ameresco.com © 2024 Ameresco, Inc. All rights reserved. Q3 2024 Supplemental Information November 7, 2024

2 Safe Harbor Forward Looking Statements Any statements in this presentation about future expectations, plans and prospects for Ameresco, Inc., including statements about market conditions, pipeline, visibility, backlog, pending agreements, financial guidance including estimated future revenues, net income, adjusted EBITDA, Non-GAAP EPS, gross margin, effective tax rate, and capital investments, as well as statements about our financing plans, the impact the IRA, the impact of changes in the US administration, supply chain disruptions, shortage and cost of materials and labor, and other macroeconomic and geopolitical challenges; our expectations related to our agreement with SCE including the impact of delays and any requirement to pay liquidated damages, and other statements containing the words “projects,” “believes,” “anticipates,” “plans,” “expects,” “will” and similar expressions, constitute forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those indicated by such forward looking statements as a result of various important factors, including: demand for our energy efficiency and renewable energy solutions; the timing of, and ability to, enter into contracts for awarded projects on the terms proposed or at all; the timing of work we do on projects where we recognize revenue on a percentage of completion basis; the ability to perform under signed contracts without delay and in accordance with their terms and related liquidated and other damages we may be subject to; the fiscal health of the government and the risk of government shutdowns; our ability to complete and operate our projects on a profitable basis and as committed to our customers; our cash flows from operations and our ability to arrange financing to fund our operations and projects; our customers’ ability to finance their projects and credit risk from our customers; our ability to comply with covenants in our existing debt agreements including the requirement to raise additional subordinated debt; the impact of macroeconomic challenges, weather related events and climate change on our business; our reliance on third parties for our construction and installation work; availability and cost of labor and equipment particularly given global supply chain challenges, tariffs and global trade conflicts; global supply chain challenges, component shortages and inflationary pressures; changes in federal, state and local government policies and programs related to energy efficiency and renewable energy; the ability of customers to cancel or defer contracts included in our backlog; the output and performance of our energy plants and energy projects; cybersecurity incidents and breaches; regulatory and other risks inherent to constructing and operating energy assets; the effects of our acquisitions and joint ventures; seasonality in construction and in demand for our products and services; a customer’s decision to delay our work on, or other risks involved with, a particular project; the addition of new customers or the loss of existing customers; market price of our Class A Common stock prevailing from time to time; the nature of other investment opportunities presented to our Company from time to time; risks related to our international operation and international growth strategy; and other factors discussed in our most recent Annual Report on Form 10-K and our quarterly reports on Form 10-Q. The forward-looking statements included in this presentation represent our views as of the date of this presentation. We anticipate that subsequent events and developments will cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we specifically disclaim any obligation to do so. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date of this presentation. Use of Non-GAAP Financial Measures This presentation and the accompanying tables include references to adjusted EBITDA, Non-GAAP EPS, Non-GAAP net income and adjusted cash from operations, which are Non-GAAP financial measures. For a description of these Non-GAAP financial measures, including the reasons management uses these measures, please see the section in the back of this presentation titled “Non-GAAP Financial Measures”. For a reconciliation of these Non-GAAP financial measures to the most directly comparable financial measures prepared in accordance with GAAP, please see the table at the end of this presentation titled “GAAP to Non-GAAP Reconciliation.”

Sources of Revenue – Q3 2024 3 Projects Energy efficiency and renewable energy projects Recurring Energy & incentive revenue from owned energy assets; plus recurring O&M from projects Other Services, software and integrated PV $385.4M $87.6M $27.9M

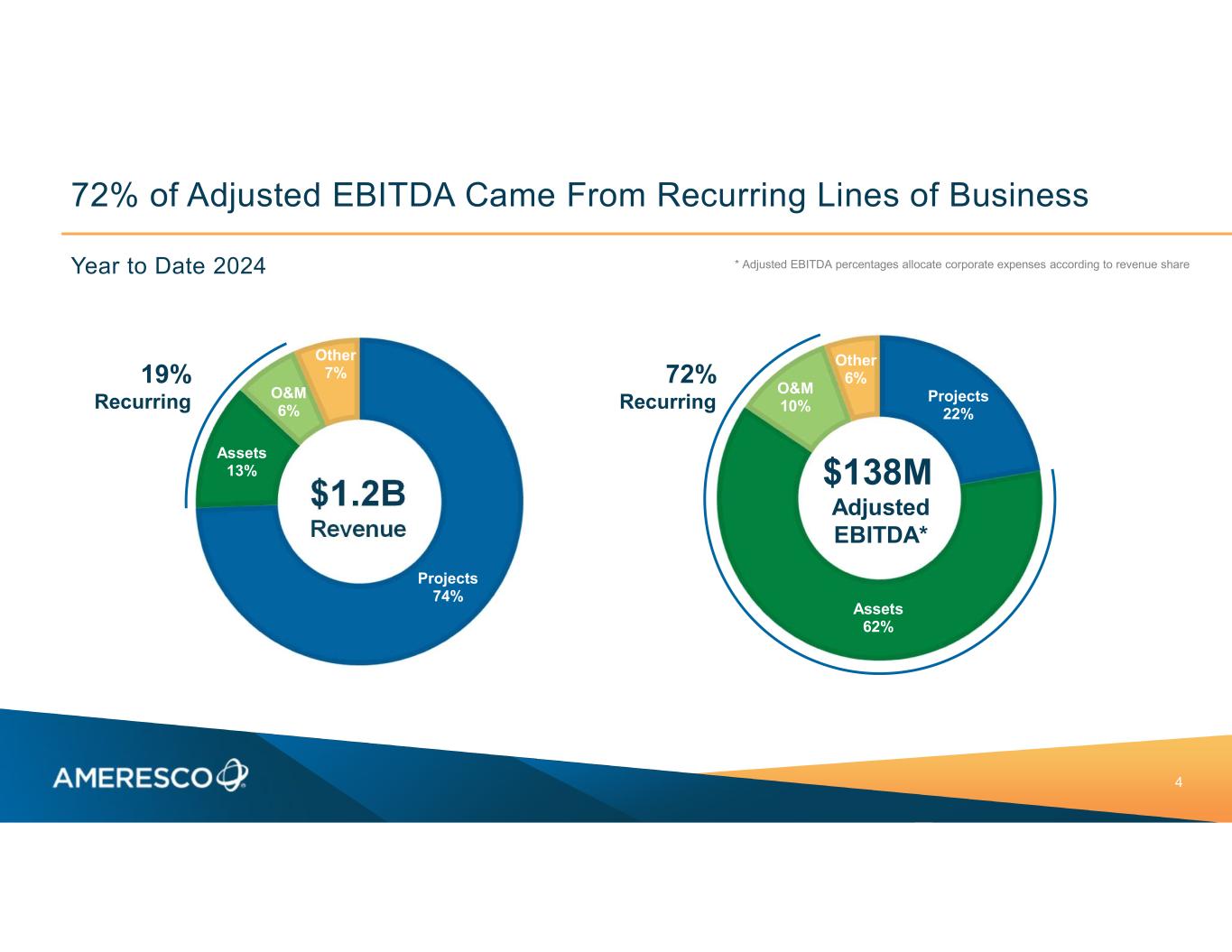

Projects 22% Assets 62% O&M 10% Other 6% $138M Adjusted EBITDA* 72% of Adjusted EBITDA Came From Recurring Lines of Business 4 $1.2B Revenue Projects 74% Assets 13% O&M 6% Other 7% * Adjusted EBITDA percentages allocate corporate expenses according to revenue shareYear to Date 2024 72% Recurring 19% Recurring

