Welcome to Ameresco’s Investor Day - London

Safe Harbor Cautionary Language Concerning Forward-Looking Statements Any statements in this presentation about future expectations, plans and prospects for Ameresco, Inc., including statements about market conditions, pipeline, assets in development, visibility and backlog, as well as estimated future revenues, net income, adjusted EBITDA, Non-GAAP EPS, gross margin, capital investments, other financial guidance and longer term outlook, statements about our agreement with SCE including the impact of any future financial results, longer term outlook, growth strategy and other statements containing the words “projects,” “believes,” “anticipates,” “plans,” “expects,” “will” and similar expressions, constitute forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those indicated by such forward looking statements as a result of various important factors, including the timing of, and ability to, enter into contracts for awarded projects on the terms proposed or at all; the timing of work we do on projects where we recognize revenue on a percentage of completion basis, including the ability to perform under signed contracts without delay and in accordance with their terms; demand for our energy efficiency and renewable energy solutions; our ability to complete and operate our projects on a profitable basis and as committed to our customers; our ability to arrange financing to fund our operations and projects and to comply with covenants in our existing debt agreements; changes in federal, state and local government policies and programs related to energy efficiency and renewable energy and the fiscal health of the government; the ability of customers to cancel or defer contracts included in our backlog; the output and performance of our energy plants and energy projects; the effects of our acquisitions and joint ventures; seasonality in construction and in demand for our products and services; a customer’s decision to delay our work on, or other risks involved with, a particular project; availability and cost of labor and equipment particularly given global supply chain challenges and global trade conflicts; our reliance on third parties for our construction and installation work; the addition of new customers or the loss of existing customers; the impact of macroeconomic challenges, weather related events and climate change on our business; global supply chain challenges, component shortages and inflationary pressures; market price of the Company's stock prevailing from time to time; the nature of other investment opportunities presented to the Company from time to time; the Company's cash flows from operations; cybersecurity incidents and breaches; regulatory and other risks inherent to constructing and operating energy assets; risks related to our international operation and international growth strategy; and other factors discussed in our most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q. The forward-looking statements included in this presentation represent our views as of the date of this presentation. We anticipate that subsequent events and developments will cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we specifically disclaim any obligation to do so. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date of this presentation. Use of Non-GAAP Financial Measures This presentation include references to adjusted EBITDA, which is a Non-GAAP financial measure. For a description of this Non-GAAP financial measure, including the reasons management uses these measures, please see the section in the back of the Q1 2023 earnings presentation titled “Non-GAAP Financial Measures”

9:00am Welcome Remarks 9:05am Ameresco’s European Strategy & Policy Trends 9:15am Panel: EU Merger & Acquisition and Partnership Success Strategy 9:45am Panel: UK Business and Growth Strategy 10:15am Customer Presentation: Bristol City Leap 10:35am Ameresco, Inc. Financial Update 10:50am Closing Comments 11:00am Q&A Agenda

Kye Dudd Councillor Bristol City Council Giorgio Pucci Executive Chairman ENERQOS Enrico Giglioli CEO & Senior Advisor ENERQOS Konstantinos Zygouras Chairman & CEO Sunel Group Mark Apsey Managing Director UK London Kath Chapman Managing Director UK Leeds Josh Baribeau SVP, Finance & Corporate Treasury Conference Participants George Sakellaris CEO & President Britta MacIntosh EVP, General Manager West & Europe Region Doran Hole CFO & EVP Leila Dillon SVP, Marketing & Communications

Welcome Remarks George Sakellaris CEO & President

6 Ameresco’s European Focus Strengthen Clean Energy Global Leadership via Strategic Expansion Across Europe Create Organic Growth Trajectory and Invest in Acquisitions, Joint Ventures and Partnerships Aspire to be the #1 Cleantech Company in Europe & North America, creating a Sustainable World Leverage Ameresco’s Proven Track Record of Customer Satisfaction Apply our Holistic and Unbiased Approach to Deliver Best-in-Class, Cost Saving, Sustainable Solutions Develop Broad and Deep Bench of Local Technical Talent to Drive Meaningful Customer Growth and Success

European Strategy & Policy Trends Britta MacIntosh EVP, GM – West & Europe Region

Ameresco’s Current European Portfolio 8 Beale Hill Wind Farm NHS - Wexham Park Hospital Kefalonia Wind Project Delfini Solar Sunel Group Beckfoot Trust ENERQOS Building the Ameresco Portfolio in Europe since 2013 West County Cork Wind Farm West Lothian CouncilLED University of West LondonLED Merthyr Tydfil CouncilLED Scottish CollegesLED Wind Solar Combined Heat & Power LED Interior LED Lighting LED Streetlighting Energy Efficiency CO2 Decarbonization Project Acquisitions & Partnerships Assets Bristol City LeapCO2LED

Ameresco’s Expansion in Europe 9 European Strategy • Amplify Ameresco’s robust portfolio of solutions and low-carbon technologies • Accretive acquisitions with established, local companies that have a strong track-record and customer portfolio • Enter joint ventures and secure partnerships that strengthen bidding position and regional expertise • Target jurisdictions that are underserved and have favorable political environments, making it quicker to gain traction • For example: Spain, Italy, Greece, Romania, Poland Current European Footprint Countries of Interest

