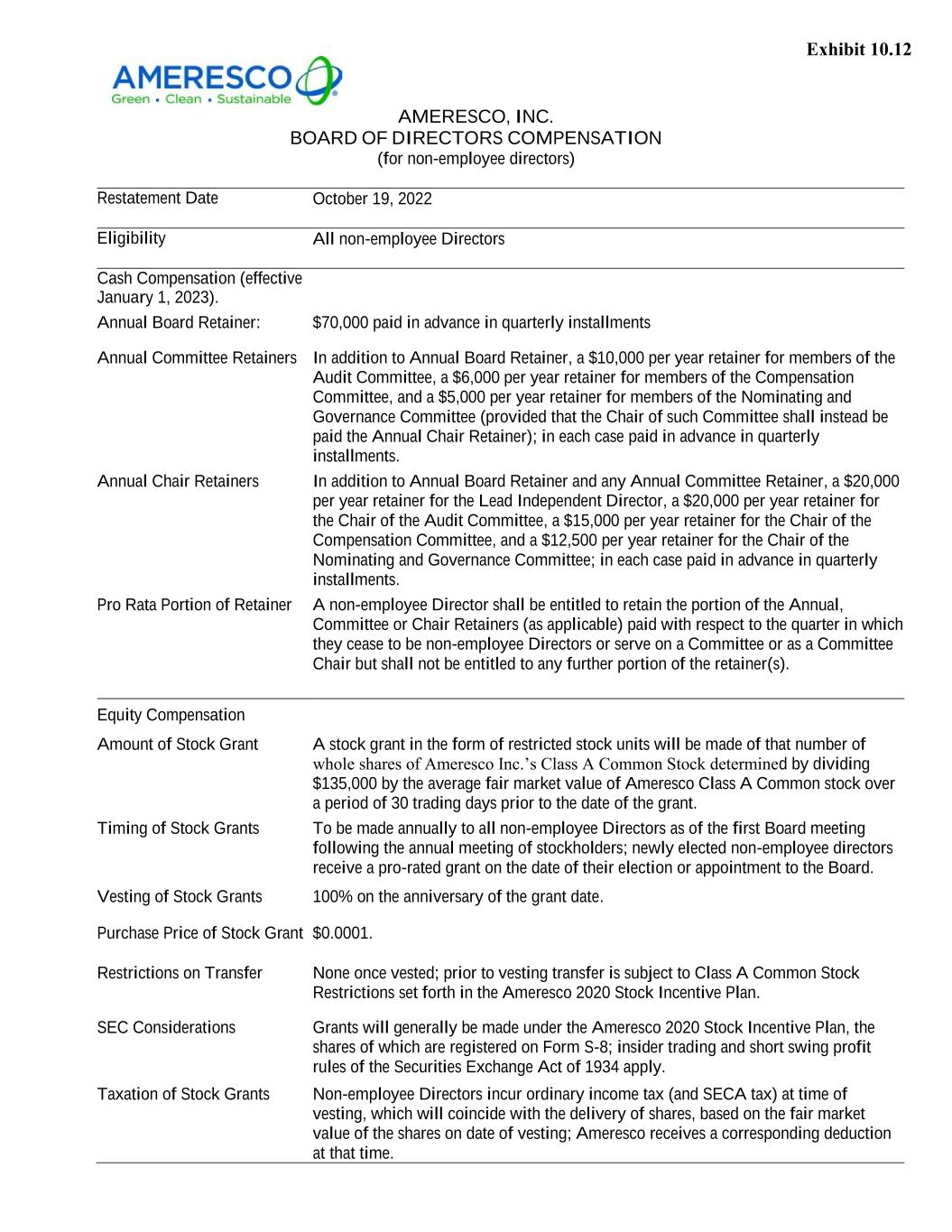

AMERESCO, INC. BOARD OF DIRECTORS COMPENSATION (for non-employee directors) Restatement Date October 19, 2022 Eligibility All non-employee Directors Cash Compensation (effective January 1, 2023). Annual Board Retainer: $70,000 paid in advance in quarterly installments Annual Committee Retainers In addition to Annual Board Retainer, a $10,000 per year retainer for members of the Audit Committee, a $6,000 per year retainer for members of the Compensation Committee, and a $5,000 per year retainer for members of the Nominating and Governance Committee (provided that the Chair of such Committee shall instead be paid the Annual Chair Retainer); in each case paid in advance in quarterly installments. Annual Chair Retainers In addition to Annual Board Retainer and any Annual Committee Retainer, a $20,000 per year retainer for the Lead Independent Director, a $20,000 per year retainer for the Chair of the Audit Committee, a $15,000 per year retainer for the Chair of the Compensation Committee, and a $12,500 per year retainer for the Chair of the Nominating and Governance Committee; in each case paid in advance in quarterly installments. Pro Rata Portion of Retainer A non-employee Director shall be entitled to retain the portion of the Annual, Committee or Chair Retainers (as applicable) paid with respect to the quarter in which they cease to be non-employee Directors or serve on a Committee or as a Committee Chair but shall not be entitled to any further portion of the retainer(s). Equity Compensation Amount of Stock Grant A stock grant in the form of restricted stock units will be made of that number of whole shares of Ameresco Inc.’s Class A Common Stock determined by dividing $135,000 by the average fair market value of Ameresco Class A Common stock over a period of 30 trading days prior to the date of the grant. Timing of Stock Grants To be made annually to all non-employee Directors as of the first Board meeting following the annual meeting of stockholders; newly elected non-employee directors receive a pro-rated grant on the date of their election or appointment to the Board. Vesting of Stock Grants 100% on the anniversary of the grant date. Purchase Price of Stock Grant $0.0001. Restrictions on Transfer None once vested; prior to vesting transfer is subject to Class A Common Stock Restrictions set forth in the Ameresco 2020 Stock Incentive Plan. SEC Considerations Grants will generally be made under the Ameresco 2020 Stock Incentive Plan, the shares of which are registered on Form S-8; insider trading and short swing profit rules of the Securities Exchange Act of 1934 apply. Taxation of Stock Grants Non-employee Directors incur ordinary income tax (and SECA tax) at time of vesting, which will coincide with the delivery of shares, based on the fair market value of the shares on date of vesting; Ameresco receives a corresponding deduction at that time. Exhibit 10.12