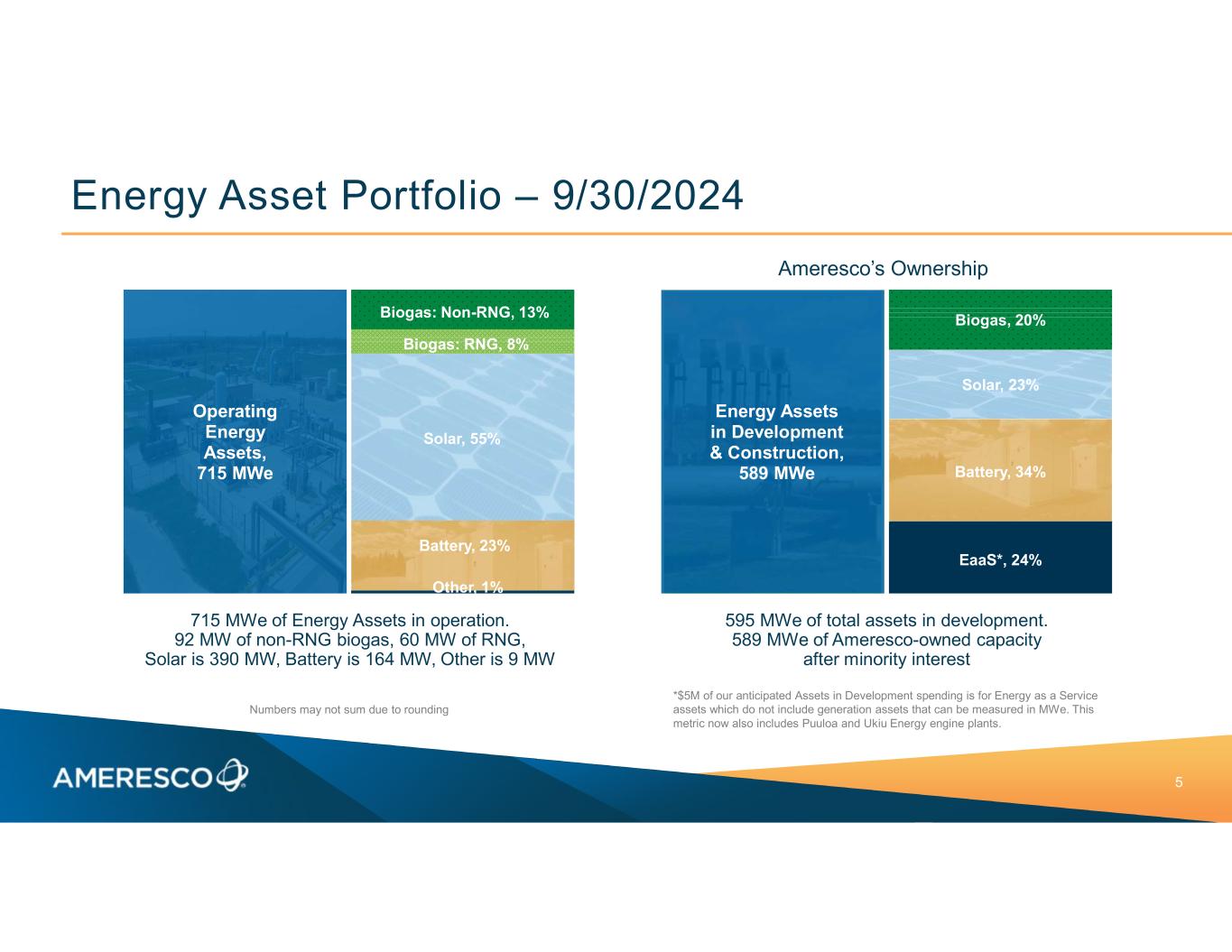

Energy Asset Portfolio – 9/30/2024 5 715 MWe of Energy Assets in operation. 92 MW of non-RNG biogas, 60 MW of RNG, Solar is 390 MW, Battery is 164 MW, Other is 9 MW 595 MWe of total assets in development. 589 MWe of Ameresco-owned capacity after minority interest Operating Energy Assets, 715 MWe Other, 1% Battery, 23% Solar, 55% Biogas: RNG, 8% Biogas: Non-RNG, 13% Energy Assets in Development & Construction, 589 MWe EaaS*, 24% Battery, 34% Solar, 23% Biogas, 20% Numbers may not sum due to rounding *$5M of our anticipated Assets in Development spending is for Energy as a Service assets which do not include generation assets that can be measured in MWe. This metric now also includes Puuloa and Ukiu Energy engine plants. Ameresco’s Ownership