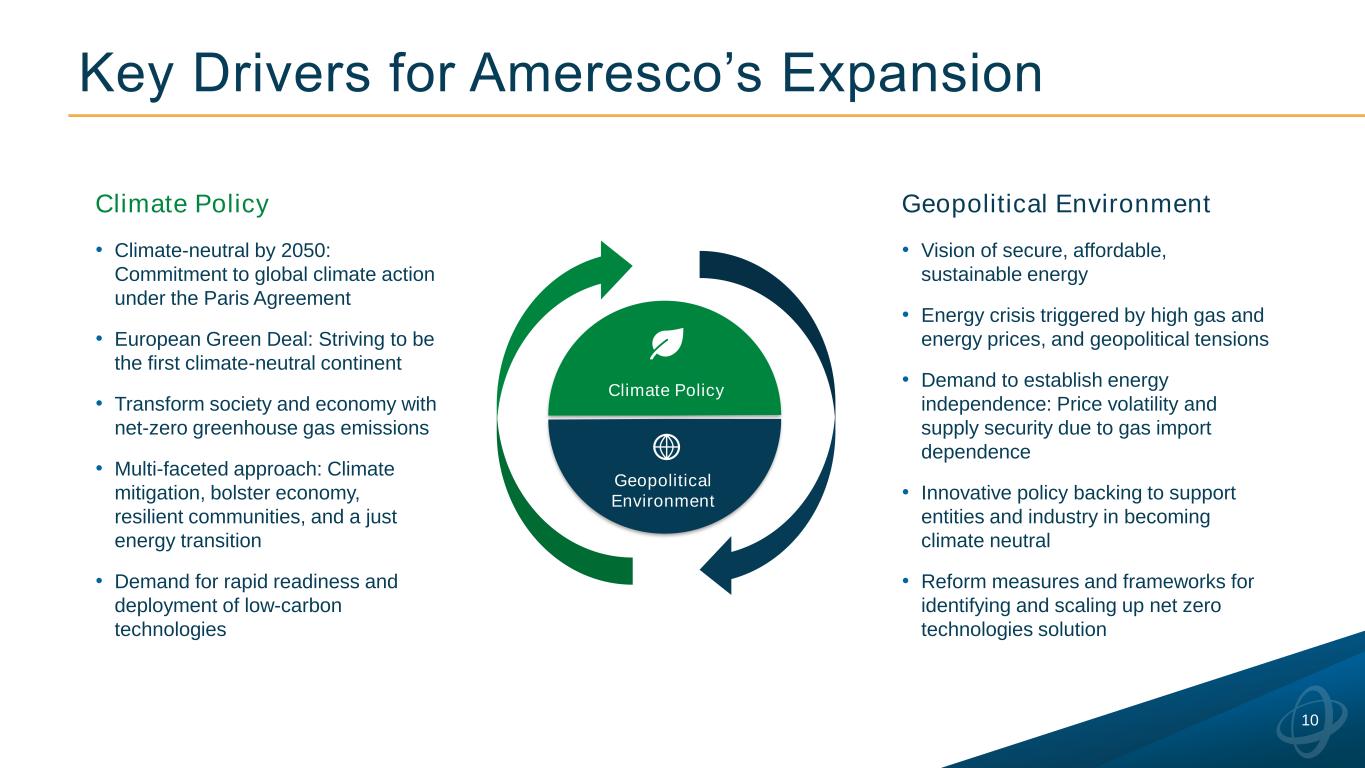

Key Drivers for Ameresco’s Expansion 10 Climate Policy • Climate-neutral by 2050: Commitment to global climate action under the Paris Agreement • European Green Deal: Striving to be the first climate-neutral continent • Transform society and economy with net-zero greenhouse gas emissions • Multi-faceted approach: Climate mitigation, bolster economy, resilient communities, and a just energy transition • Demand for rapid readiness and deployment of low-carbon technologies Geopolitical Environment Climate Policy Geopolitical Environment • Vision of secure, affordable, sustainable energy • Energy crisis triggered by high gas and energy prices, and geopolitical tensions • Demand to establish energy independence: Price volatility and supply security due to gas import dependence • Innovative policy backing to support entities and industry in becoming climate neutral • Reform measures and frameworks for identifying and scaling up net zero technologies solution

Position customer project successes as a blueprint in other countries to achieve net zero goals Target accretive acquisitions, joint ventures and partnerships to broaden our regional knowledge base and build a strong customer portfolio Leverage our global solution portfolio and financial infrastructure to support a region’s clean energy transition 11 Ameresco’s Approach

Panel: EU Merger and Acquisition & Partnership Success Strategy Josh Baribeau SVP, Finance & Corporate Treasury Doran Hole EVP & CFO Giorgio Pucci Executive Chairman, ENERQOS Konstantinos Zygouras Chairman & CEO, Sunel Group Enrico Giglioli CEO & Senior Advisor, ENERQOS Moderator

