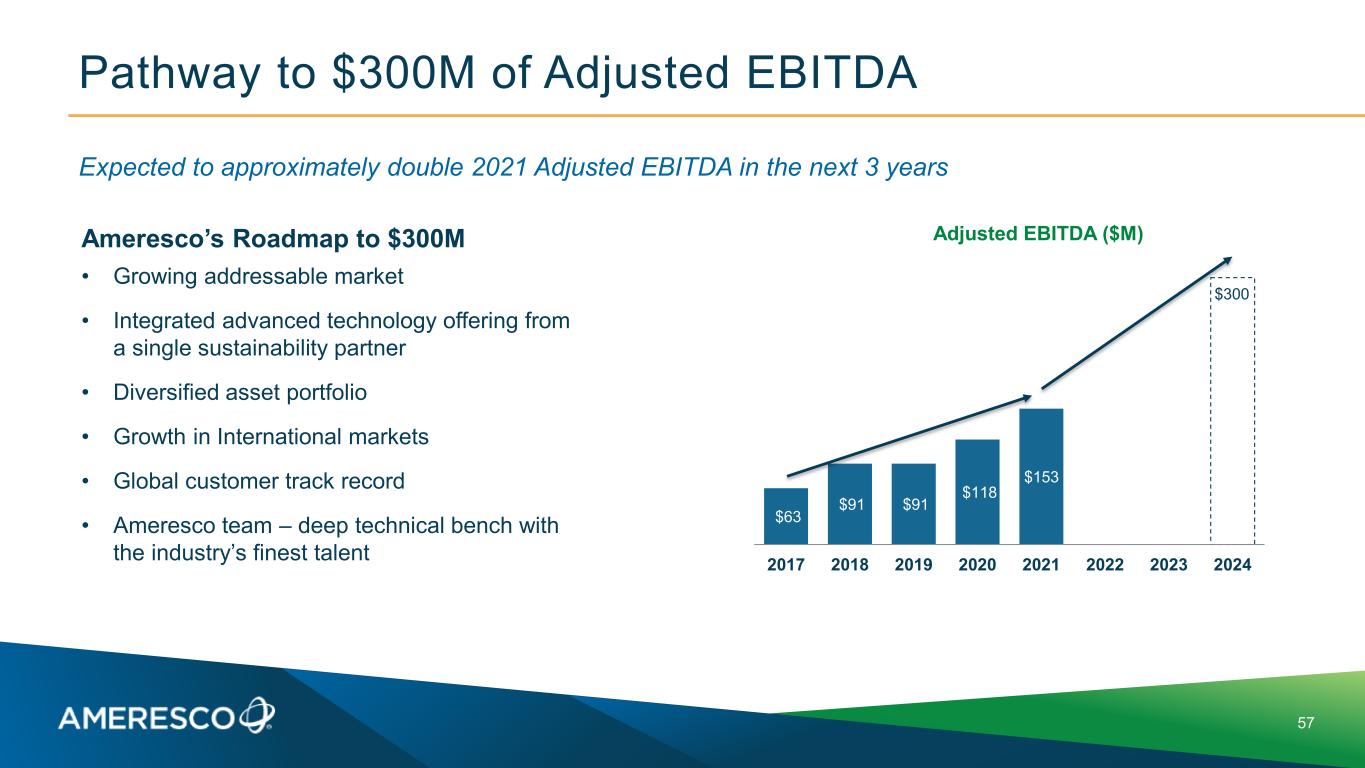

Pathway to $300M of Adjusted EBITDA 57 $63 $91 $91 $118 $153 2017 2018 2019 2020 2021 2022 2023 2024 Adjusted EBITDA ($M) $300 Expected to approximately double 2021 Adjusted EBITDA in the next 3 years Ameresco’s Roadmap to $300M • Growing addressable market • Integrated advanced technology offering from a single sustainability partner • Diversified asset portfolio • Growth in International markets • Global customer track record • Ameresco team – deep technical bench with the industry’s finest talent

Questions & Answers

George Sakellaris CEO & President Doran Hole CFO & EVP Nicole Bulgarino EVP & GM, Federal Michael Bakas EVP, Distributed Energy Systems Leila Dillon SVP, Marketing & Communications Bob Georgeoff EVP Britta MacIntosh SVP, Western & London Operations Lou Maltezos EVP Josh Baribeau VP, Finance & Corporate Treasury Mark Chiplock SVP & Chief Accounting Officer Jon Mancini SVP, Solar Project Business Pete Christakis SVP, Construction & Operations David Corrsin SVP, General Counsel, Corporate Secretary Nina Andersson Willard Assistant General Counsel Jim Bishop VP, Advanced Technology Solutions

ameresco.com © 2022 Ameresco, Inc. All rights reserved. Thank You