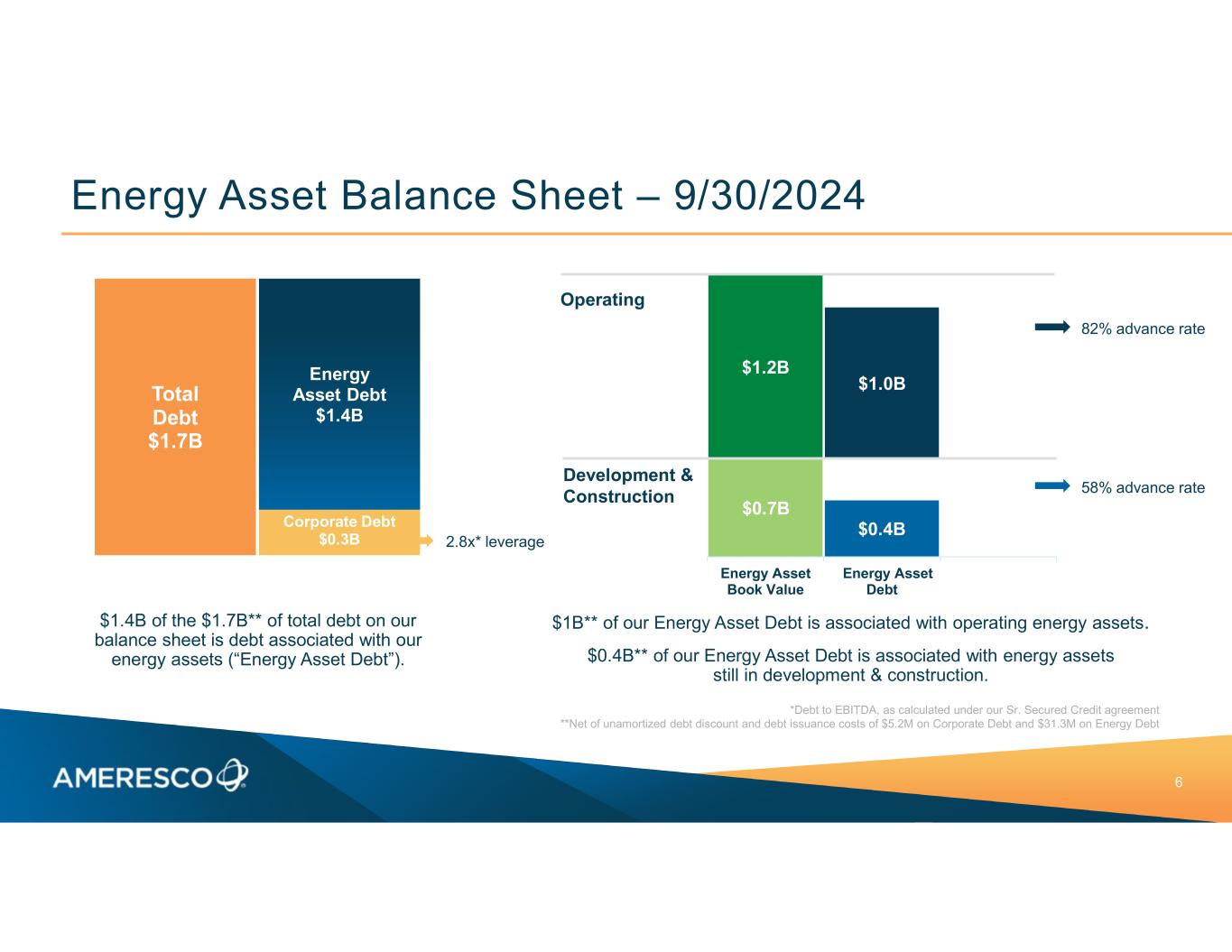

Energy Asset Balance Sheet – 9/30/2024 6 *Debt to EBITDA, as calculated under our Sr. Secured Credit agreement **Net of unamortized debt discount and debt issuance costs of $5.2M on Corporate Debt and $31.3M on Energy Debt $1B** of our Energy Asset Debt is associated with operating energy assets. $0.4B** of our Energy Asset Debt is associated with energy assets still in development & construction. $1.4B of the $1.7B** of total debt on our balance sheet is debt associated with our energy assets (“Energy Asset Debt”). Total Debt $1.7B Corporate Debt $0.3B Energy Asset Debt $1.4B 2.8x* leverage $0.7B $0.4B $1.2B $1.0B Energy Asset Book Value Energy Asset Debt 82% advance rate Operating Development & Construction 58% advance rate

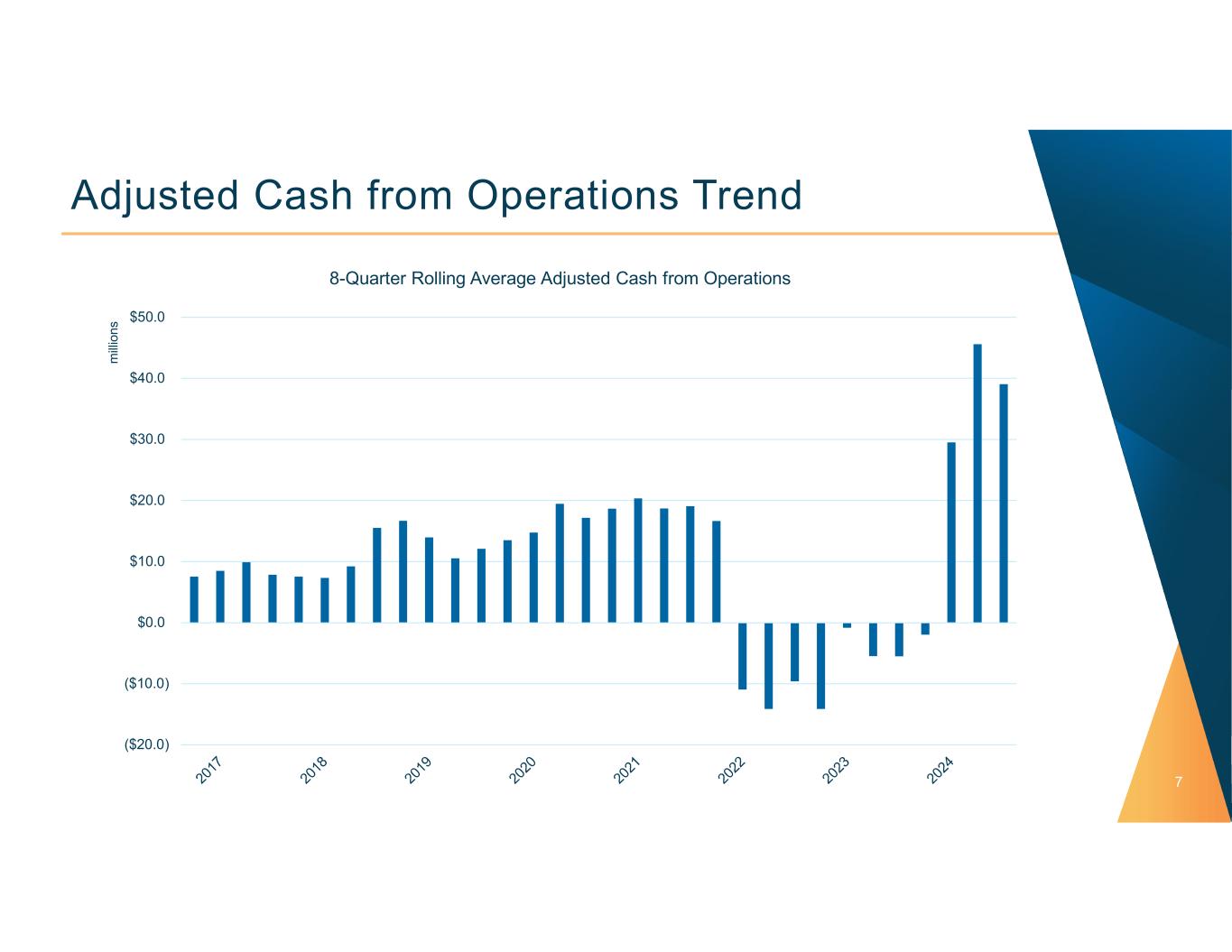

Adjusted Cash from Operations Trend 7 ($20.0) ($10.0) $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 m ill io ns 8-Quarter Rolling Average Adjusted Cash from Operations