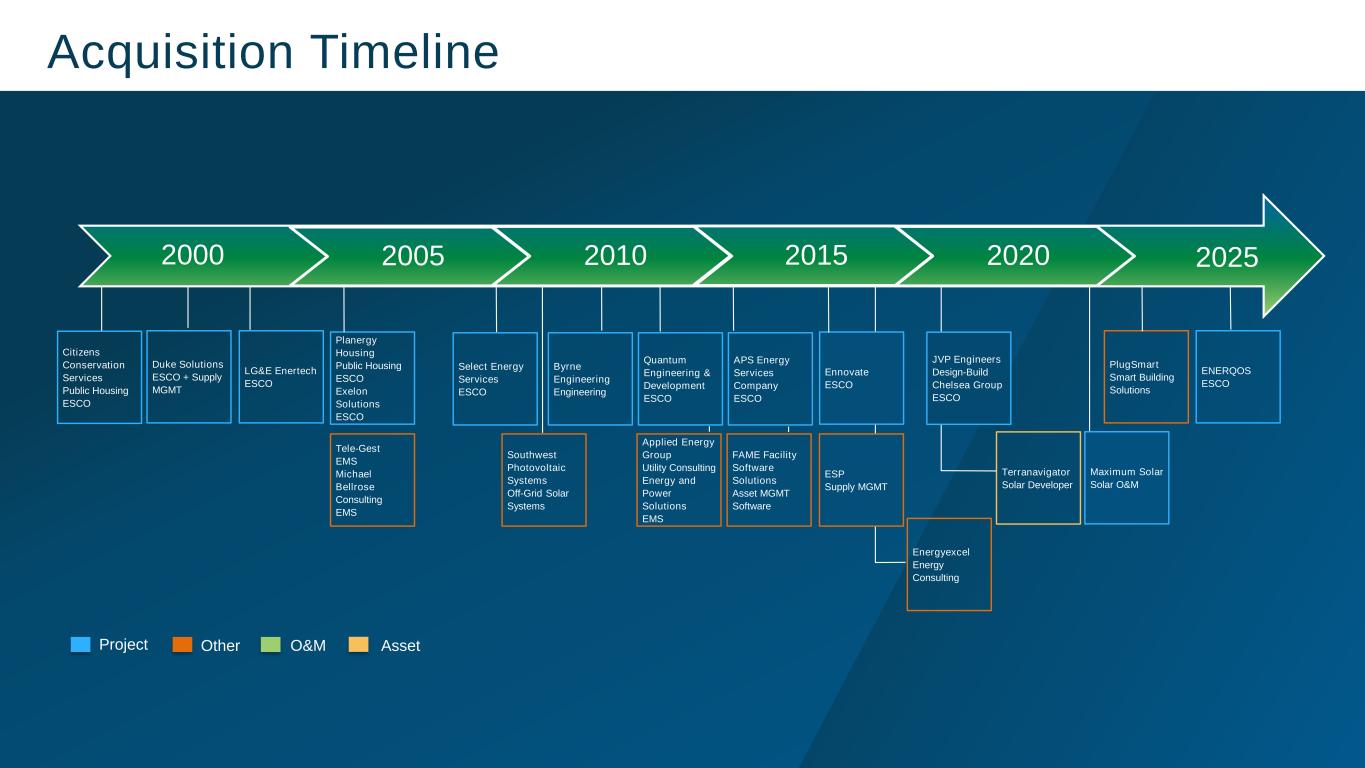

Acquisition Timeline 2000 2025 Citizens Conservation Services Public Housing ESCO Duke Solutions ESCO + Supply MGMT LG&E Enertech ESCO Planergy Housing Public Housing ESCO Exelon Solutions ESCO Southwest Photovoltaic Systems Off-Grid Solar Systems Select Energy Services ESCO Tele-Gest EMS Michael Bellrose Consulting EMS Byrne Engineering Engineering Quantum Engineering & Development ESCO APS Energy Services Company ESCO Ennovate ESCO JVP Engineers Design-Build Chelsea Group ESCO Applied Energy Group Utility Consulting Energy and Power Solutions EMS FAME Facility Software Solutions Asset MGMT Software ESP Supply MGMT Energyexcel Energy Consulting Terranavigator Solar Developer Maximum Solar Solar O&M PlugSmart Smart Building Solutions ENERQOS ESCO 2005 2010 2015 2020 Project Other O&M Asset

Panel: UK Business and Growth Strategy Leila Dillon SVP, Marketing & Communications Kath Chapman Managing Director, UK Leeds Mark Apsey Managing Director, UK London Moderator Britta MacIntosh EVP, General Manager West & Europe Region

Customer Presentation: Bristol City Leap Kye Dudd Councillor, Bristol City Council

Ameresco, Inc. Financial Update Doran Hole EVP & CFO

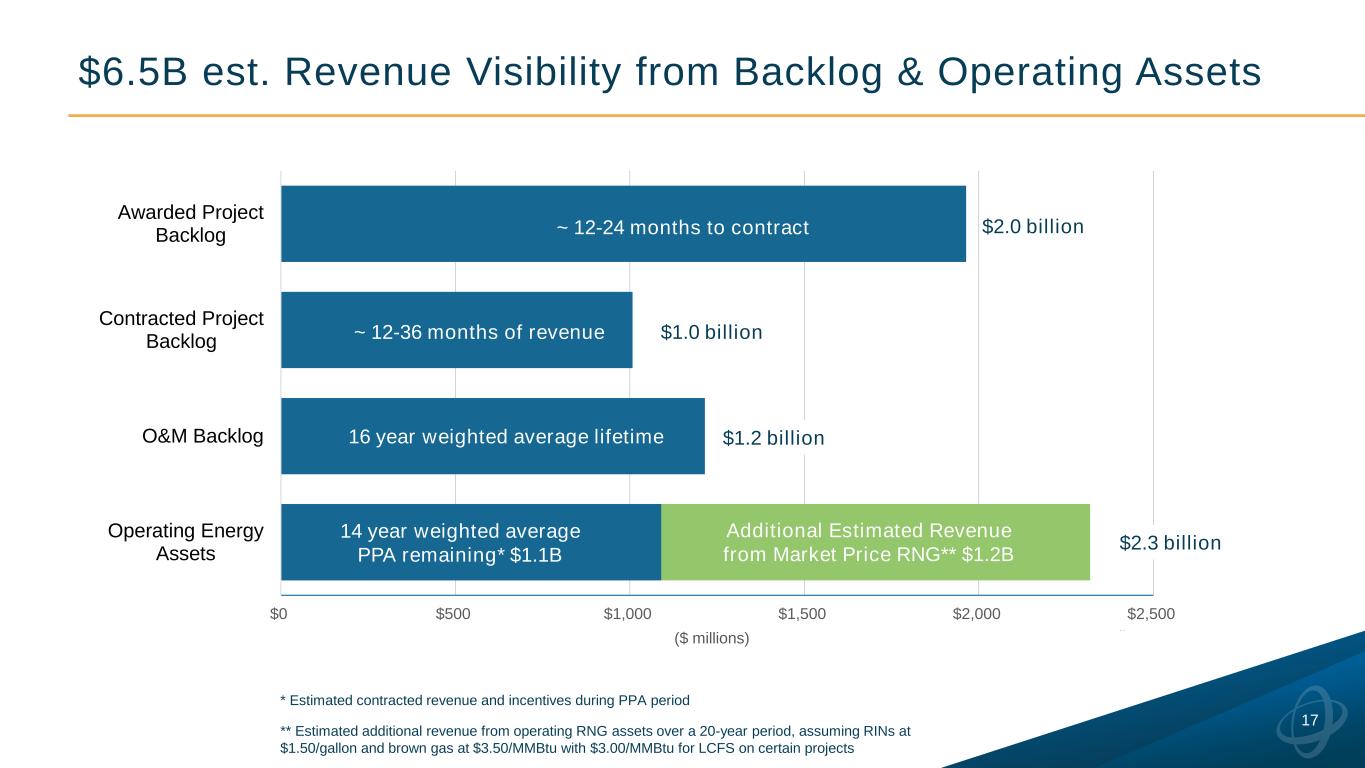

17 $6.5B est. Revenue Visibility from Backlog & Operating Assets $0 $500 $1,000 $1,500 $2,000 $2,500 Awarded Project Backlog Contracted Project Backlog O&M Backlog Operating Energy Assets Millions Additional Estimated Revenue from Market Price RNG** $1.2B ~ 12-24 months to contract ~ 12-36 months of revenue 14 year weighted average PPA remaining* $1.1B 16 year weighted average lifetime * Estimated contracted revenue and incentives during PPA period ** Estimated additional revenue from operating RNG assets over a 20-year period, assuming RINs at $1.50/gallon and brown gas at $3.50/MMBtu with $3.00/MMBtu for LCFS on certain projects $2.0 billion $1.0 billion $2.3 billion $1.2 billion ($ millions)

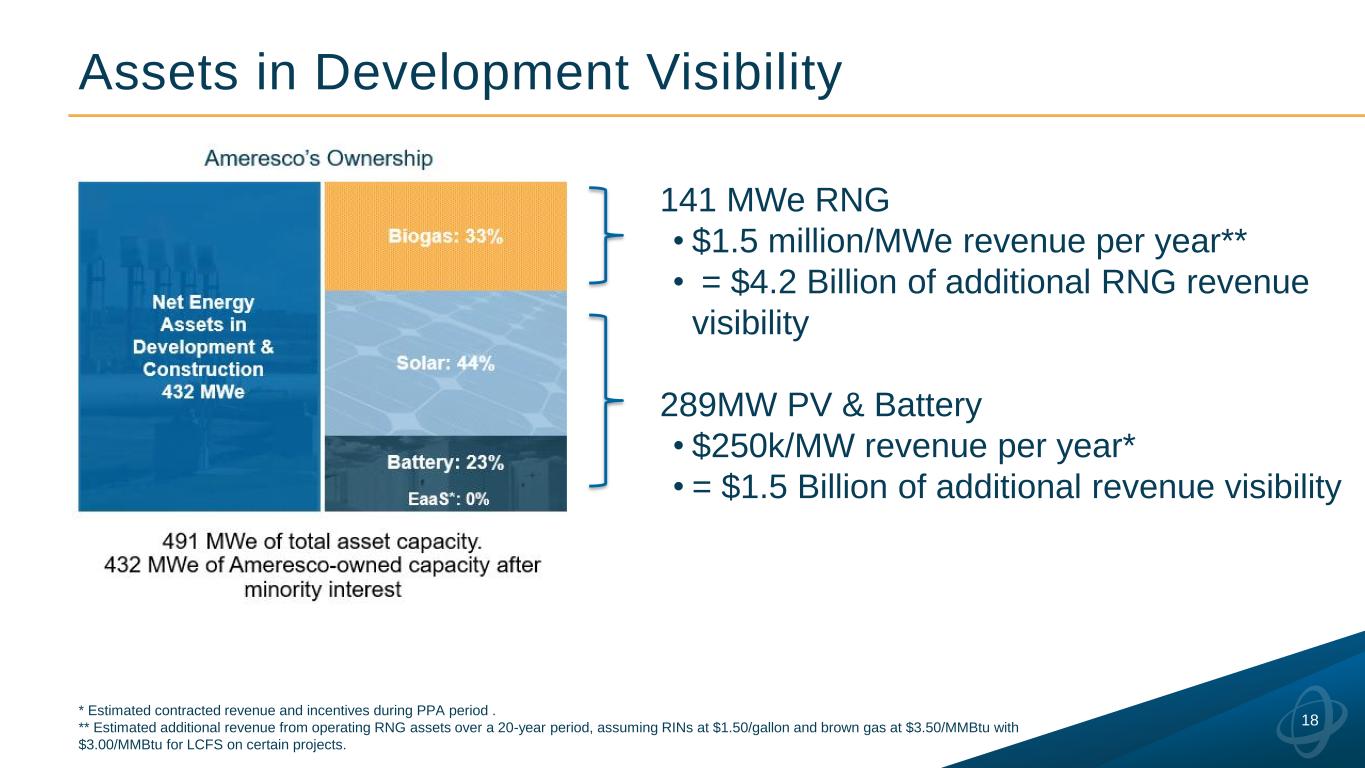

18 Assets in Development Visibility * Estimated contracted revenue and incentives during PPA period . ** Estimated additional revenue from operating RNG assets over a 20-year period, assuming RINs at $1.50/gallon and brown gas at $3.50/MMBtu with $3.00/MMBtu for LCFS on certain projects. 141 MWe RNG • $1.5 million/MWe revenue per year** • = $4.2 Billion of additional RNG revenue visibility 289MW PV & Battery • $250k/MW revenue per year* • = $1.5 Billion of additional revenue visibility