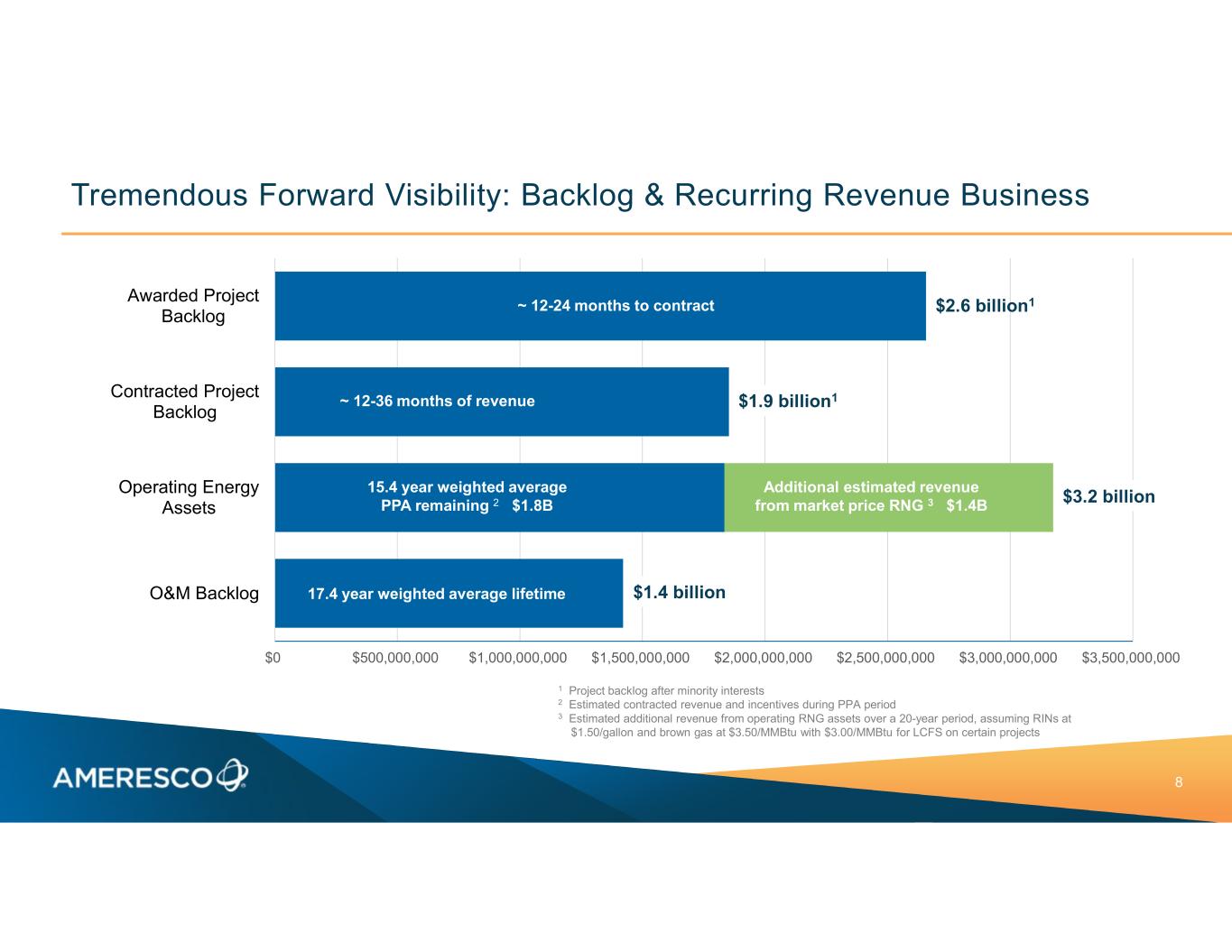

$0 $500,000,000 $1,000,000,000 $1,500,000,000 $2,000,000,000 $2,500,000,000 $3,000,000,000 $3,500,000,000 Awarded Project Backlog Contracted Project Backlog Operating Energy Assets O&M Backlog Tremendous Forward Visibility: Backlog & Recurring Revenue Business 8 $1.9 billion1 $3.2 billion ~ 12-24 months to contract ~ 12-36 months of revenue 17.4 year weighted average lifetime $2.6 billion1 $1.4 billion 15.4 year weighted average PPA remaining 2 $1.8B Additional estimated revenue from market price RNG 3 $1.4B 1 Project backlog after minority interests 2 Estimated contracted revenue and incentives during PPA period 3 Estimated additional revenue from operating RNG assets over a 20-year period, assuming RINs at $1.50/gallon and brown gas at $3.50/MMBtu with $3.00/MMBtu for LCFS on certain projects

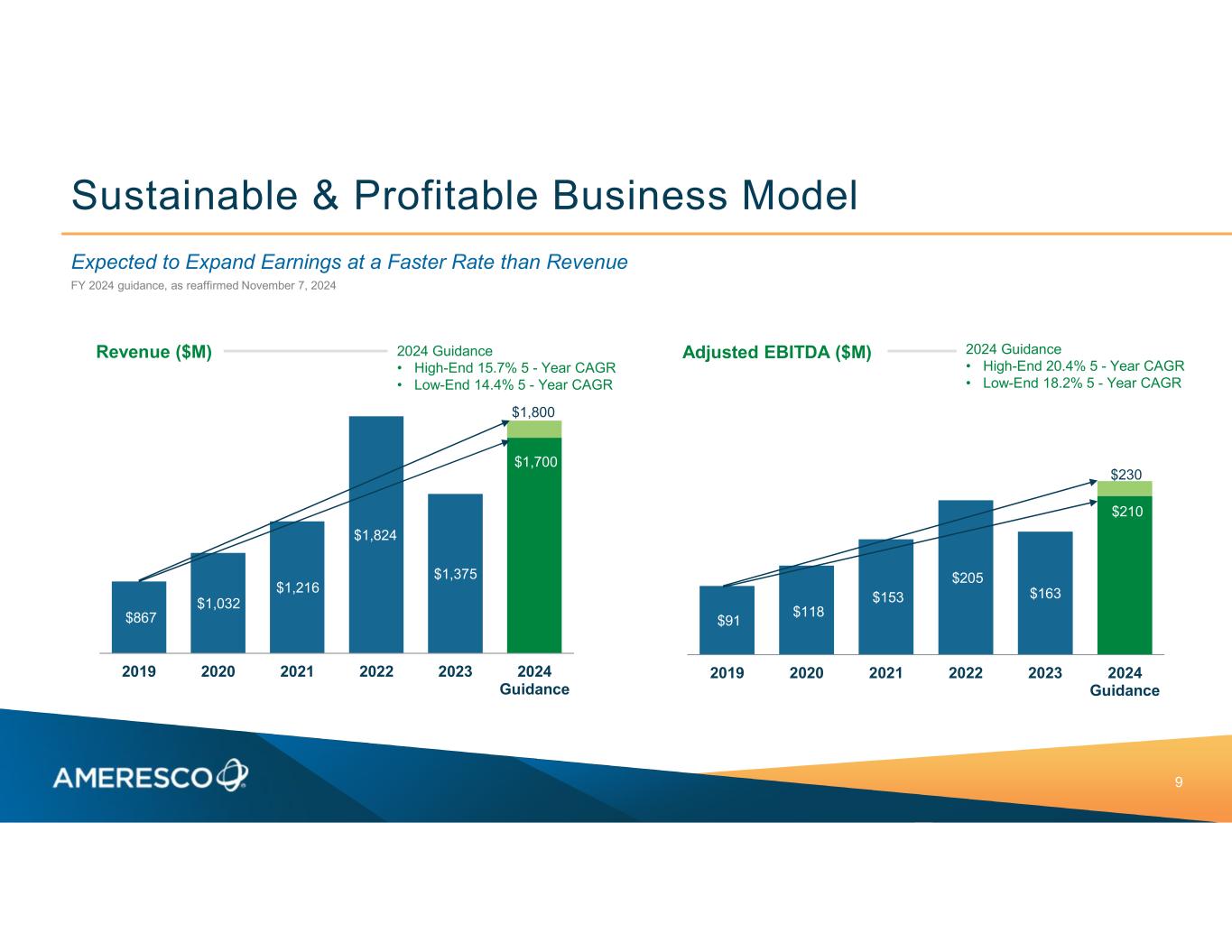

Sustainable & Profitable Business Model 9 Expected to Expand Earnings at a Faster Rate than Revenue FY 2024 guidance, as reaffirmed November 7, 2024 Revenue ($M) $867 $1,032 $1,216 $1,824 $1,375 $1,700 2019 2020 2021 2022 2023 2024 Guidance $1,800 2024 Guidance • High-End 15.7% 5 - Year CAGR • Low-End 14.4% 5 - Year CAGR $91 $118 $153 $205 $163 $210 2019 2020 2021 2022 2023 2024 Guidance Adjusted EBITDA ($M) $230 2024 Guidance • High-End 20.4% 5 - Year CAGR • Low-End 18.2% 5 - Year CAGR

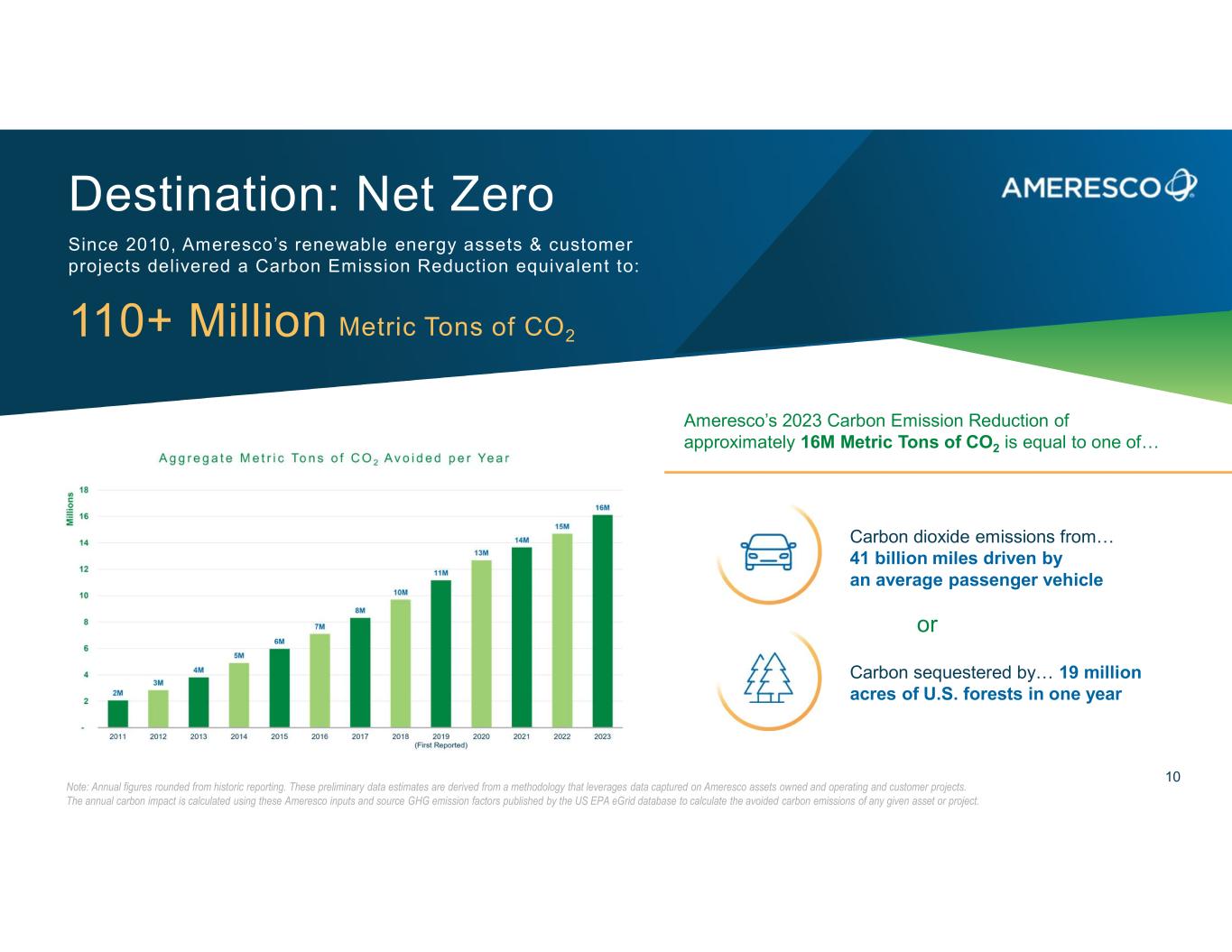

Destination: Net Zero Since 2010, Ameresco’s renewable energy assets & customer projects delivered a Carbon Emission Reduction equivalent to: 110+ Million Metric Tons of CO2 10 Carbon dioxide emissions from… 41 billion miles driven by an average passenger vehicle Carbon sequestered by… 19 million acres of U.S. forests in one year or Ameresco’s 2023 Carbon Emission Reduction of approximately 16M Metric Tons of CO2 is equal to one of… Note: Annual figures rounded from historic reporting. These preliminary data estimates are derived from a methodology that leverages data captured on Ameresco assets owned and operating and customer projects. The annual carbon impact is calculated using these Ameresco inputs and source GHG emission factors published by the US EPA eGrid database to calculate the avoided carbon emissions of any given asset or project. 10