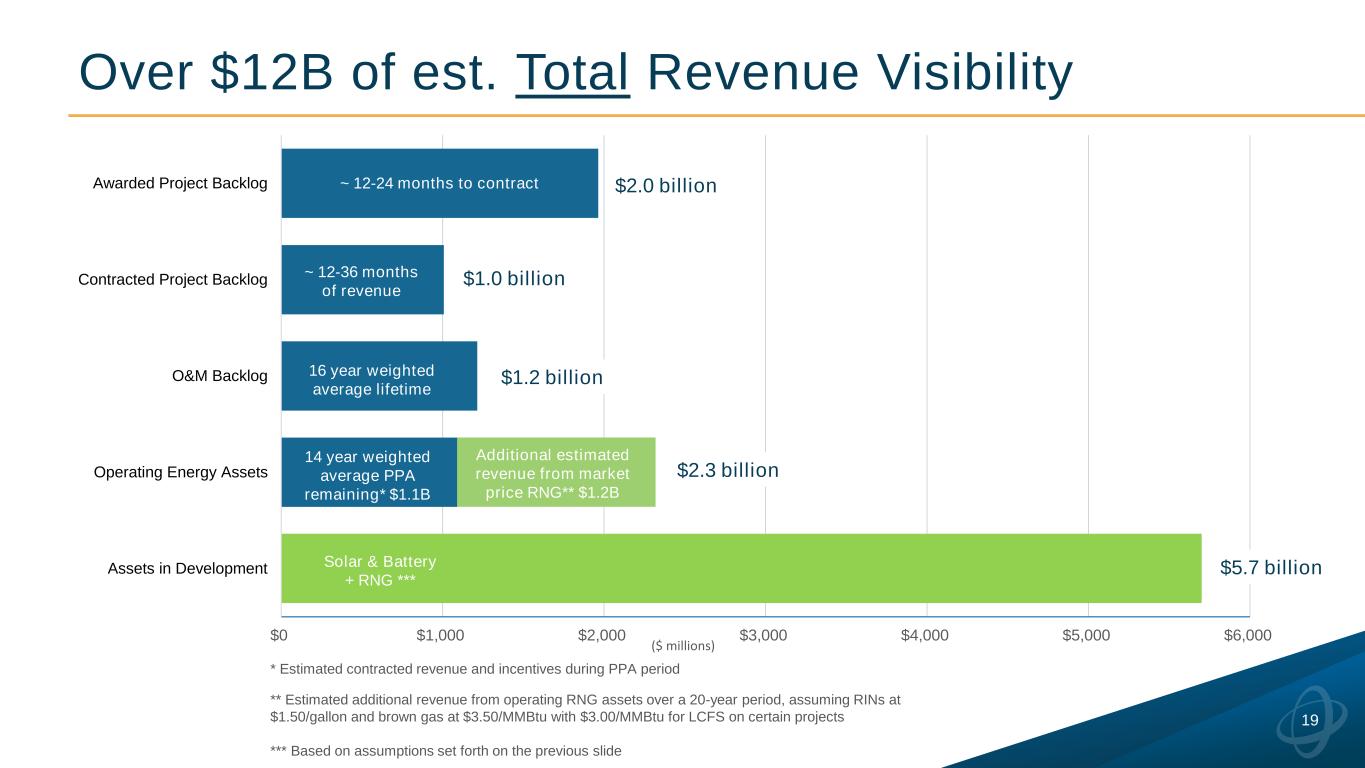

* Estimated contracted revenue and incentives during PPA period ** Estimated additional revenue from operating RNG assets over a 20-year period, assuming RINs at $1.50/gallon and brown gas at $3.50/MMBtu with $3.00/MMBtu for LCFS on certain projects *** Based on assumptions set forth on the previous slide 19 Over $12B of est. Total Revenue Visibility $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 Awarded Project Backlog Contracted Project Backlog O&M Backlog Operating Energy Assets Assets in Development ($ millions) ~ 12-24 months to contract ~ 12-36 months of revenue 14 year weighted average PPA remaining* $1.1B 16 year weighted average lifetime $2.0 billion $1.0 billion $2.3 billion $1.2 billion $5.7 billion Additional estimated revenue from market price RNG** $1.2B Solar & Battery + RNG ***