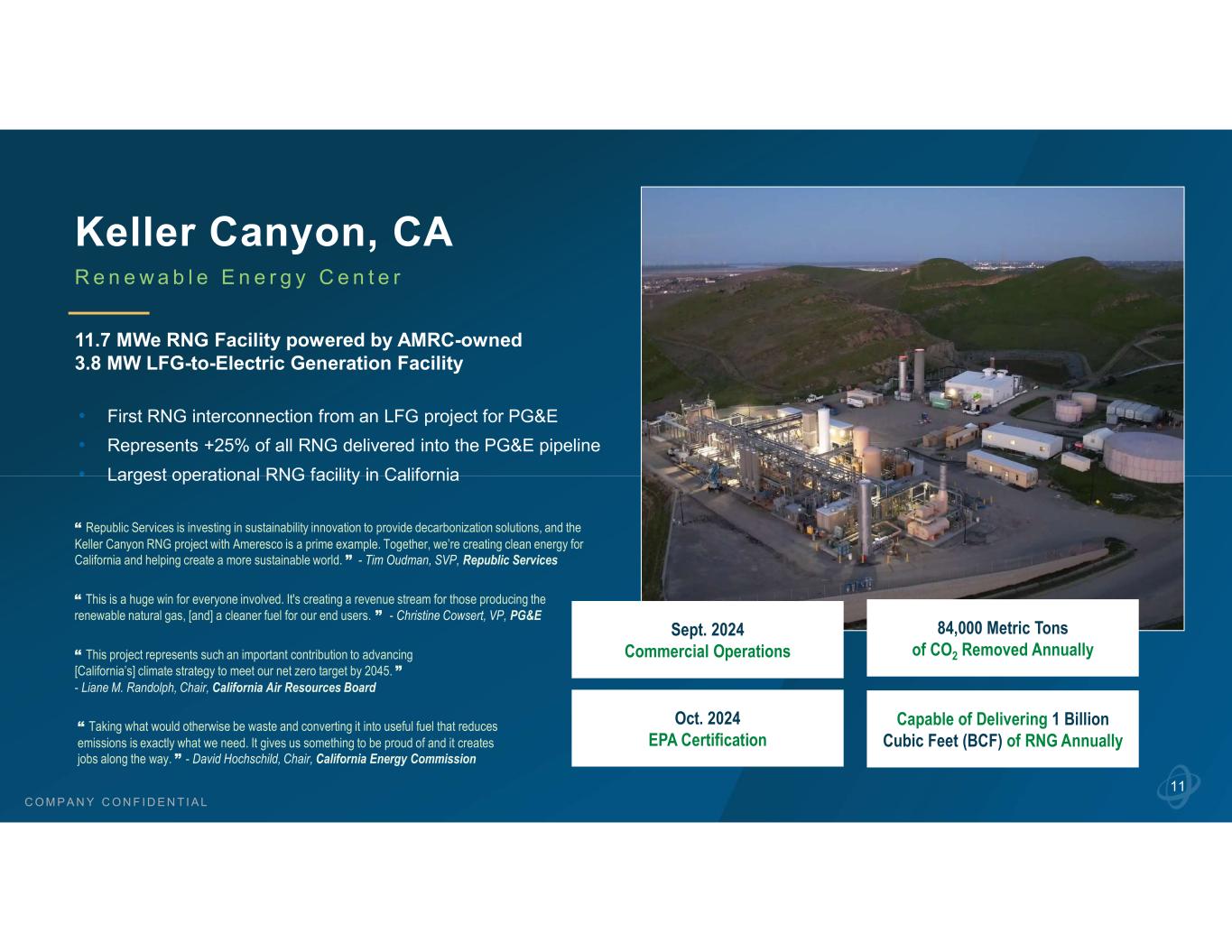

C O M P A N Y C O N F I D E N T I A L Keller Canyon, CA • First RNG interconnection from an LFG project for PG&E • Represents +25% of all RNG delivered into the PG&E pipeline • Largest operational RNG facility in California R e n e w a b l e E n e r g y C e n t e r 11.7 MWe RNG Facility powered by AMRC-owned 3.8 MW LFG-to-Electric Generation Facility Sept. 2024 Commercial Operations Oct. 2024 EPA Certification 84,000 Metric Tons of CO2 Removed Annually Capable of Delivering 1 Billion Cubic Feet (BCF) of RNG Annually “ Republic Services is investing in sustainability innovation to provide decarbonization solutions, and the Keller Canyon RNG project with Ameresco is a prime example. Together, we’re creating clean energy for California and helping create a more sustainable world. ” - Tim Oudman, SVP, Republic Services “ This is a huge win for everyone involved. It's creating a revenue stream for those producing the renewable natural gas, [and] a cleaner fuel for our end users. ” - Christine Cowsert, VP, PG&E “ This project represents such an important contribution to advancing [California’s] climate strategy to meet our net zero target by 2045. ” - Liane M. Randolph, Chair, California Air Resources Board 11 “ Taking what would otherwise be waste and converting it into useful fuel that reduces emissions is exactly what we need. It gives us something to be proud of and it creates jobs along the way. ” - David Hochschild, Chair, California Energy Commission

ameresco.com © 2024 Ameresco, Inc. All rights reserved. to Our Customers, Employees, and Shareholders Thank You