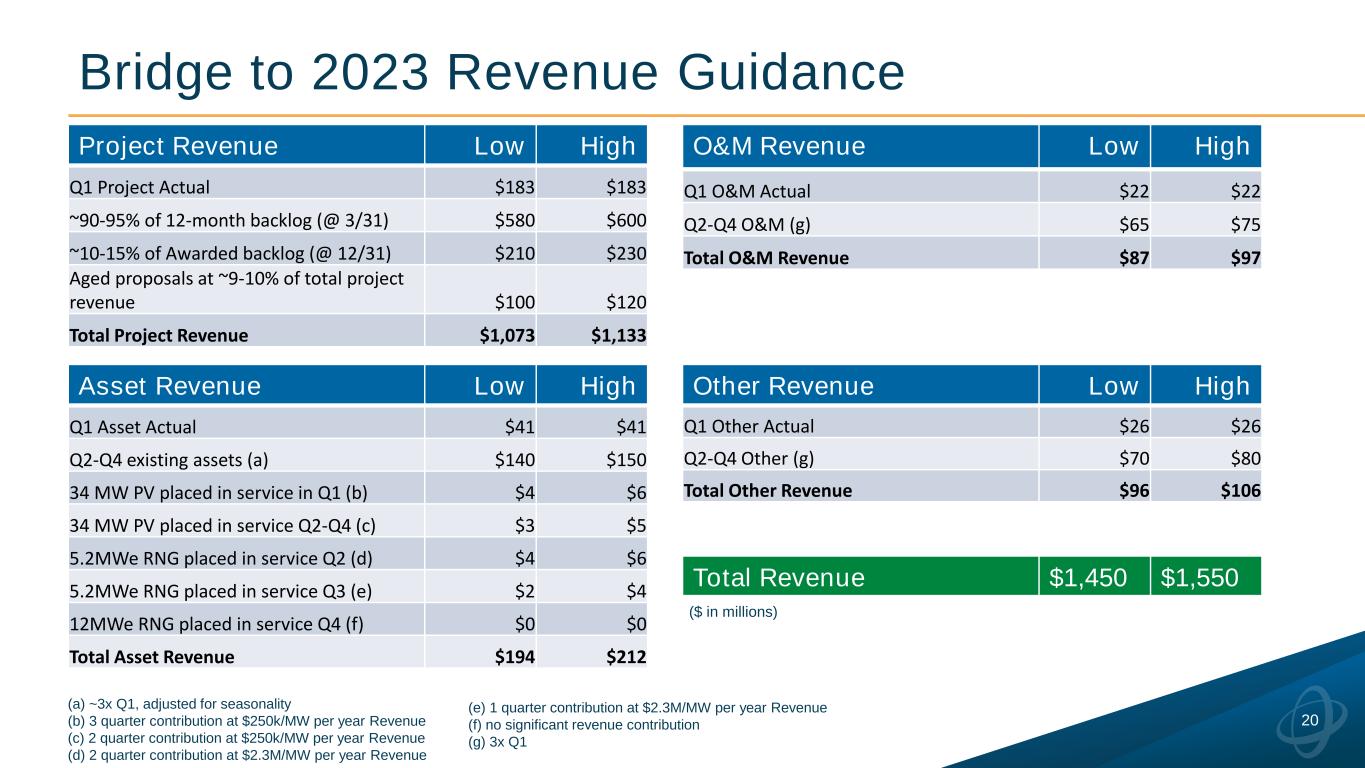

20 Bridge to 2023 Revenue Guidance Project Revenue Low High Q1 Project Actual $183 $183 ~90-95% of 12-month backlog (@ 3/31) $580 $600 ~10-15% of Awarded backlog (@ 12/31) $210 $230 Aged proposals at ~9-10% of total project revenue $100 $120 Total Project Revenue $1,073 $1,133 Asset Revenue Low High Q1 Asset Actual $41 $41 Q2-Q4 existing assets (a) $140 $150 34 MW PV placed in service in Q1 (b) $4 $6 34 MW PV placed in service Q2-Q4 (c) $3 $5 5.2MWe RNG placed in service Q2 (d) $4 $6 5.2MWe RNG placed in service Q3 (e) $2 $4 12MWe RNG placed in service Q4 (f) $0 $0 Total Asset Revenue $194 $212 O&M Revenue Low High Q1 O&M Actual $22 $22 Q2-Q4 O&M (g) $65 $75 Total O&M Revenue $87 $97 Other Revenue Low High Q1 Other Actual $26 $26 Q2-Q4 Other (g) $70 $80 Total Other Revenue $96 $106 Total Revenue $1,450 $1,550 (a) ~3x Q1, adjusted for seasonality (b) 3 quarter contribution at $250k/MW per year Revenue (c) 2 quarter contribution at $250k/MW per year Revenue (d) 2 quarter contribution at $2.3M/MW per year Revenue (e) 1 quarter contribution at $2.3M/MW per year Revenue (f) no significant revenue contribution (g) 3x Q1 ($ in millions)