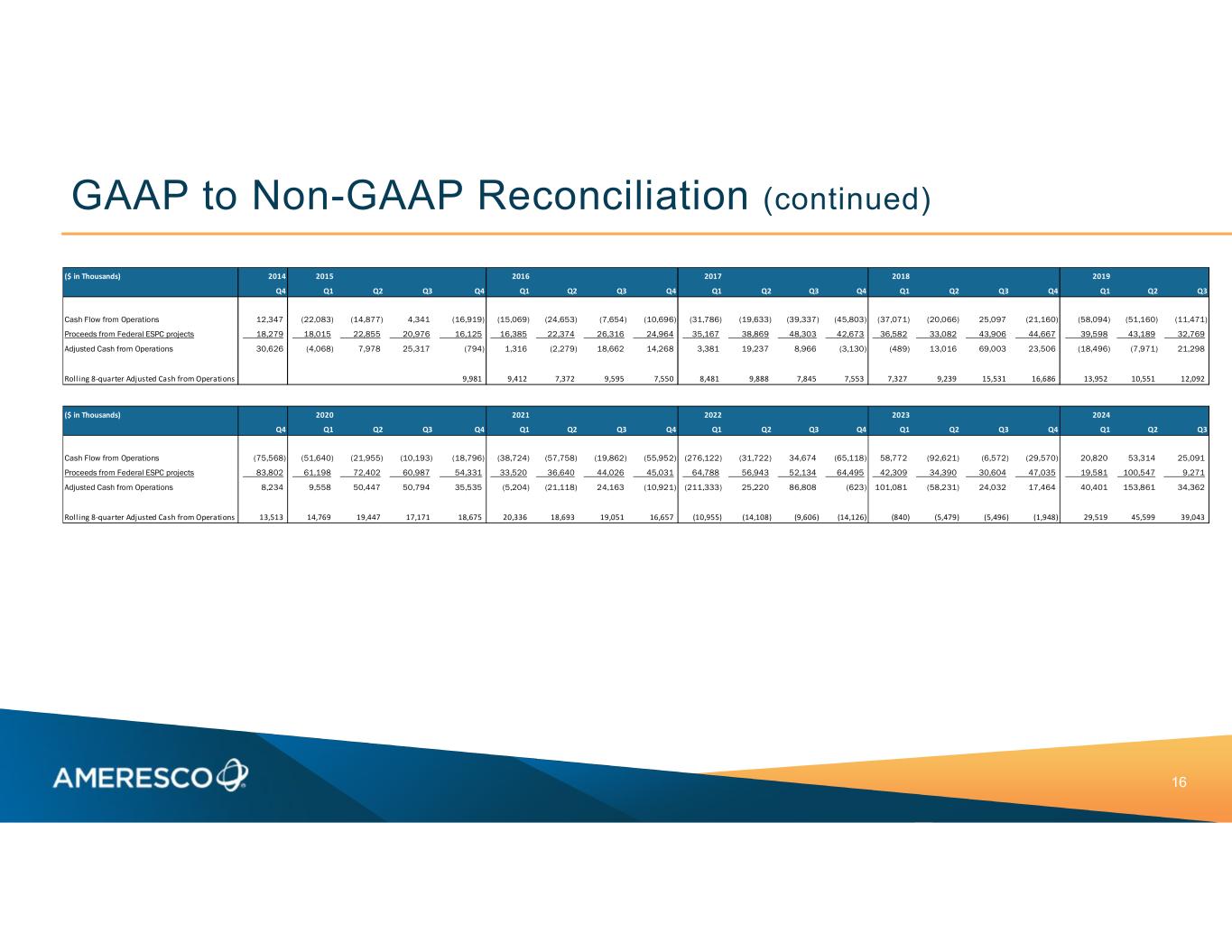

13 Non-GAAP Financial Measures We use the Non-GAAP financial measures defined and discussed below to provide investors and others with useful supplemental information to our financial results prepared in accordance with GAAP. These Non-GAAP financial measures should not be considered as an alternative to any measure of financial performance calculated and presented in accordance with GAAP. For a reconciliation of these Non-GAAP measures to the most directly comparable financial measures prepared in accordance with GAAP, please see the table at the end of this presentation titled “GAAP to Non-GAAP Reconciliation.” We understand that, although measures similar to these Non- GAAP financial measures are frequently used by investors and securities analysts in their evaluation of companies, they have limitations as analytical tools, and investors should not consider them in isolation or as a substitute for the most directly comparable GAAP financial measures or an analysis of our results of operations as reported under GAAP. To properly and prudently evaluate our business, we encourage investors to review our GAAP financial statements and not to rely on any single financial measure to evaluate our business. Adjusted EBITDA and Adjusted EBITDA Margin We define adjusted EBITDA as net income attributable to common shareholders, including impact from redeemable non-controlling interests, before income tax (benefit) provision, other expenses net, depreciation, amortization of intangible assets, accretion of asset retirement obligations, contingent consideration expense, stock-based compensation expense, energy asset impairment, restructuring and other charges, gain or loss on sale of equity investment, and gain or loss upon deconsolidation of a variable interest entity. We believe adjusted EBITDA is useful to investors in evaluating our operating performance for the following reasons: adjusted EBITDA and similar Non-GAAP measures are widely used by investors to measure a company's operating performance without regard to items that can vary substantially from company to company depending upon financing and accounting methods, book values of assets, capital structures and the methods by which assets were acquired; securities analysts often use adjusted EBITDA and similar Non-GAAP measures as supplemental measures to evaluate the overall operating performance of companies; and by comparing our adjusted EBITDA in different historical periods, investors can evaluate our operating results without the additional variations of depreciation and amortization expense, accretion of asset retirement obligations, contingent consideration expense, stock-based compensation expense, impact from redeemable non-controlling interests, restructuring and asset impairment charges. We define adjusted EBITDA margin as adjusted EBITDA stated as a percentage of revenue. Our management uses adjusted EBITDA and adjusted EBITDA margin as measures of operating performance, because they do not include the impact of items that we do not consider indicative of our core operating performance; for planning purposes, including the preparation of our annual operating budget; to allocate resources to enhance the financial performance of the business; to evaluate the effectiveness of our business strategies; and in communications with the board of directors and investors concerning our financial performance. Non-GAAP Net Income and EPS We define Non-GAAP net income and earnings per share (EPS) to exclude certain discrete items that management does not consider representative of our ongoing operations, including energy asset impairment, restructuring and other charges, impact from redeemable non-controlling interests, gain or loss on sale of equity investment, and gain or loss upon deconsolidation of a variable interest entity. We consider Non-GAAP net income and Non- GAAP EPS to be important indicators of our operational strength and performance of our business because they eliminate the effects of events that are not part of the Company's core operations. Adjusted Cash from Operations We define adjusted cash from operations as cash flows from operating activities plus proceeds from Federal ESPC projects. Cash received in payment of Federal ESPC projects is treated as a financing cash flow under GAAP due to the unusual financing structure for these projects. These cash flows, however, correspond to the revenue generated by these projects. Thus we believe that adjusting operating cash flow to include the cash generated by our Federal ESPC projects provides investors with a useful measure for evaluating the cash generating ability of our core operating business. Our management uses adjusted cash from operations as a measure of liquidity because it captures all sources of cash associated with our revenue generated by operations.

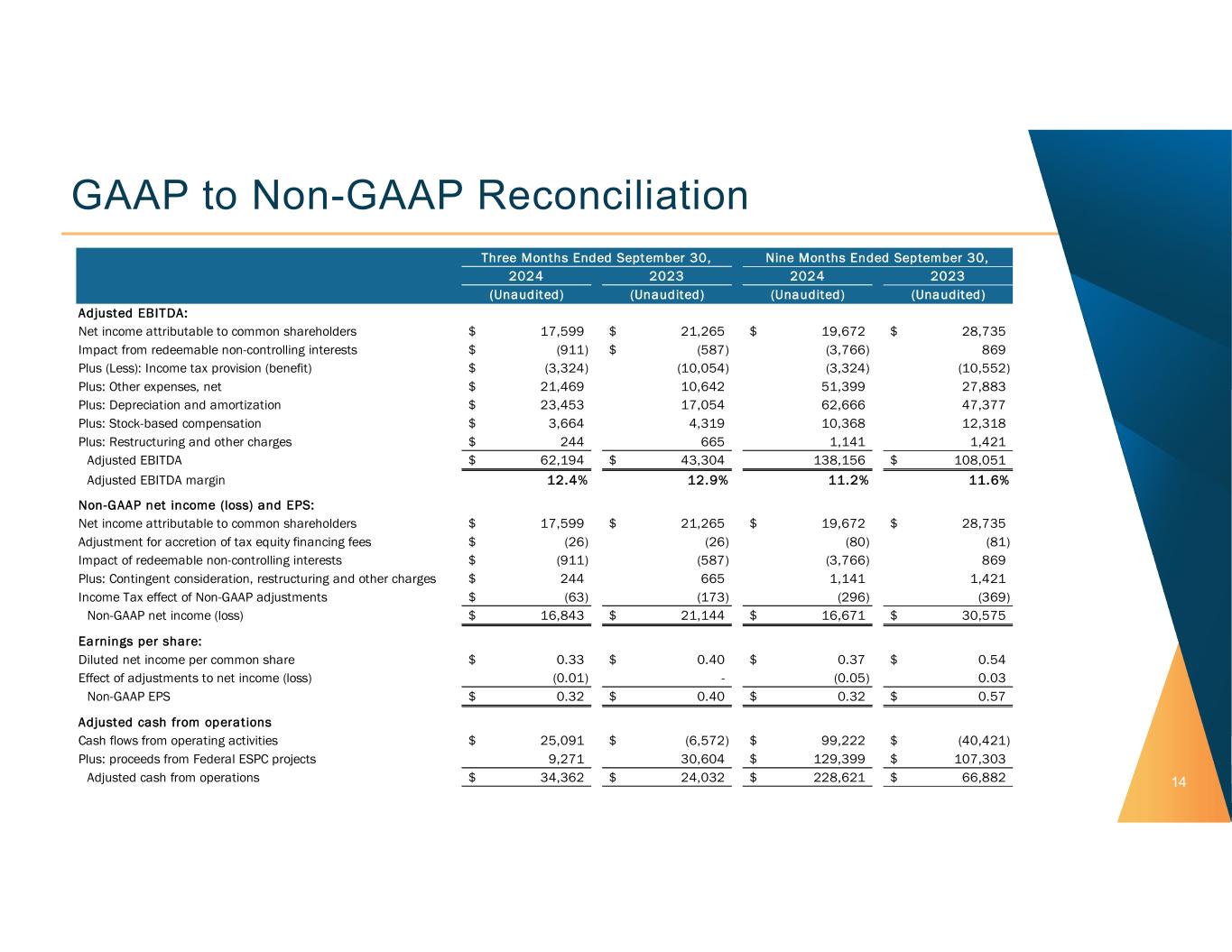

GAAP to Non-GAAP Reconciliation 14 (Unaudited) (Unaudited) (Unaudited) (Unaudited) Adjusted EBITDA: Net income attributable to common shareholders 17,599$ 21,265$ 19,672$ 28,735$ Impact from redeemable non-controlling interests (911)$ (587)$ (3,766) 869 Plus (Less): Income tax provision (benefit) (3,324)$ (10,054) (3,324) (10,552) Plus: Other expenses, net 21,469$ 10,642 51,399 27,883 Plus: Depreciation and amortization 23,453$ 17,054 62,666 47,377 Plus: Stock-based compensation 3,664$ 4,319 10,368 12,318 Plus: Restructuring and other charges 244$ 665 1,141 1,421 Adjusted EBITDA 62,194$ 43,304$ 138,156 108,051$ Adjusted EBITDA margin 12.4% 12.9% 11.2% 11.6% Non-GAAP net income (loss) and EPS: Net income attributable to common shareholders 17,599$ 21,265$ 19,672$ 28,735$ Adjustment for accretion of tax equity financing fees (26)$ (26) (80) (81) Impact of redeemable non-controlling interests (911)$ (587) (3,766) 869 Plus: Contingent consideration, restructuring and other charges 244$ 665 1,141 1,421 Income Tax effect of Non-GAAP adjustments (63)$ (173) (296) (369) Non-GAAP net income (loss) 16,843$ 21,144$ 16,671$ 30,575$ Earnings per share: Diluted net income per common share 0.33$ 0.40$ 0.37$ 0.54$ Effect of adjustments to net income (loss) (0.01) - (0.05) 0.03 Non-GAAP EPS 0.32$ 0.40$ 0.32$ 0.57$ Adjusted cash from operations Cash flows from operating activities 25,091$ (6,572)$ 99,222$ (40,421)$ Plus: proceeds from Federal ESPC projects 9,271 30,604 129,399$ 107,303$ Adjusted cash from operations 34,362$ 24,032$ 228,621$ 66,882$ 2024 2023 2024 2023 Nine Months Ended September 30,Three Months Ended September 30,