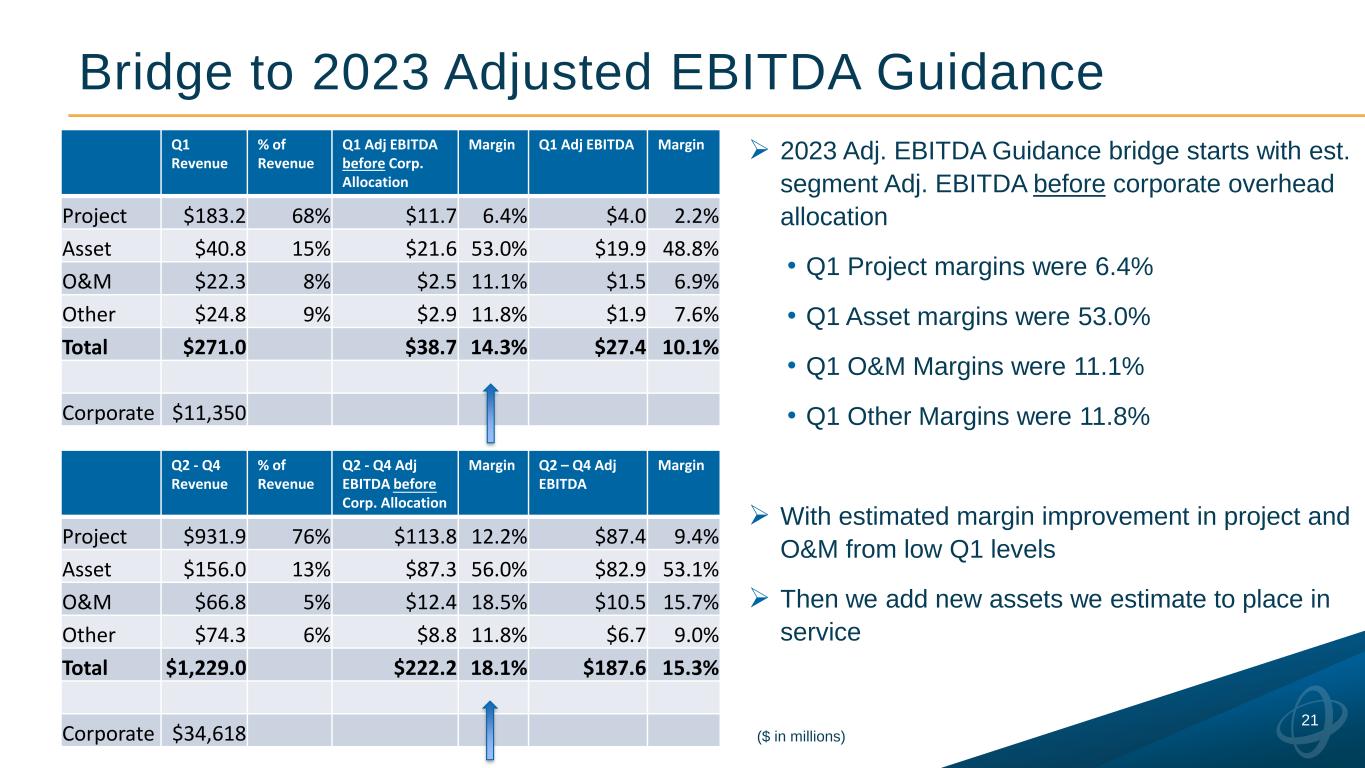

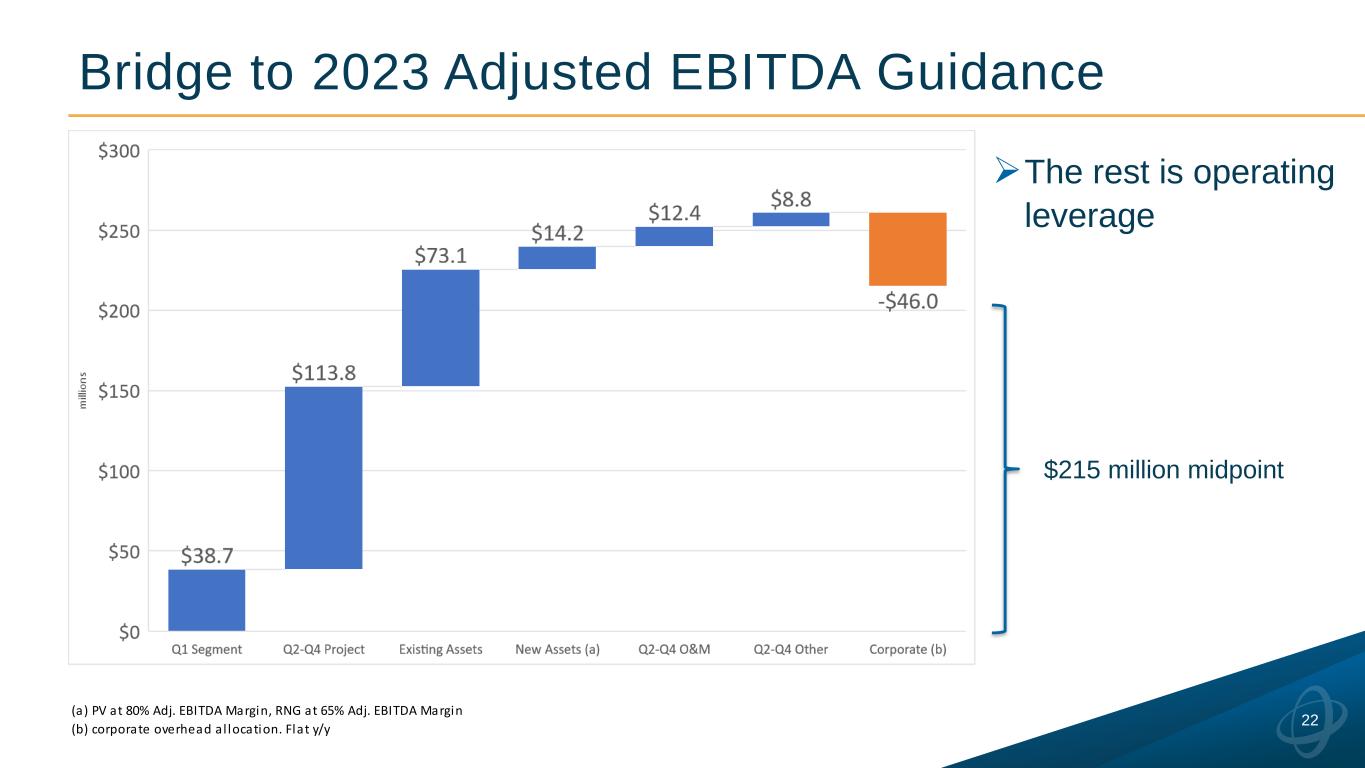

Q2 - Q4 Revenue % of Revenue Q2 - Q4 Adj EBITDA before Corp. Allocation Margin Q2 – Q4 Adj EBITDA Margin Project $931.9 76% $113.8 12.2% $87.4 9.4% Asset $156.0 13% $87.3 56.0% $82.9 53.1% O&M $66.8 5% $12.4 18.5% $10.5 15.7% Other $74.3 6% $8.8 11.8% $6.7 9.0% Total $1,229.0 $222.2 18.1% $187.6 15.3% Corporate $34,618 21 Bridge to 2023 Adjusted EBITDA Guidance ➢ 2023 Adj. EBITDA Guidance bridge starts with est. segment Adj. EBITDA before corporate overhead allocation • Q1 Project margins were 6.4% • Q1 Asset margins were 53.0% • Q1 O&M Margins were 11.1% • Q1 Other Margins were 11.8% ➢ With estimated margin improvement in project and O&M from low Q1 levels ➢ Then we add new assets we estimate to place in service Q1 Revenue % of Revenue Q1 Adj EBITDA before Corp. Allocation Margin Q1 Adj EBITDA Margin Project $183.2 68% $11.7 6.4% $4.0 2.2% Asset $40.8 15% $21.6 53.0% $19.9 48.8% O&M $22.3 8% $2.5 11.1% $1.5 6.9% Other $24.8 9% $2.9 11.8% $1.9 7.6% Total $271.0 $38.7 14.3% $27.4 10.1% Corporate $11,350 ($ in millions)

22 Bridge to 2023 Adjusted EBITDA Guidance $215 million midpoint ➢The rest is operating leverage (a) PV at 80% Adj. EBITDA Margin, RNG at 65% Adj. EBITDA Margin (b) corporate overhead al location. Flat y/y