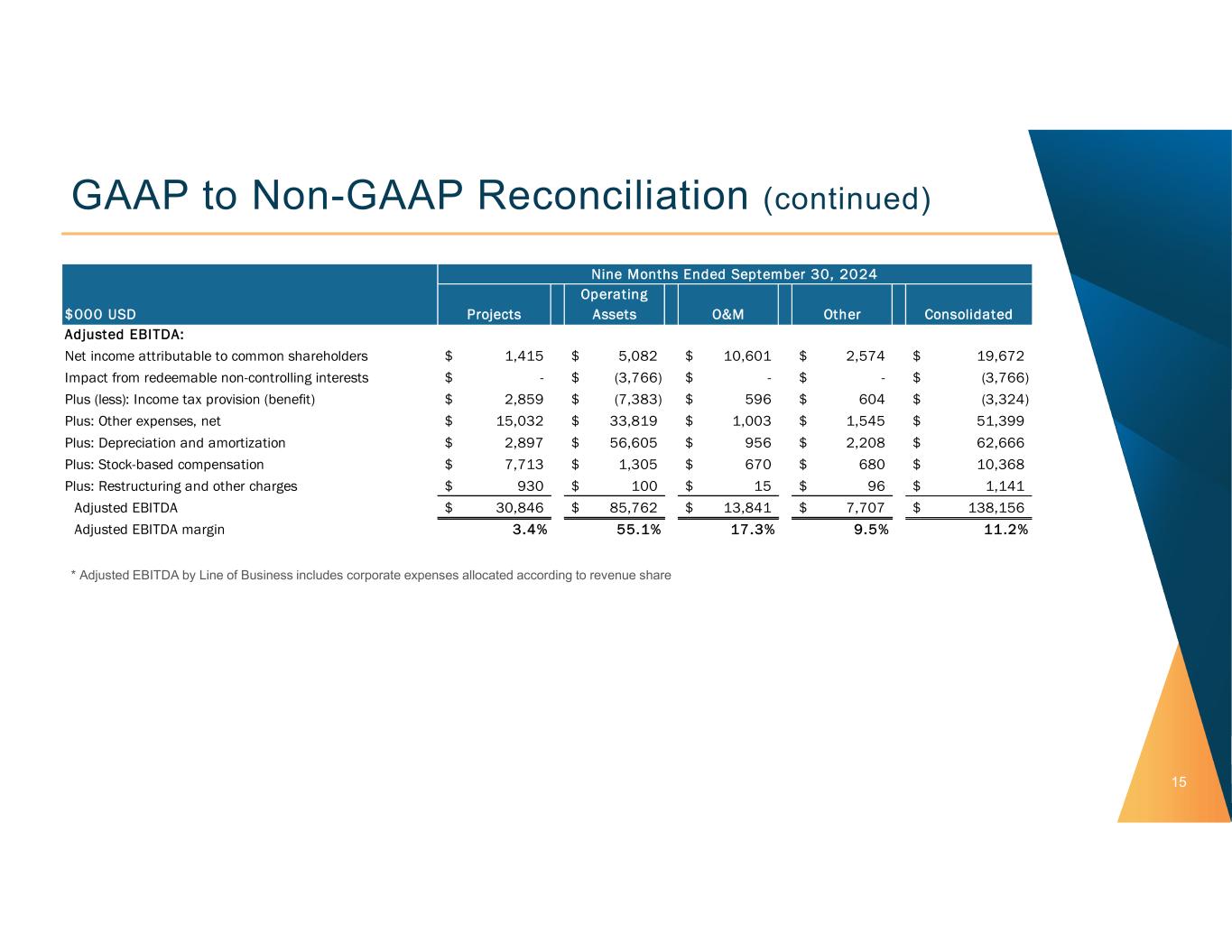

GAAP to Non-GAAP Reconciliation (continued) 15 * Adjusted EBITDA by Line of Business includes corporate expenses allocated according to revenue share $000 USD Projects Operating Assets O&M Other Consolidated Adjusted EBITDA: Net income attributable to common shareholders 1,415$ 5,082$ 10,601$ 2,574$ 19,672$ Impact from redeemable non-controlling interests -$ (3,766)$ -$ -$ (3,766)$ Plus (less): Income tax provision (benefit) 2,859$ (7,383)$ 596$ 604$ (3,324)$ Plus: Other expenses, net 15,032$ 33,819$ 1,003$ 1,545$ 51,399$ Plus: Depreciation and amortization 2,897$ 56,605$ 956$ 2,208$ 62,666$ Plus: Stock-based compensation 7,713$ 1,305$ 670$ 680$ 10,368$ Plus: Restructuring and other charges 930$ 100$ 15$ 96$ 1,141$ Adjusted EBITDA 30,846$ 85,762$ 13,841$ 7,707$ 138,156$ Adjusted EBITDA margin 3.4% 55.1% 17.3% 9.5% 11.2% Nine Months Ended September 30, 2024

GAAP to Non-GAAP Reconciliation (continued) 16 ($ in Thousands) 2014 2015 2016 2017 2018 2019 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Cash Flow from Operations 12,347 (22,083) (14,877) 4,341 (16,919) (15,069) (24,653) (7,654) (10,696) (31,786) (19,633) (39,337) (45,803) (37,071) (20,066) 25,097 (21,160) (58,094) (51,160) (11,471) Proceeds from Federal ESPC projects 18,279 18,015 22,855 20,976 16,125 16,385 22,374 26,316 24,964 35,167 38,869 48,303 42,673 36,582 33,082 43,906 44,667 39,598 43,189 32,769 Adjusted Cash from Operations 30,626 (4,068) 7,978 25,317 (794) 1,316 (2,279) 18,662 14,268 3,381 19,237 8,966 (3,130) (489) 13,016 69,003 23,506 (18,496) (7,971) 21,298 Roll ing 8-quarter Adjusted Cash from Operations 9,981 9,412 7,372 9,595 7,550 8,481 9,888 7,845 7,553 7,327 9,239 15,531 16,686 13,952 10,551 12,092 ($ in Thousands) 2020 2021 2022 2023 2024 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Cash Flow from Operations (75,568) (51,640) (21,955) (10,193) (18,796) (38,724) (57,758) (19,862) (55,952) (276,122) (31,722) 34,674 (65,118) 58,772 (92,621) (6,572) (29,570) 20,820 53,314 25,091 Proceeds from Federal ESPC projects 83,802 61,198 72,402 60,987 54,331 33,520 36,640 44,026 45,031 64,788 56,943 52,134 64,495 42,309 34,390 30,604 47,035 19,581 100,547 9,271 Adjusted Cash from Operations 8,234 9,558 50,447 50,794 35,535 (5,204) (21,118) 24,163 (10,921) (211,333) 25,220 86,808 (623) 101,081 (58,231) 24,032 17,464 40,401 153,861 34,362 Roll ing 8-quarter Adjusted Cash from Operations 13,513 14,769 19,447 17,171 18,675 20,336 18,693 19,051 16,657 (10,955) (14,108) (9,606) (14,126) (840) (5,479) (5,496) (1,948) 29,519 45,599 39,043