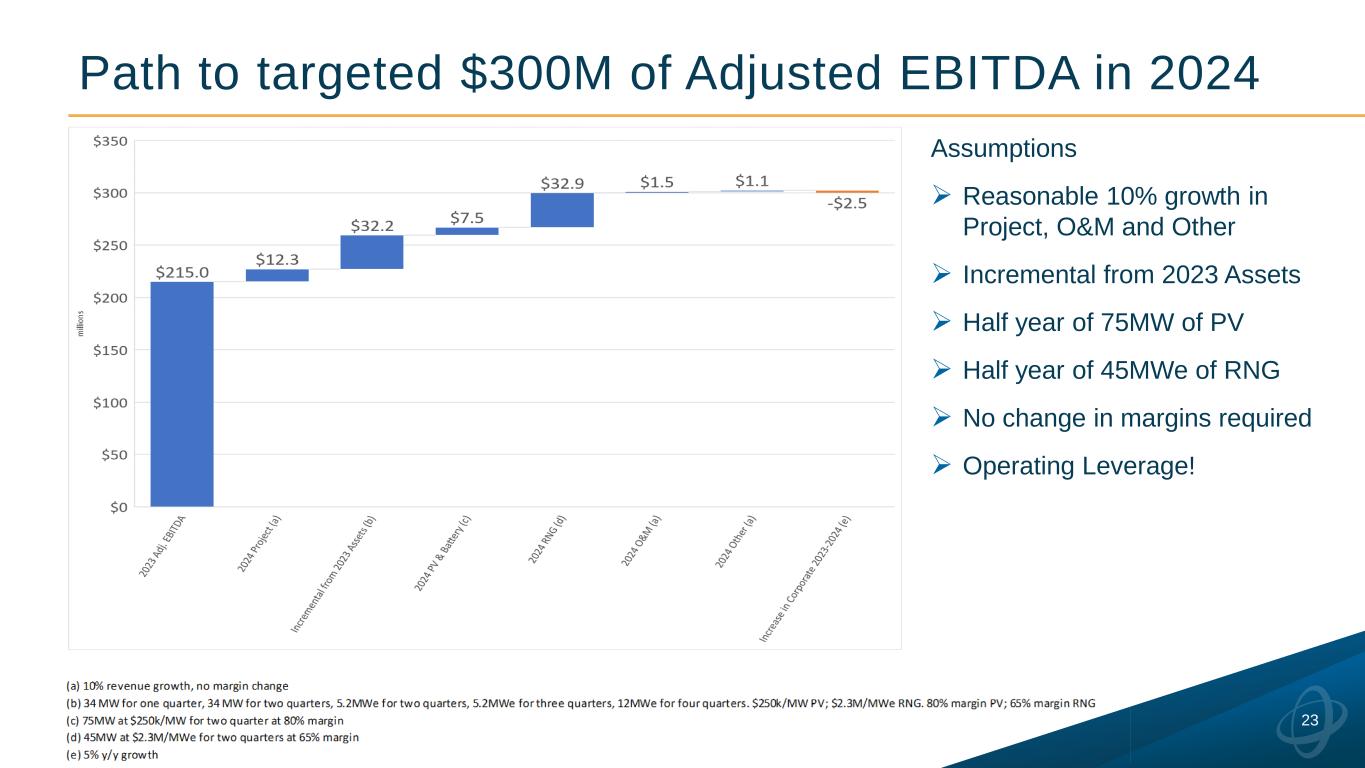

Path to targeted $300M of Adjusted EBITDA in 2024 23 Assumptions ➢ Reasonable 10% growth in Project, O&M and Other ➢ Incremental from 2023 Assets ➢ Half year of 75MW of PV ➢ Half year of 45MWe of RNG ➢ No change in margins required ➢ Operating Leverage!

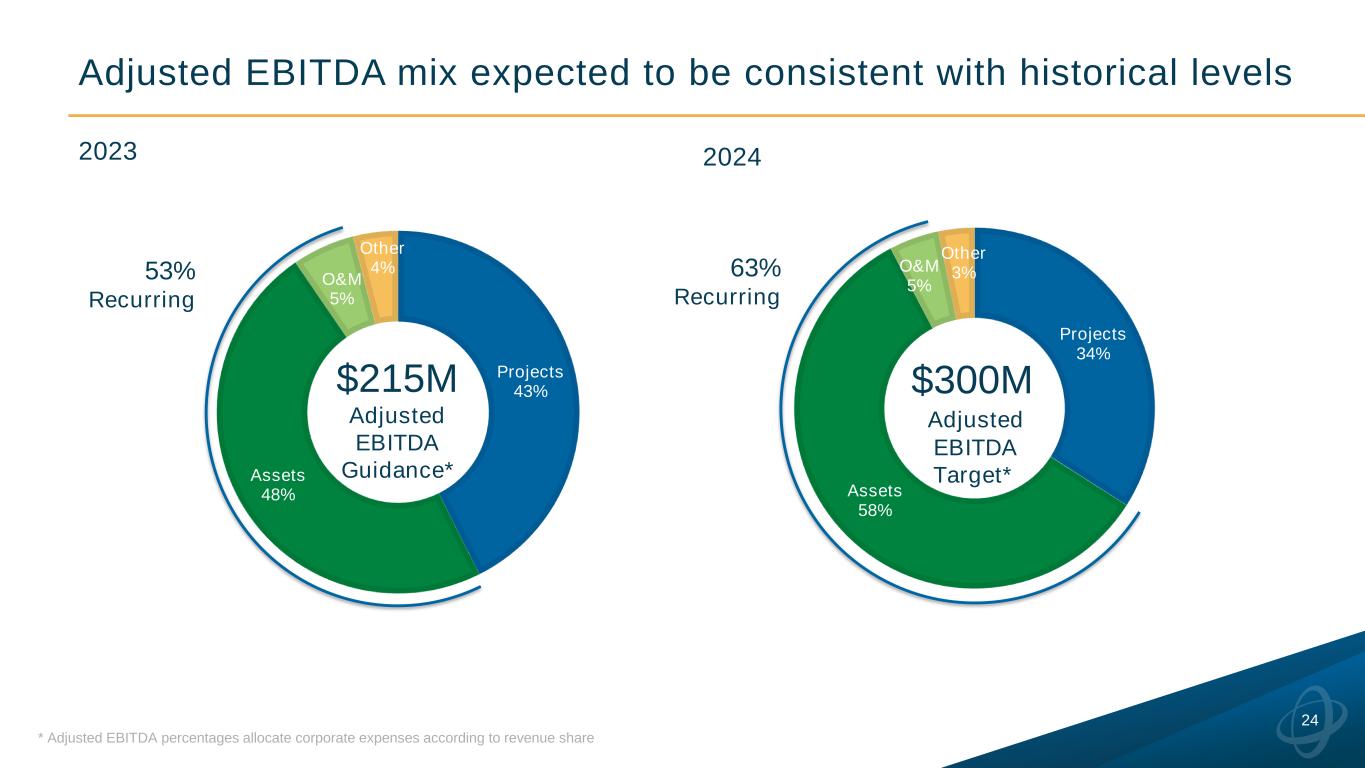

Adjusted EBITDA mix expected to be consistent with historical levels 24 Projects 34% Assets 58% O&M 5% Other 3% $300M Adjusted EBITDA Target* Projects 43% Assets 48% O&M 5% Other 4%53% Recurring $215M Adjusted EBITDA Guidance* * Adjusted EBITDA percentages allocate corporate expenses according to revenue share 2023 63% Recurring 2024

Closing Remarks George Sakellaris CEO & President

Q&A

Kye Dudd Councillor Bristol City Council Giorgio Pucci Executive Chairman ENERQOS Enrico Giglioli CEO & Senior Advisor ENERQOS Konstantinos Zygouras Chairman & CEO Sunel Group Mark Apsey Managing Director UK London Kath Chapman Managing Director UK Leeds Josh Baribeau SVP, Finance & Corporate Treasury Conference Participants George Sakellaris CEO & President Britta MacIntosh EVP, General Manager West & Europe Region Doran Hole CFO & EVP Leila Dillon SVP, Marketing & Communications

ameresco.com Thank You © 2023 Ameresco, Inc. All rights reserved.